Loading News...

Loading News...

VADODARA, February 4, 2026 — Binance holds $155.64 billion in total assets, ranking first among major cryptocurrency exchanges according to the latest crypto news from Wu Blockchain. This data, sourced from CoinMarketCap, reveals a significant concentration of liquidity as the broader market grapples with extreme fear sentiment. Binance's holdings include $47.47 billion in stablecoins and $49.84 billion in Bitcoin, underscoring its role in global crypto liquidity.

According to Wu Blockchain, Binance's asset total of $155.64 billion as of last month far exceeds its closest competitors. OKX holds $31.29 billion, Bybit $14.17 billion, Gate.io $7.86 billion, and HTX $6.92 billion. This disparity highlights a stark liquidity hierarchy. Market structure suggests that Binance's dominance acts as a central liquidity hub, influencing price discovery across major trading pairs. Consequently, shifts in its asset composition can create Fair Value Gaps (FVGs) in altcoin markets.

Historically, exchange asset rankings have correlated with market cycles. During the 2021 bull run, centralized exchange balances peaked before distribution phases. In contrast, the current extreme fear sentiment, with a Crypto Fear & Greed Index score of 14/100, mirrors late-2022 conditions. Underlying this trend is a flight to quality, where capital consolidates in top-tier exchanges. This mirrors patterns seen in traditional finance during volatility spikes, as detailed in Federal Reserve studies on market liquidity.

Related developments include regulatory challenges in South Korea and a study on fraudulent crypto promotions, which add regulatory overhead to exchange operations.

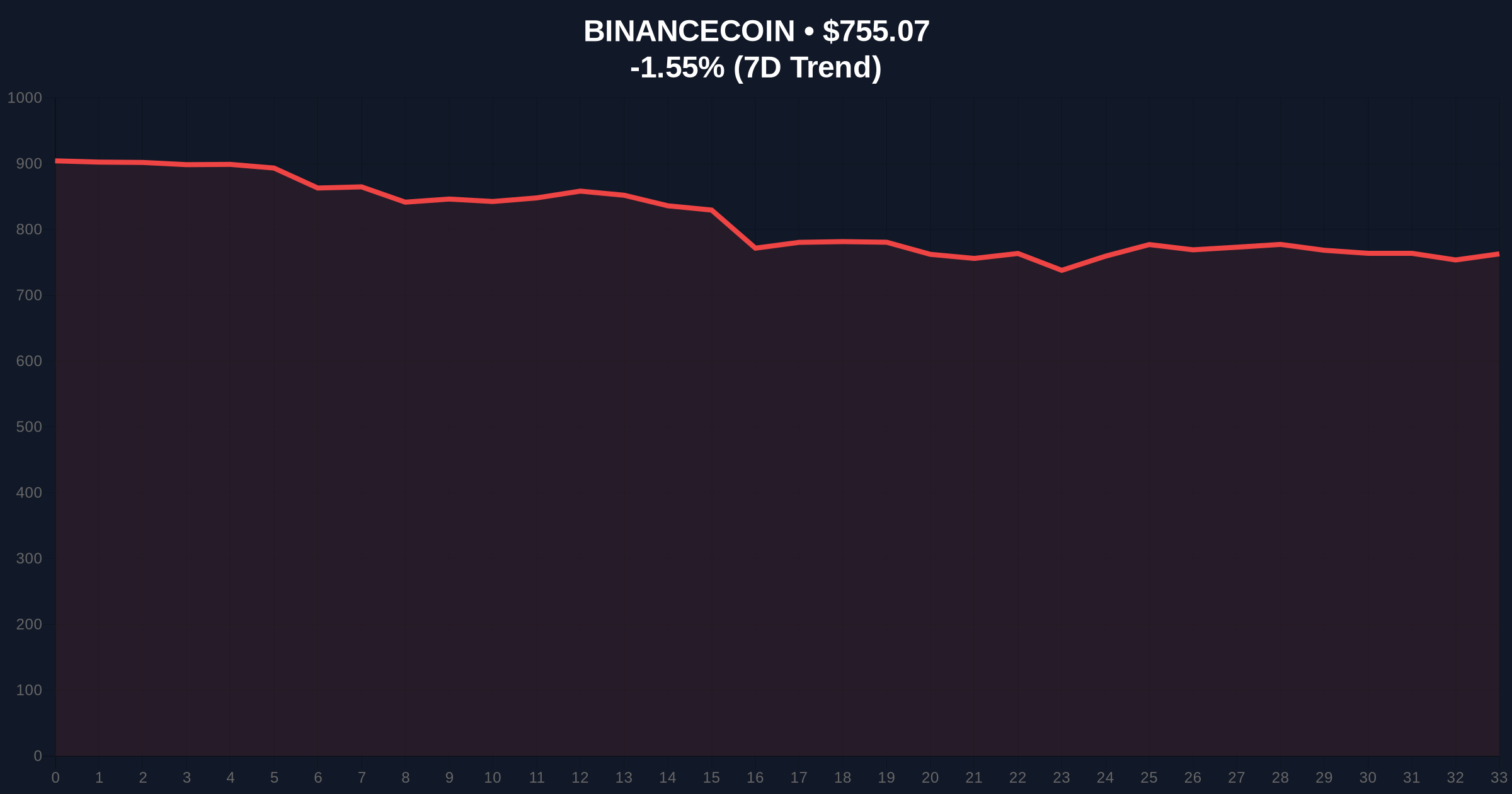

BNB, Binance's native token, currently trades at $755.06, down 1.56% in 24 hours. On-chain data indicates that BNB's price action is testing key Fibonacci retracement levels from its 2025 high. The 0.618 Fibonacci support at $720 represents a critical Order Block. A break below this level would invalidate the current consolidation structure. , RSI readings on the daily chart hover near oversold territory, suggesting potential for a short-term bounce if liquidity conditions stabilize.

| Metric | Value |

|---|---|

| Binance Total Assets | $155.64B |

| Binance Bitcoin Holdings | $49.84B |

| BNB Current Price | $755.06 |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| BNB 24h Change | -1.56% |

Binance's asset dominance matters for institutional liquidity cycles and retail market structure. A concentration of $155.64 billion in one exchange creates systemic dependencies. Consequently, any operational or regulatory shock to Binance could trigger cascading liquidations across derivatives markets. This is evidenced by the recent funding round for TRM Labs, highlighting increased investment in compliance infrastructure. Market analysts note that such liquidity hubs often precede Gamma Squeeze events in options markets during volatility expansions.

"Binance's asset lead reflects deep institutional trust and network effects. However, in an extreme fear market, this concentration also amplifies counterparty risk. Traders should monitor BNB's Volume Profile for signs of distribution near the $800 resistance level." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for the coming months. First, if BNB holds the Fibonacci 0.618 support at $720, a rebound toward $850 is plausible as fear subsides. Second, a break below this level could trigger a liquidation cascade toward $650. Historical cycles indicate that exchange asset peaks often precede broader market recoveries after fear capitulation.

The 12-month institutional outlook hinges on regulatory clarity and Bitcoin ETF flows. Binance's dominance may face challenges from decentralized exchanges as Ethereum's Pectra upgrade enhances scalability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.