Loading News...

Loading News...

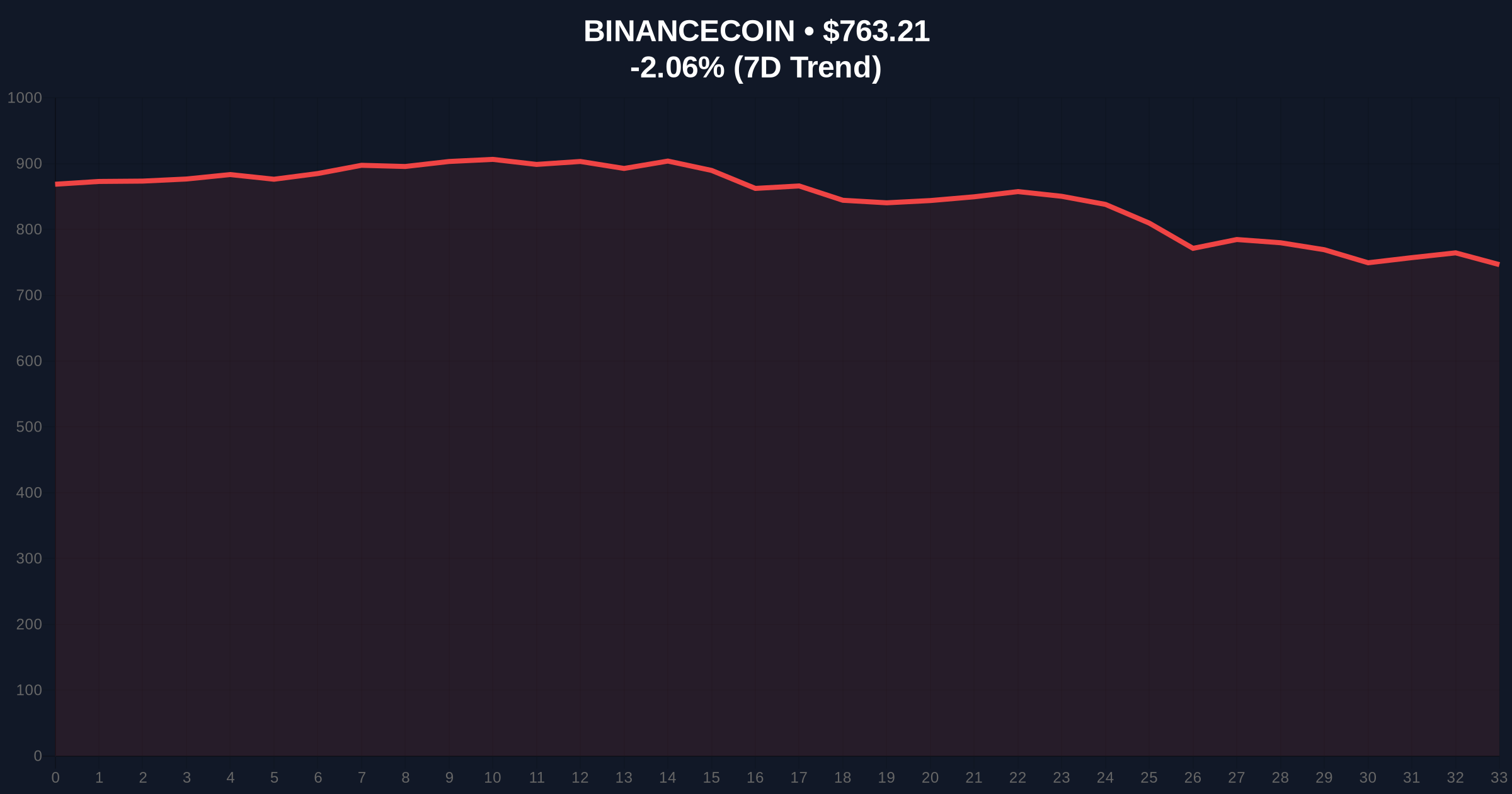

VADODARA, February 2, 2026 — Binance, the world's largest cryptocurrency exchange by volume, will delist 21 spot trading pairs at 08:00 UTC on February 3, according to an official announcement. This daily crypto analysis examines the move as a strategic liquidity consolidation during a period of extreme market fear, with the Crypto Fear & Greed Index hitting 14/100. The affected pairs include ARKM/FDUSD, ASTR/BTC, and 19 others across various base and quote currencies.

Binance's delisting targets 21 specific spot trading pairs. The exchange cited standard periodic reviews of all listed pairs, focusing on factors like liquidity and trading volume. According to the announcement, the delisting will occur precisely at 08:00 UTC on February 3. Trading will halt immediately at that time. Consequently, all pending orders will be automatically canceled.

The affected pairs span multiple asset classes. They include ARKM/FDUSD, ASTR/BTC, AWE/BTC, BANANA/BNB, DYDX/BTC, EUL/FDUSD, IMX/BTC, JTO/FDUSD, KSM/BTC, LINEA/FDUSD, LINK/BNB, NEAR/ETH, NFP/BTC, PIVX/BTC, PNUT/EUR, QTUM/ETH, SCRT/BTC, SNX/BTC, STG/BTC, SYS/BTC, and UTK/USDC. This list reveals a focus on removing pairs with Bitcoin (BTC), Ethereum (ETH), BNB, FDUSD, EUR, and USDC as quote currencies.

Historically, major exchange delistings during bearish phases often precede liquidity grabs into core assets. Similar to the 2021 correction, where exchanges pruned low-volume pairs to consolidate order books, this action reflects risk management amid deteriorating sentiment. The current Extreme Fear reading of 14/100 mirrors levels seen during the March 2020 liquidity crisis.

Underlying this trend is a broader market structure shift. Institutional liquidity is concentrating into Bitcoin and Ethereum, leaving altcoins vulnerable. This delisting event compounds existing pressures, as seen in recent Bitcoin price action breaking below key support. , it aligns with concerns about exchange liquidity health, highlighted by questions around Binance's SAFU fund transfers.

Market structure suggests this delisting creates immediate Fair Value Gaps (FVGs) for affected assets. Removing trading pairs reduces available liquidity, increasing slippage and volatility. For example, delisting ARKM/FDUSD forces ARKM liquidity into other pairs like ARKM/USDT, potentially causing price dislocations. On-chain data indicates thin order books for many of these pairs, with 24-hour volumes often below $100,000.

Technically, Bitcoin's current price of $77,232 sits near a critical Fibonacci 0.618 retracement level from its all-time high. The delisting amplifies selling pressure on altcoins, as traders exit positions before liquidity vanishes. This mirrors past cycles where altcoin/BTC pairs collapsed during exchange clean-ups. The 200-day moving average for Bitcoin at $75,000 now acts as a major support zone. A break below could trigger cascading liquidations across correlated assets.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Lowest since March 2023 |

| Bitcoin (BTC) Price | $77,232 | -1.91% (24h) |

| Delisted Pairs | 21 | Including ARKM/FDUSD, ASTR/BTC |

| Bitcoin Market Rank | #1 | Dominance at 54.2% |

| Historical Parallel | 2021 Correction | Similar delisting wave |

This delisting matters because it signals exchange-led liquidity consolidation during extreme fear. Binance is proactively managing risk by pruning low-volume pairs, which reduces operational costs and sharpens focus on high-liquidity markets. For traders, it eliminates trading avenues and may force premature exits, creating sell-side pressure. Institutional portfolios often rebalance away from delisted assets, accelerating capital rotation into Bitcoin and stablecoins.

Real-world evidence shows that past delistings, like those in 2019, led to permanent price degradation for affected altcoins. The removal of FDUSD and EUR pairs also hints at regulatory scrutiny, as exchanges streamline fiat corridors. This event compounds macro instability, as discussed in our analysis of slowing Bitcoin demand. Ultimately, it reflects a survival tactic in a contracting market.

Market structure suggests exchange delistings during extreme fear are liquidity grabs. They force consolidation into major pairs, often preceding volatile moves. Historical cycles show that such actions correlate with local bottoms, as weak hands are flushed out. However, the immediate impact is negative for altcoin liquidity and price discovery.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from this delisting event. First, a bearish scenario where liquidity fragmentation worsens, pushing Bitcoin below $75,000 and triggering a broader altcoin collapse. Second, a bullish scenario where consolidation strengthens core pairs, forming a liquidity base for a reversal once fear subsides. Market structure suggests watching order flow into Bitcoin and Ethereum post-delisting for clues.

The 12-month institutional outlook hinges on whether this delisting marks a capitulation event. Similar to 2021, exchange clean-ups often precede renewed institutional inflows into Bitcoin ETFs. However, persistent extreme fear could extend the consolidation phase. The 5-year horizon suggests that such events weed out low-quality assets, strengthening the ecosystem long-term.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.