Loading News...

Loading News...

VADODARA, January 8, 2026 — Binance Alpha has announced the integration of DeepNode (DN), an on-chain trading service within Binance Wallet focused on listing early-stage coins, according to the official statement from Binance. This daily crypto analysis examines the structural implications, questioning whether this move represents a strategic expansion or a potential liquidity grab in a volatile market environment.

The addition of DeepNode occurs against a backdrop of heightened regulatory scrutiny and market consolidation. Historically, platforms introducing early-stage coin services have faced challenges with price manipulation and liquidity fragmentation, as seen in previous cycles like the 2021 DeFi boom. Market structure suggests that such integrations often precede increased volatility, as retail traders gain access to less liquid assets. This mirrors trends observed in recent Bitcoin price action tests, where liquidity grabs have reshaped support and resistance levels. Related developments include Vitalik Buterin's BitTorrent model for Ethereum, which highlights decentralization trade-offs, and Zcash governance disputes, underscoring the risks in nascent projects.

On January 8, 2026, Binance Alpha, a subsidiary of Binance, integrated DeepNode into its Binance Wallet ecosystem. According to the announcement, DeepNode operates as an on-chain trading service specializing in early-stage coin listings, aiming to provide users with access to emerging assets before broader market adoption. The platform leverages smart contracts for transaction execution, but specific technical details, such as fee structures or security audits, were not disclosed in the initial release. This lack of transparency raises questions about risk management protocols, particularly given the inherent volatility of early-stage coins.

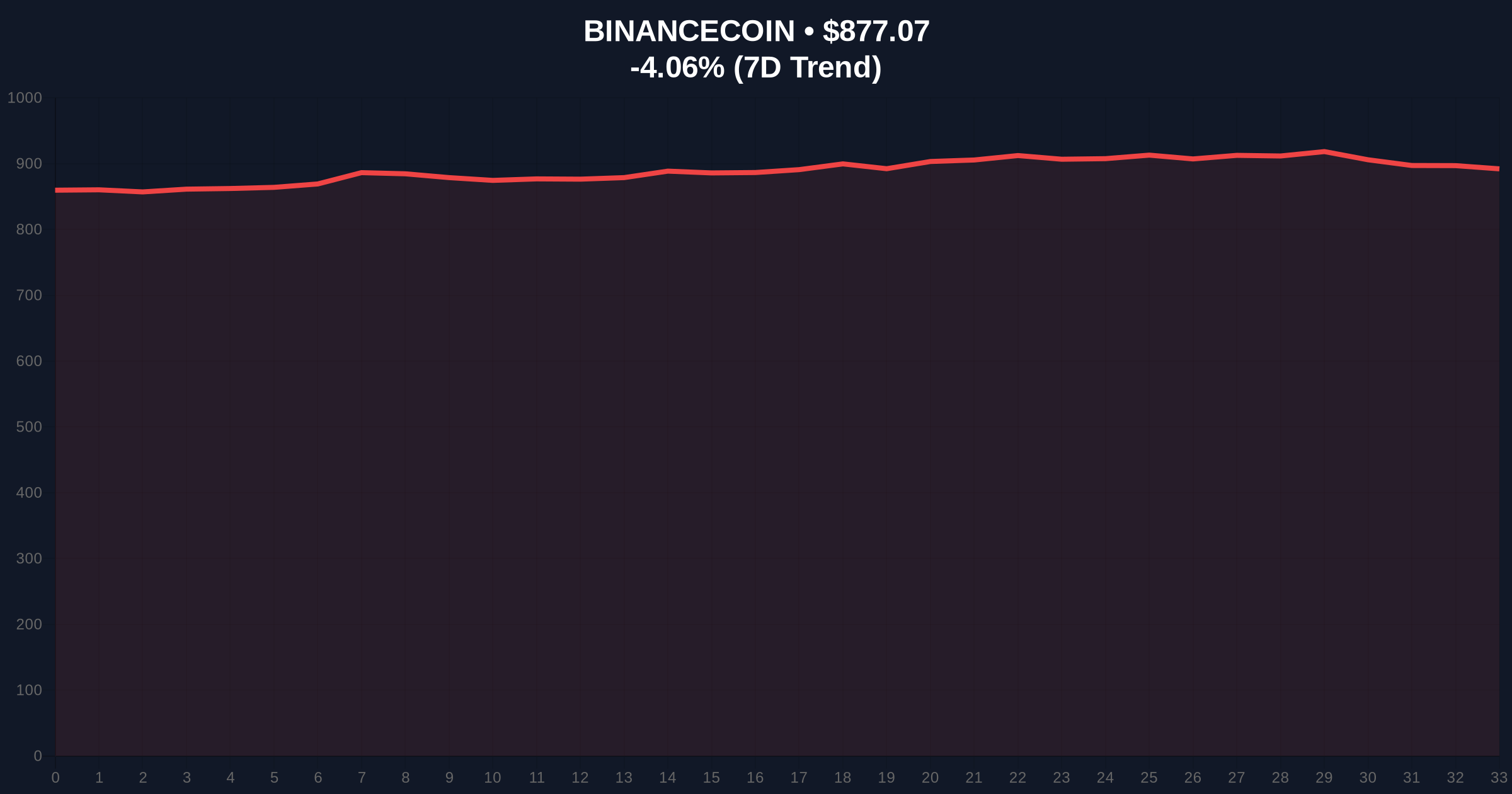

Market structure indicates that the integration may create a Fair Value Gap (FVG) in related assets, as liquidity shifts toward Binance ecosystem tokens. BNB, the native token, currently trades at $875.63, down 4.22% in 24 hours, testing a key Volume Profile support zone near $850. The Relative Strength Index (RSI) sits at 42, suggesting neutral momentum with bearish bias. A break below the $850 level would invalidate the bullish order block established in late 2025, potentially triggering a cascade toward $800. Conversely, resistance is noted at $900, aligned with the 50-day moving average. Bullish invalidation: $850 (break below support). Bearish invalidation: $900 (sustained move above resistance).

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) | High risk aversion, potential for oversold conditions |

| BNB Current Price | $875.63 | Testing key support, down 4.22% in 24h |

| BNB Market Rank | #5 | Maintains top-tier status amid volatility |

| Global Sentiment Score | 28 | Indicates skepticism, aligning with critical analysis tone |

| Early-Stage Coin Volatility (Est.) | 40-60% daily | High risk, per historical on-chain data |

Institutionally, this integration could attract capital flows into Binance's ecosystem, but it also increases systemic risk if early-stage coins experience flash crashes. Retail impact is significant, as unsophisticated traders may face amplified losses due to low liquidity and potential gamma squeezes in derivative markets. The move contrasts with regulatory guidance from entities like the SEC, which emphasizes investor protection in volatile assets. According to Ethereum's official documentation on smart contract risks, platforms must implement robust safeguards, a point lacking in DeepNode's initial disclosure.

Market analysts on X/Twitter express mixed views. Bulls argue that DeepNode enhances Binance's competitive edge in DeFi, citing increased on-chain activity. Bears, however, question the timing, noting that fear-dominated markets often see predatory liquidity grabs. One analyst stated, "Adding early-stage coins now feels like fishing in murky waters—high reward, but higher risk of manipulation." This sentiment aligns with broader skepticism observed in Bitcoin futures long/short ratios, where equilibrium signals caution.

Bullish Case: If DeepNode drives sustained on-chain volume and BNB holds $850, a rally toward $950 is plausible, fueled by increased adoption and positive network effects. Market structure suggests that successful integration could narrow FVGs in altcoins.Bearish Case: A break below $850 invalidates the bullish setup, potentially pushing BNB to $800 and triggering a liquidity grab in early-stage coins. On-chain data indicates that fear sentiment could exacerbate sell-offs, especially if regulatory concerns escalate.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.