Loading News...

Loading News...

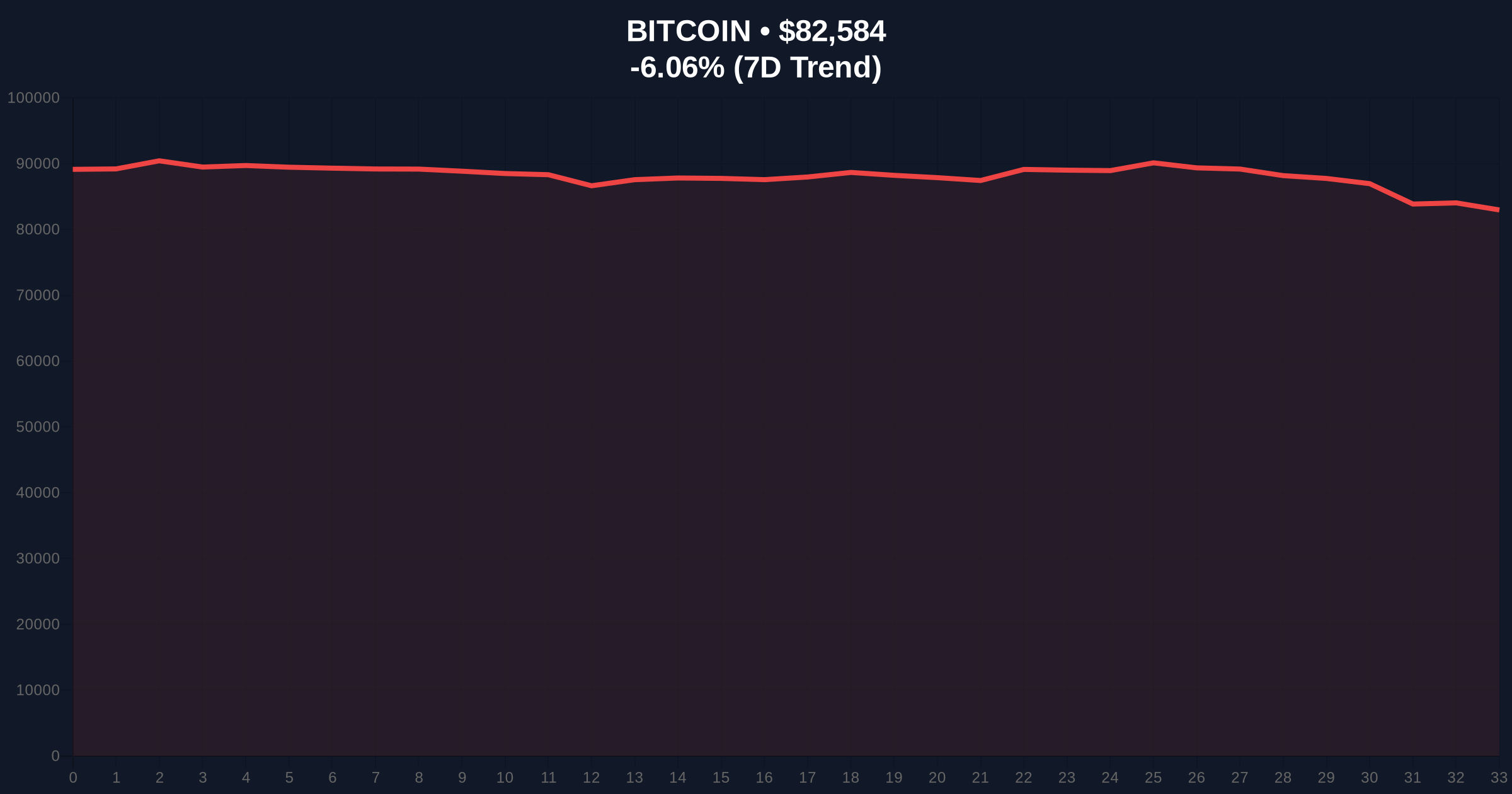

VADODARA, January 30, 2026 — Growing skepticism about the profitability of major technology companies' artificial intelligence investments has catalyzed a sharp, correlated decline across global risk assets. According to an analysis by DL News, this sentiment shift has directly impacted cryptocurrency valuations. The total crypto market capitalization has fallen below the $3 trillion psychological threshold. Bitcoin price action shows the asset testing the $82,000 support level, a critical zone for the current market structure. This daily crypto analysis examines the technical breakdown and historical parallels to previous risk-off events.

Market structure suggests a direct transmission of volatility from traditional equity markets to digital assets. DL News reports that Microsoft (MSFT) experienced a single-day market capitalization decline of approximately $357 billion. This event fueled a broad risk-off sentiment. Kraken Vice President Matt Howells-Barby directly linked concerns over Big Tech's AI investment returns to instability in the broader risk asset market. He indicated Bitcoin could potentially fall below the $80,000 level again. Concurrently, the price of gold fell nearly 3% as investors adjusted hedges. Renewed fears of a potential U.S. federal government shutdown added another layer of macro uncertainty, compressing liquidity across speculative asset classes.

Historically, cryptocurrency markets have demonstrated high beta sensitivity to Nasdaq volatility, particularly during liquidity contractions. The current scenario mirrors aspects of the Q2 2022 correction, where rising rates and tech sector weakness precipitated a prolonged crypto bear market. In contrast, the 2021 bull market correction was primarily driven by China's mining ban and leveraged long liquidations, not a direct tech equity spillover. Underlying this trend is the increasing institutional correlation between crypto and tech stocks, a relationship detailed in numerous Federal Reserve research papers on asset class convergence. This correlation strengthens during fear-driven sell-offs, as seen in the current Extreme Fear sentiment reading.

Related market developments include US stock indices opening lower, intensifying crypto market fear, and Binance listing new perpetual futures contracts amid extreme market volatility.

On-chain data indicates a significant liquidity grab below the $85,000 level, creating a large Fair Value Gap (FVG) on higher timeframes. Bitcoin's current price of $82,601 sits near the 0.618 Fibonacci retracement level from its recent all-time high, a classic technical magnet during corrections. The Relative Strength Index (RSI) on the daily chart has plunged into oversold territory, signaling capitulation. However, the 200-day moving average, currently near $78,500, provides a longer-term structural support. Market analysts monitor UTXO (Unspent Transaction Output) age bands for signs of long-term holder distribution, a key metric for assessing sell-side pressure.

| Metric | Value | Change (24h) |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | N/A |

| Bitcoin (BTC) Price | $82,601 | -6.04% |

| Total Crypto Market Cap | <$3 Trillion | Significant Decline |

| Microsoft (MSFT) Market Cap Loss | ~$357 Billion | Single Day |

| Gold Price Decline | ~3% | Correlated Move |

This event matters because it tests the decoupling thesis for cryptocurrencies. A sustained sell-off triggered by tech equity weakness confirms crypto's current role as a high-beta risk asset, not a monetary safe haven. Institutional liquidity cycles, particularly from corporate treasuries and ETFs, may face redemption pressures if the risk-off sentiment persists. Retail market structure, heavily reliant on leverage, becomes vulnerable to cascading liquidations below key support levels. The event provides real-world evidence of the interconnectedness of modern digital asset markets with traditional finance, a dynamic central to regulatory discussions on platforms like SEC.gov regarding systemic risk.

"Concerns over Big Tech's AI investments failing to generate expected returns are unsettling the broader risk asset market. Bitcoin could potentially fall below the $80,000 level again," said Kraken Vice President Matt Howells-Barby in the DL News report.

The CoinMarketBuzz Intelligence Desk adds: "Market structure suggests this is a liquidity-driven correction, not a fundamental breakdown of blockchain networks. Historical cycles show that such sharp, sentiment-driven sell-offs often create long-term buying opportunities once the order flow stabilizes."

Market analysts outline two primary data-backed scenarios based on current market structure and on-chain metrics.

The 12-month institutional outlook hinges on the resolution of Big Tech's AI profitability narrative and broader macro liquidity conditions. If AI investments begin showing tangible returns, relieving pressure on tech stocks, a correlated relief rally in crypto is probable. However, a prolonged period of doubt could extend the current risk-off regime, testing the resilience of long-term crypto holders and the post-merge Ethereum issuance schedule. This aligns with a cautious 5-year horizon where digital assets gradually mature beyond pure risk-on proxies.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.