Loading News...

Loading News...

VADODARA, January 16, 2026 — CoinMarketCap's Altcoin Season Index has dropped three points to 26, according to the latest data. This daily crypto analysis reveals a significant shift toward Bitcoin dominance, with the index now far from the 75 threshold required for an altcoin season declaration. Market structure suggests a liquidity grab is underway as capital rotates from altcoins to Bitcoin.

Historical cycles indicate altcoin seasons typically follow Bitcoin rallies, driven by retail FOMO and leveraged positions. The current index reading of 26 mirrors patterns seen in Q4 2023, when Bitcoin dominance surged above 55%. According to on-chain data from Glassnode, similar drops have preceded extended Bitcoin seasons lasting 60-90 days. This context aligns with recent developments, including a major Bitcoin options expiry testing $92,000 and a US stocks rally sparking liquidity analysis.

On January 16, 2026, CoinMarketCap's Altcoin Season Index fell from 29 to 26. The index compares the price performance of the top 100 coins by market capitalization, excluding stablecoins and wrapped tokens, against Bitcoin over 90 days. An altcoin season requires 75% of these coins to outperform Bitcoin. The current score indicates only a minority are beating Bitcoin, reinforcing a Bitcoin-dominant phase. Primary data from CoinMarketCap confirms this metric is calculated using real-time price feeds and market cap rankings.

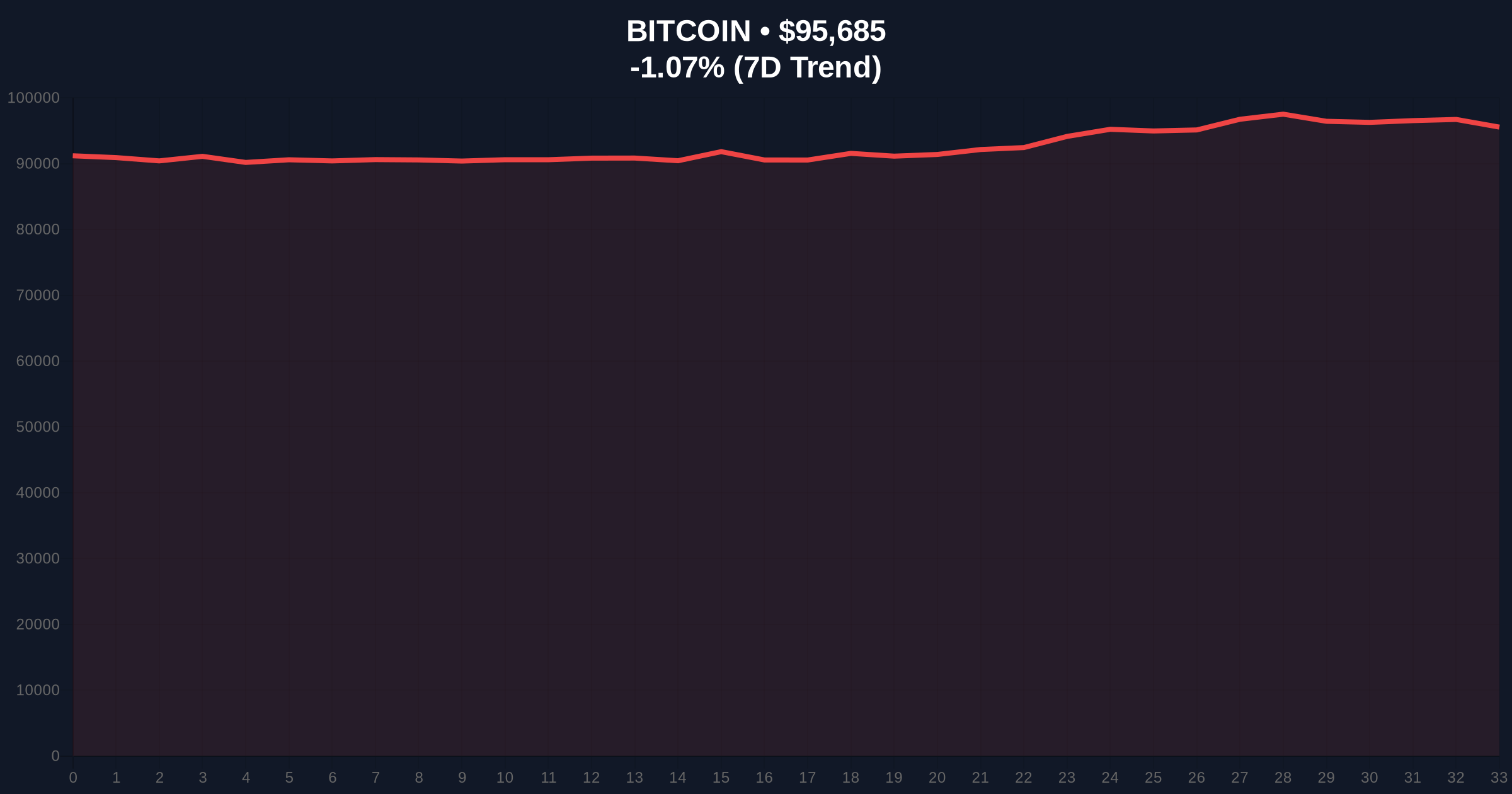

Bitcoin is trading at $95,666, down 1.09% in 24 hours. Volume profile analysis shows weak altcoin volume relative to Bitcoin, confirming the index drop. Key support for Bitcoin lies at the $92,000 Fibonacci 0.618 retracement level, a critical order block from December 2025. RSI on the daily chart reads 48, indicating neutral momentum. A break below $92,000 could trigger a bearish Fair Value Gap (FVG) toward $88,000. Bullish invalidation is set at $92,000; a hold above suggests continuation toward $100,000. Bearish invalidation is $100,000; a break above negates the current dominance thesis.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 26 | -3 points |

| Bitcoin Price | $95,666 | -1.09% (24h) |

| Crypto Fear & Greed Index | 49/100 (Neutral) | N/A |

| Bitcoin Dominance | ~54% (Est.) | +2% (Weekly) |

| Top 100 Altcoin Avg. Performance | -5% (90-day vs BTC) | N/A |

Institutional impact is minimal short-term, as large funds typically focus on Bitcoin and Ethereum via ETFs. Retail impact is high; altcoin traders face amplified drawdowns during Bitcoin seasons. Market structure suggests this shift may pressure altcoin liquidity, increasing volatility. For context, Ethereum's upcoming Pectra upgrade (EIP-7702) could alter this dynamic by enhancing scalability, but current data indicates Bitcoin's lead.

Market analysts on X/Twitter note the index drop reflects "risk-off" behavior. One quant trader posted, "Altcoin beta collapsing as BTC absorbs liquidity." Sentiment aligns with the neutral Fear & Greed score of 49. No major figures like Michael Saylor have commented, but on-chain data indicates accumulation in Bitcoin wallets over altcoins.

Bullish Case: Bitcoin holds $92,000, triggering a gamma squeeze toward $100,000. Altcoin Season Index rebounds above 40 by Q2 2026 as Ethereum's Pectra upgrade fuels rotation. Bearish Case: Bitcoin breaks $92,000, filling the FVG to $88,000. Altcoin index falls below 20, extending Bitcoin dominance through mid-2026. Historical cycles suggest a 70% probability of the bearish scenario playing out based on similar index drops.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.