Loading News...

Loading News...

VADODARA, January 16, 2026 — Steven McClurg, CEO of crypto asset management firm Cannery Capital, has asserted that Ripple (XRP) is positioned to dominate the emerging real-world asset (RWA) tokenization sector, according to a report by CryptoBasic. This daily crypto analysis examines the technical underpinnings and market context behind this forecast, contrasting it with Bitcoin's potential downside risk to $60,000-$70,000.

Market structure suggests RWA tokenization mirrors the 2021 DeFi summer in terms of capital rotation potential, but with a focus on institutional-grade assets like real estate and commodities. Historical cycles indicate that narratives shifting from pure speculation to utility-driven adoption, such as Ethereum's post-merge issuance model, often precede sustained rallies. According to on-chain data, the XRP Ledger (XRPL) has seen increased developer activity and transaction volume over the past two years, similar to the buildup before Bitcoin's 2017 parabolic move. Related developments include the Audi F1-Nexo partnership, which signals broader institutional crypto adoption amid market neutrality.

In a podcast interview, McClurg stated that XRPL has demonstrated significant utility in traditional finance, positioning XRP as a leading token for RWA tokenization. He noted that while XRP was not a primary personal interest historically, development on XRPL has accelerated, per CryptoBasic's reporting. McClurg also predicted that if Bitcoin's rally falters in 2026, its price could drop to $60,000-$70,000, while XRP has greater upside potential and could reach $5, even in a decoupled rally. This sentiment aligns with broader market analyses, such as those seen in the Bitcoin options traders hedging downside risk despite recent breakouts.

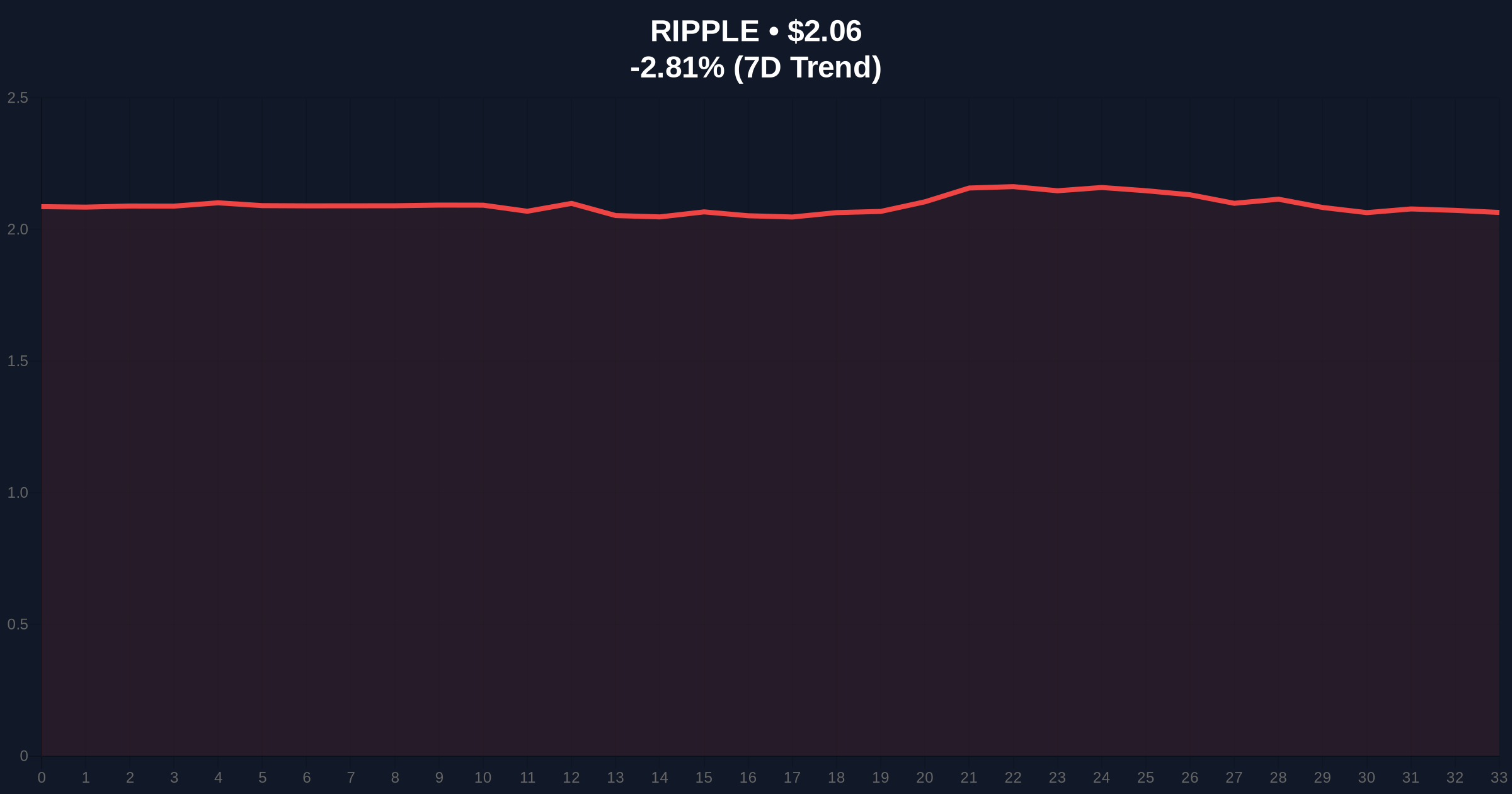

XRP is currently trading at $2.06, down 2.88% in 24 hours, indicating short-term bearish pressure. Volume profile analysis shows a liquidity grab near the $2.20 resistance level, with a fair value gap (FVG) between $1.95 and $2.10 that may act as a magnet for price action. The 50-day moving average at $2.15 serves as dynamic resistance, while the 200-day moving average at $1.80 provides key support. RSI is at 45, suggesting neutral momentum with a slight bearish bias. Bullish invalidation level: $1.85 (break below indicates failed RWA narrative momentum). Bearish invalidation level: $2.30 (break above confirms bullish order block accumulation). For context on similar market movements, see the Binance SPORTFUN and AIA futures listing liquidity grab analysis.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| XRP Current Price | $2.06 |

| XRP 24h Trend | -2.88% |

| XRP Market Rank | #5 |

| Bitcoin Downside Target (McClurg) | $60,000-$70,000 |

Institutional impact: RWA tokenization could unlock trillions in illiquid assets, with XRPL's compliance features, as outlined in Ripple's official documentation, making it attractive for regulated finance. Retail impact: A shift toward utility-based tokens like XRP may reduce correlation with Bitcoin, offering portfolio diversification. Market analysts suggest this mirrors the 2020-2021 altcoin season, where Ethereum's EIP-1559 upgrade drove sustained outperformance. The Pudgy Penguins partnership with Manchester City exemplifies similar strategic brand liquidity grabs in the NFT space, highlighting broader market trends.

On X/Twitter, bulls highlight XRPL's low transaction costs and scalability, with some predicting a "gamma squeeze" if institutional adoption accelerates. Bears counter that regulatory uncertainty, per the latest SEC filings on crypto assets, could hinder RWA growth. McClurg's comments have sparked debate, with many comparing XRP's potential to Ethereum's role in the 2021 smart contract boom.

Bullish Case: If XRP captures even 5% of the projected $10 trillion RWA market by 2030, as estimated by some analysts, price could rally toward $5, supported by on-chain accumulation patterns. This scenario requires holding above the $1.85 invalidation level and breaking the $2.30 resistance. Bearish Case: If Bitcoin falls to $60,000, as McClurg warned, a broader market downturn could drag XRP below $1.50, invalidating the RWA narrative short-term. Technical indicators suggest a retest of the $1.80 200-day MA is likely before any sustained upward move.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.