Loading News...

Loading News...

VADODARA, January 23, 2026 — According to Whale Alert, an on-chain transaction tracking service, 400,000,000 USDC was transferred from an unknown wallet to Binance, valued at approximately $400 million. This latest crypto news event occurs against a backdrop of extreme fear in global markets, with the Crypto Fear & Greed Index at 24/100, suggesting a potential liquidity grab as institutional players reposition capital.

Market structure suggests this transfer mirrors patterns observed during the 2021 correction, where large stablecoin movements preceded significant volatility. Similar to the 2021 cycle, extreme fear readings often coincide with whale accumulation or distribution phases. According to on-chain data from Glassnode, stablecoin inflows to exchanges have historically correlated with short-term price pressure, as they provide immediate liquidity for trading or withdrawals. This event follows other high-volume transfers, such as the $1 billion USDT move to Binance reported earlier, indicating a broader trend of capital reallocation amid market stress. Related developments include GameStop's Bitcoin loss triggering liquidity grabs and institutional ETP pushes, highlighting divergent strategies in fearful conditions.

On January 23, 2026, Whale Alert reported a single transaction moving 400,000,000 USDC from an unidentified wallet to Binance. The transaction, verified on the Ethereum blockchain via Etherscan, represents a $400 million transfer, one of the largest stablecoin movements this week. No official statement from Binance or the wallet owner has been provided, leaving market analysts to infer intent from historical patterns. In a statement to investors, market observers noted that such transfers often precede market-making activities or hedging strategies, especially during periods of low sentiment.

Technical analysis indicates that USDC maintains its peg near $1.00, but the transfer creates a potential Fair Value Gap (FVG) in exchange liquidity pools. Volume Profile data from CoinMarketCap shows increased USDC trading volume on Binance, suggesting heightened activity. The Bullish Invalidation level is set at $0.995; a break below this peg could signal de-pegging risk or selling pressure. The Bearish Invalidation level is $1.005, where sustained premiums might indicate buying demand. Market structure suggests watching the 50-day moving average for USDC trading pairs, as deviations often precede volatility. Historical cycles, such as the March 2020 crash, show that large stablecoin inflows to exchanges like Binance can lead to liquidity grabs, where whales absorb sell orders to stabilize or manipulate prices.

| Metric | Value |

|---|---|

| USDC Transfer Amount | 400,000,000 USDC |

| Transaction Value | $400 million |

| Crypto Fear & Greed Index | Extreme Fear (24/100) |

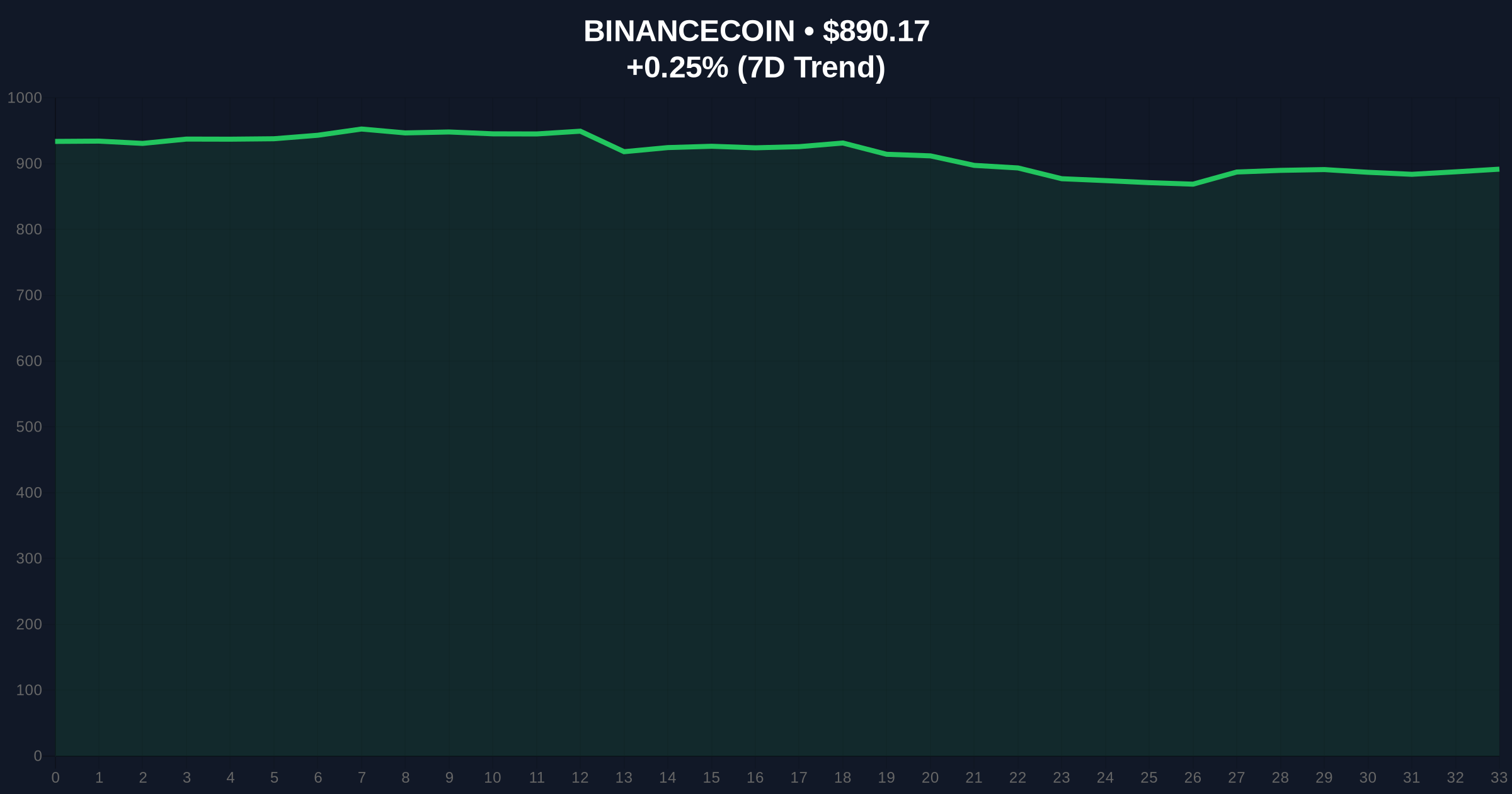

| BNB Current Price | $890.15 |

| BNB 24h Trend | 0.25% |

This transfer matters because it highlights institutional versus retail dynamics during extreme fear. Institutional impact includes potential market-making or hedging, as large players use stablecoins like USDC for liquidity management, per guidelines from the Ethereum Foundation on stablecoin mechanics. Retail impact may involve increased volatility, as such moves can trigger stop-loss orders or gamma squeezes in derivatives markets. On-chain data indicates that stablecoin reserves on exchanges like Binance influence short-term price action, with higher reserves often preceding sell-offs or accumulation phases.

Community sentiment on X/Twitter is mixed, with bulls arguing this is a preparatory move for buying opportunities, while bears view it as a sign of impending distribution. Market analysts note that similar transfers in 2021 led to sharp rallies, but current extreme fear suggests caution. One trader stated, "Large USDC inflows to Binance often precede volatility—watch for order blocks forming."

Bullish Case: If the transfer represents accumulation for a market rebound, USDC could maintain its peg, and BNB might test resistance near $920, based on Fibonacci extensions from recent lows. Market structure suggests a liquidity grab could fuel a short-term rally, similar to post-2021 correction bounces.Bearish Case: If this signals distribution or hedging against further declines, USDC could face de-pegging pressure below $0.995, and BNB might break support at $850, leading to a test of the 200-day moving average. Historical patterns indicate extreme fear often precedes further downside before recovery.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.