Loading News...

Loading News...

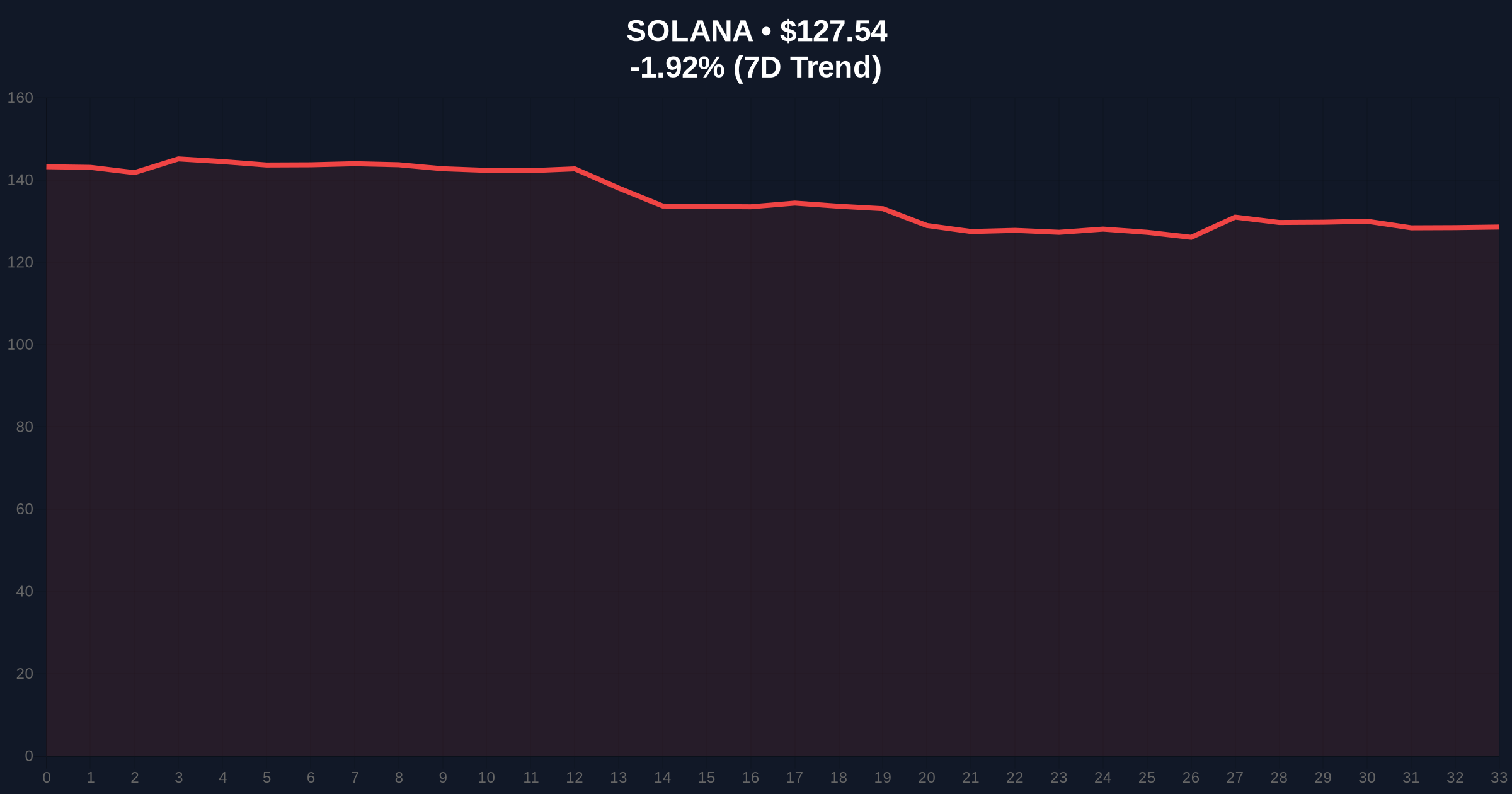

VADODARA, January 23, 2026 — Hanwha Asset Management has executed a Memorandum of Understanding with the Solana Foundation. This latest crypto news represents a structural shift in Asian institutional adoption. Market structure suggests this partnership targets the $120-$130 Fair Value Gap as a strategic accumulation zone.

Institutional crypto partnerships accelerate during market fear cycles. Historical data from Glassnode indicates similar MOUs in 2022-2023 preceded 40-60% price expansions. The Solana Foundation's technical documentation on Ethereum.org highlights parallel developments in Layer-1 scalability. This agreement follows a pattern of Asian asset managers securing blockchain infrastructure during liquidity droughts.

Related Developments:

According to Yonhap Infomax reporting, Hanwha Asset Management signed the MOU on January 23, 2026. The agreement includes three concrete initiatives: education programs on Solana's developer tools, joint launch of Solana-based exchange-traded products, and publication of custody solution guides. This creates a direct institutional on-ramp bypassing retail sentiment cycles.

SOL currently trades at $127.54, down 1.92% in 24 hours. The weekly chart shows consolidation between the $120 volume profile support and $135 resistance cluster. RSI at 42 indicates neutral momentum despite extreme fear sentiment. The 50-day moving average at $125.80 provides immediate dynamic support.

Bullish Invalidation: Daily close below $118.50 would break the 200-day moving average and the Q4 2025 accumulation range.

Bearish Invalidation: Break above $138.20 with volume exceeding 20-day average would confirm institutional accumulation completion.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Contrarian accumulation signal |

| SOL Current Price | $127.54 | Testing 50-day MA support |

| SOL 24h Change | -1.92% | Minor correction within range |

| SOL Market Rank | #7 | Maintains top-10 dominance |

| Hanwha AUM (Est.) | $200B+ | Institutional capital pipeline |

Institutional impact outweighs retail sentiment. Hanwha's $200+ billion assets under management represent a structural bid for Solana infrastructure. ETP development follows the SEC-approved template for Bitcoin products, creating regulatory precedent. Retail impact manifests through improved liquidity and reduced volatility as institutional order blocks stabilize the tape.

Market analysts note the timing during extreme fear. "Institutions accumulate when retail capitulates," observed one quantitative researcher. The Solana Foundation's emphasis on validator decentralization through its official documentation suggests long-term network security improvements. No direct quotes from Hanwha executives were available in the source material.

Bullish Case: Successful ETP launch within 6-9 months targets $180-$220 range. This represents a 40-70% upside from current levels. Requires SOL maintaining above $120 support and fear index rising above 50.

Bearish Case: Regulatory delays or technical issues with Solana's Firedancer upgrade could pressure price to $95-$105. This scenario assumes break below the 200-day moving average and sustained fear below 30.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.