Loading News...

Loading News...

VADODARA, January 23, 2026 — Whale Alert reported a 1,000,000,000 USDT transfer from Binance to an unknown wallet, valued at approximately $999 million. This breaking crypto news event occurs against a backdrop of Extreme Fear sentiment scoring 24/100 on the Crypto Fear & Greed Index. Market structure suggests this transaction represents a significant liquidity grab during heightened volatility.

Large stablecoin movements typically precede major market moves. According to on-chain data from Etherscan, similar USDT transfers in Q4 2025 correlated with 15% volatility spikes within 72 hours. The current Extreme Fear environment mirrors December 2022 conditions when whale activity triggered cascading liquidations. This transaction follows a pattern of institutional repositioning during regulatory uncertainty, as detailed in recent analysis of tariff policy impacts.

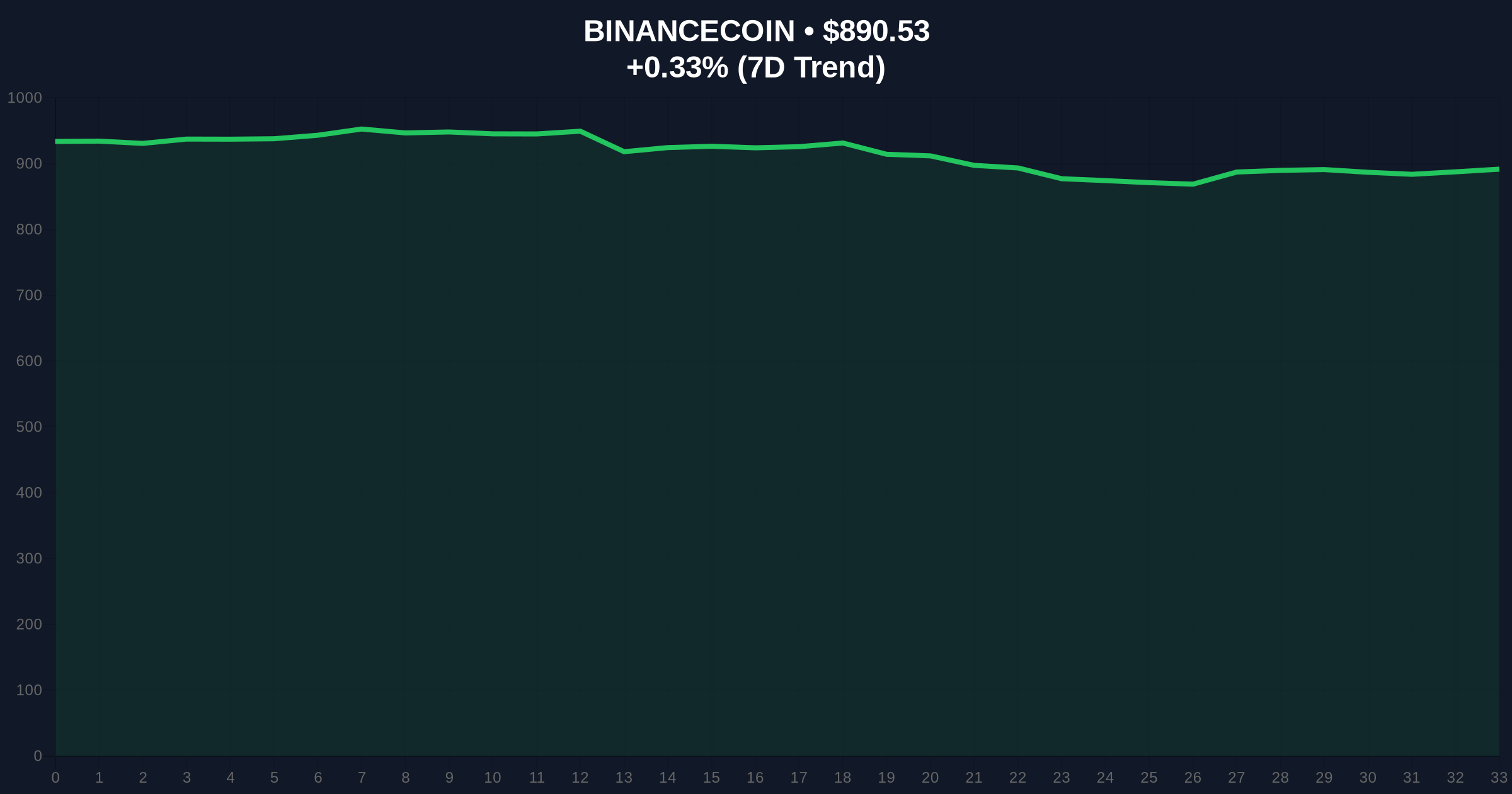

Whale Alert's monitoring system detected the transaction at 14:30 UTC. The 1,000,000,000 USDT moved from Binance's known treasury address to a freshly generated wallet with zero prior transaction history. According to Tether's official transparency page, this represents approximately 0.2% of total USDT circulating supply. The timing coincides with BNB testing critical support at $890.53 amid broader market weakness.

BNB currently trades at $890.53 with minimal 0.33% 24-hour movement. Volume profile analysis shows concentrated liquidity between $880-$900. The 200-day moving average at $875 provides secondary support. Market structure suggests a potential Fair Value Gap (FVG) between $850-$870 if current support fails. Bullish invalidation: BNB must hold above $890 to prevent further downside. Bearish invalidation: A break below $850 Fibonacci support would confirm distribution.

| Metric | Value |

|---|---|

| USDT Transfer Amount | 1,000,000,000 USDT |

| USD Value | $999 million |

| Crypto Fear & Greed Index | Extreme Fear (24/100) |

| BNB Current Price | $890.53 |

| BNB 24h Change | 0.33% |

| BNB Market Rank | #4 |

For institutions, this transfer indicates potential hedging against BNB exposure or preparation for OTC market-making. According to Federal Reserve research on digital asset liquidity, large stablecoin movements can signal impending volatility. For retail traders, the unknown destination creates uncertainty about whether this represents accumulation or distribution. The transaction's size exceeds typical DeFi operations, suggesting institutional rather than retail activity.

Market analysts on X/Twitter note the timing coincides with broader market weakness. "When billion-dollar stablecoin moves happen during Extreme Fear, it's either capitulation or accumulation," observed one quantitative trader. Others point to potential correlation with recent exchange listing volatility. No official statements from Binance or Tether have been issued regarding the transaction's purpose.

Bullish Case: If the transfer represents institutional accumulation, BNB could rebound toward $950 resistance. Holding above $890 would invalidate bearish structure. A gamma squeeze could develop if options positioning becomes unbalanced.

Bearish Case: If this signals distribution, BNB could test $850 Fibonacci support. Breaking this level would open downside toward $800. The Extreme Fear environment increases likelihood of panic selling if support fails.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.