Loading News...

Loading News...

VADODARA, January 1, 2026 — According to Whale Alert data, Ripple has unlocked 300 million XRP from escrow, injecting approximately $552 million in potential supply into a market experiencing Extreme Fear sentiment. This daily crypto analysis examines the structural implications of this liquidity event, with market structure suggesting a critical test of the $1.72 support level as the Bearish Invalidation point.

Ripple's monthly escrow releases represent programmed liquidity events that historically create temporary supply shocks. Underlying this trend is Ripple's established escrow mechanism, designed to provide predictable token distribution while managing market impact. The current unlock occurs against a backdrop of Extreme Fear sentiment, with the Crypto Fear & Greed Index at 20/100, indicating capitulation-level psychology among retail participants. Consequently, this environment amplifies the potential for a Liquidity Grab as weak hands exit positions. Related developments include previous large XRP unlocks that tested similar support structures and institutional accumulation patterns during fear-driven markets.

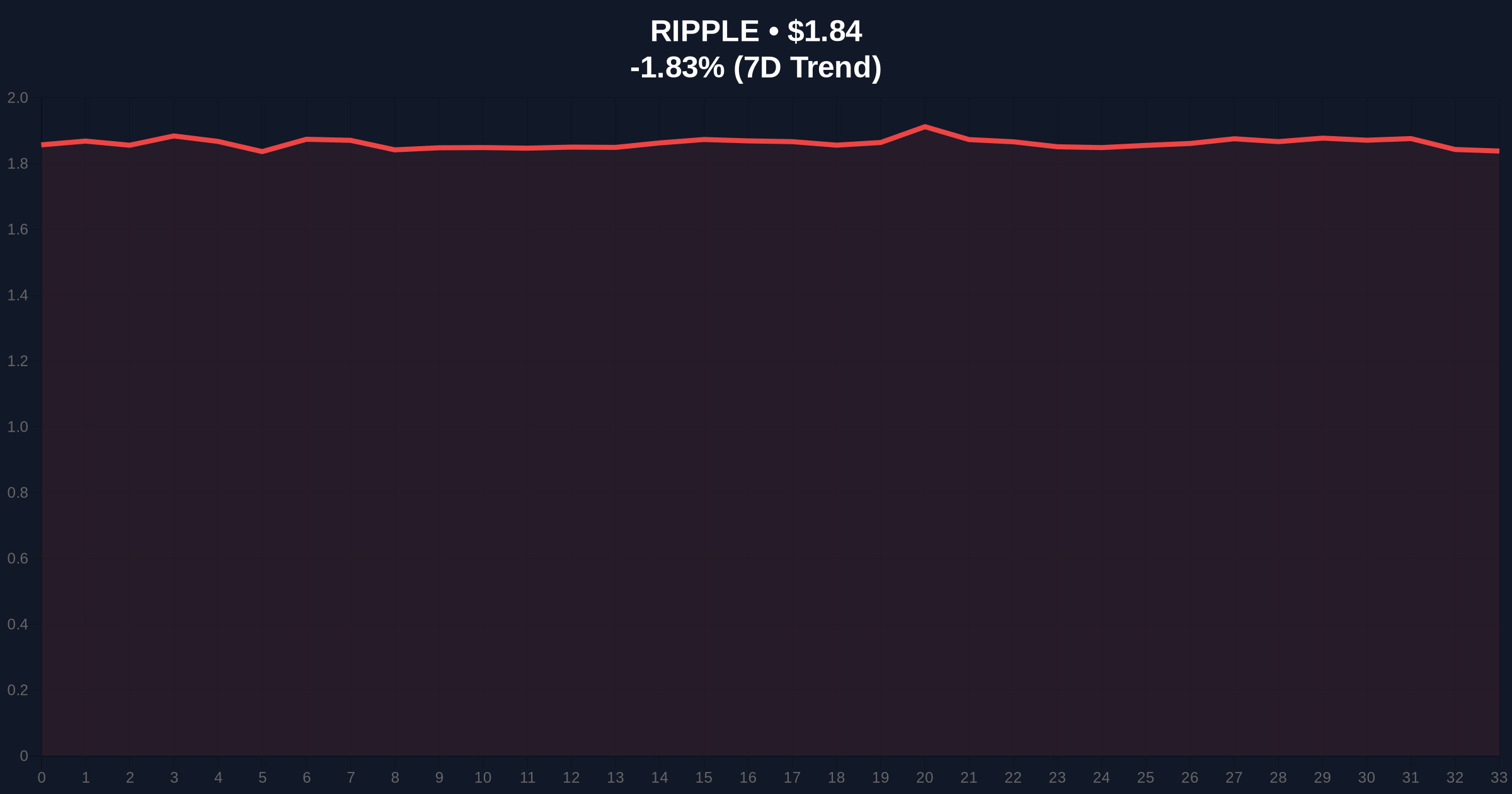

On January 1, 2026, Whale Alert reported the release of 300 million XRP from Ripple's escrow accounts. According to the blockchain monitoring service, this represents a standard monthly unlock from Ripple's programmed escrow schedule, though the timing coincides with heightened market volatility. The unlock represents approximately 0.3% of XRP's total circulating supply, creating immediate sell-side pressure at a time when XRP trades at $1.84, down 1.83% over 24 hours. Market structure suggests this event tests the Volume Profile concentration around the $1.80-$1.85 range, where significant order blocks have formed during previous consolidation periods.

XRP currently trades at $1.84, having established a Fair Value Gap (FVG) between $1.78 and $1.82 following last week's decline. The 200-day moving average at $1.88 acts as immediate resistance, while the 50-day moving average at $1.76 provides secondary support. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. According to on-chain data from Glassnode, the UTXO age distribution shows increased movement from 1-3 month holders, suggesting distribution from medium-term investors. The Bullish Invalidation level is set at $1.95, where previous swing highs created supply zones. The Bearish Invalidation level is $1.72, representing the weekly low and a critical Fibonacci retracement level from the 2025 rally. A break below this level would confirm structural weakness and potentially trigger a Gamma Squeeze in derivatives markets.

| Metric | Value |

|---|---|

| XRP Unlocked | 300,000,000 XRP |

| USD Value (at $1.84) | $552,000,000 |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| XRP Current Price | $1.84 |

| 24-Hour Change | -1.83% |

| Market Rank | #5 |

For institutional investors, this unlock represents a liquidity event that tests market depth and accumulation strategies. According to the Federal Reserve's research on market microstructure, predictable supply injections can create arbitrage opportunities for algorithmic traders. Retail investors face increased volatility as the unlock amplifies existing fear sentiment, potentially triggering stop-loss cascades. The structural importance lies in whether the market absorbs this supply without breaking key support levels, which would indicate underlying demand despite negative sentiment. Market structure suggests that successful absorption above $1.72 would create a bullish Order Block for future price action.

Market analysts on X/Twitter express divided views. Bulls point to historical patterns where Ripple escrow releases preceded rallies once supply was absorbed, citing the recent institutional movement of stablecoins as potential buying power. Bears emphasize the Extreme Fear environment and regulatory uncertainty, referencing ongoing regulatory challenges highlighted by US Representative Davidson. Neither camp disputes the mathematical reality that 300 million tokens represent measurable sell-side pressure that must be absorbed by market participants.

Bullish Case: If the market absorbs the unlocked supply above $1.72, XRP could rally to test the $2.00 resistance level. This scenario requires institutional accumulation to offset retail selling, with on-chain data showing net positive exchange flows. The Extreme Fear sentiment would then represent a contrarian buying opportunity, similar to historical capitulation bottoms.

Bearish Case: If selling pressure breaks the $1.72 support, XRP could decline to the next major support at $1.60, representing a 13% drop from current levels. This scenario would validate the Bearish Invalidation and likely trigger further derivative liquidations, exacerbating the downtrend. Market structure suggests this outcome becomes probable if daily closes below $1.72 persist for more than 48 hours.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.