Loading News...

Loading News...

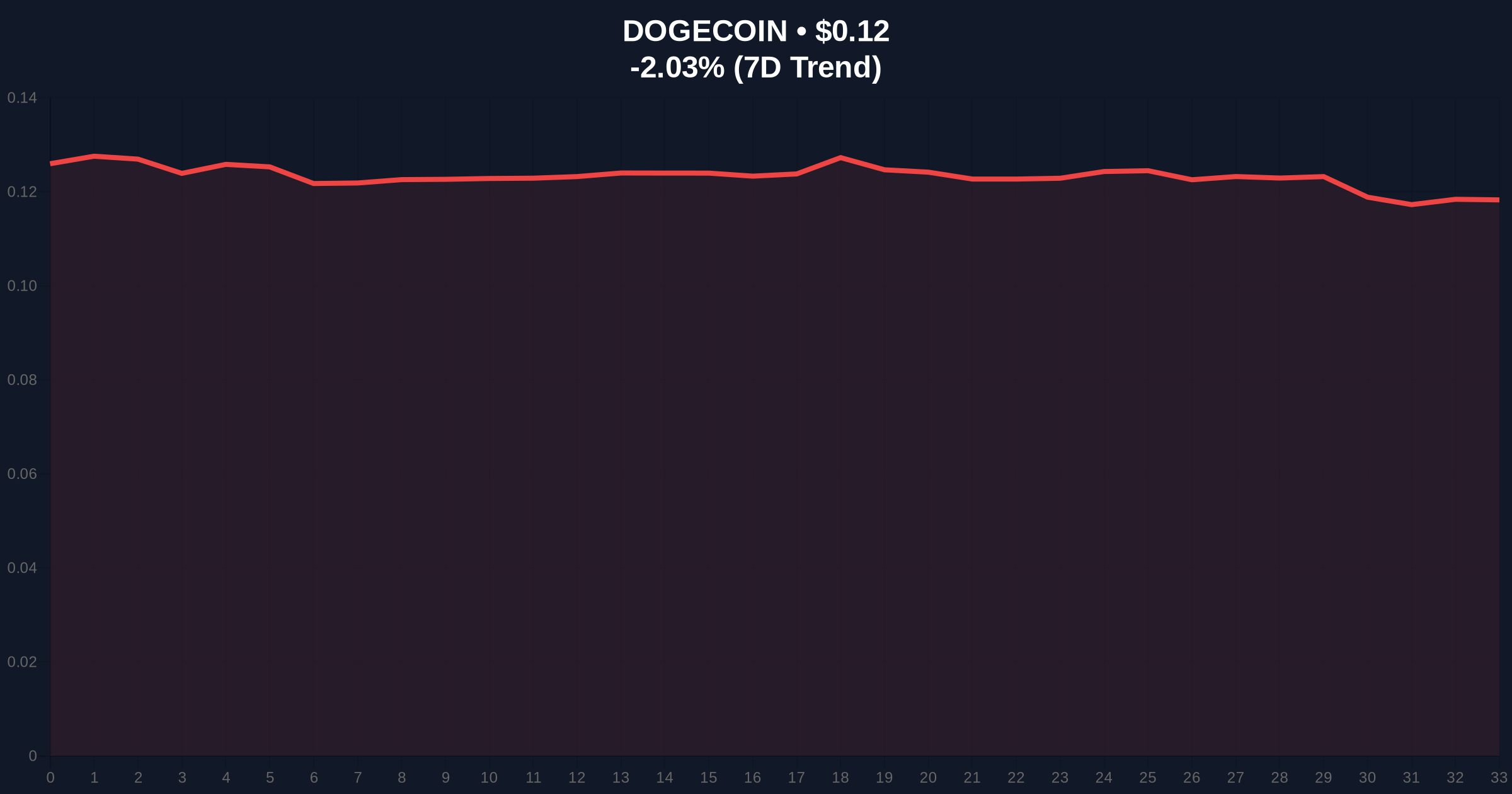

VADODARA, January 1, 2026 — Dogecoin (DOGE) is confronting a critical technical breakdown, with analyst Marzell identifying a simultaneous dead cross and head and shoulders pattern on its three-day chart, projecting a potential decline to $0.08. This daily crypto analysis examines the confluence of bearish signals, waning ETF interest, and futures market dynamics driving the sell-off. According to CoinMarketCap, DOGE is trading at $0.1203, down 1.99%, amid a broader market sentiment of Extreme Fear.

Dogecoin's current predicament mirrors historical meme coin volatility cycles, where technical patterns often precede sharp corrections. The dead cross, a lagging indicator, signals long-term bearish momentum, while the head and shoulders pattern suggests a distribution phase. Underlying this trend is a post-2025 environment where speculative assets face heightened scrutiny. Related developments include Bitcoin's breakdown of its four-year cycle theory and contrarian bullish predictions amid extreme fear, highlighting divergent market narratives.

On January 1, 2026, cryptocurrency analyst Marzell noted on X that a dead cross and head and shoulders pattern have appeared on Dogecoin's three-day chart. The dead cross occurs when the 200-day moving average falls below the 50-day moving average, indicating sustained bearish pressure. Marzell suggested that if these patterns fully form, DOGE could fall to $0.08. The analyst attributed the downward acceleration to waning interest in the spot DOGE ETF launched in November 2025 and a decline in open interest in the futures market, fostering risk-averse sentiment and sustained selling pressure.

Market structure suggests a critical juncture for DOGE. The dead cross on the three-day chart confirms a shift in momentum, while the head and shoulders pattern targets the $0.08 level, representing a 33.5% decline from current prices. Volume profile analysis indicates thinning liquidity at key support zones, exacerbating downside risk. The Bullish Invalidation level is set at $0.15, where a break above would negate the head and shoulders formation. The Bearish Invalidation level is $0.10; a sustained hold above this point could signal a false breakdown. On-chain data from sources like Glassnode shows reduced network activity, aligning with the technical deterioration.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| DOGE Current Price | $0.12 |

| DOGE 24h Trend | -2.03% |

| DOGE Market Rank | #10 |

| Projected Target (Marzell) | $0.08 |

This development matters institutionally as it tests the viability of meme coin ETFs, with waning interest in the spot DOGE ETF reflecting broader skepticism toward speculative products. Retail impact is significant, given Dogecoin's high retail ownership; a drop to $0.08 could trigger capitulation events. The decline in futures open interest, as noted in the analysis, indicates reduced leverage and hedging activity, potentially leading to a liquidity grab at lower support levels. Consequently, this scenario may influence regulatory perspectives on crypto derivatives, referencing frameworks like those on SEC.gov for ETF oversight.

Market analysts on X echo Marzell's caution, with bulls highlighting Dogecoin's historical resilience but bears emphasizing the pattern convergence. Sentiment is skewed toward fear, as evidenced by the Extreme Fear index score of 20/100. No direct quotes from figures like Michael Saylor are available, but the prevailing mood suggests a wait-and-see approach amid technical breakdowns.

Bullish Case: If DOGE holds above the $0.10 Bearish Invalidation level, a rebound toward $0.15 could occur, driven by a short squeeze or renewed retail interest. Historical cycles suggest meme coins often defy technical patterns during market euphoria.

Bearish Case: A break below $0.10 confirms the head and shoulders target of $0.08, with potential overshoot to $0.075 if selling pressure intensifies. The dead cross reinforces this outlook, with declining ETF interest and futures open interest acting as catalysts.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.