Loading News...

Loading News...

VADODARA, January 1, 2026 — According to Whale Alert's on-chain monitoring, Ripple executed a scheduled escrow release of 500 million XRP tokens, valued at approximately $920 million at current prices. This latest crypto news event occurs against a backdrop of extreme fear sentiment, with the Crypto Fear & Greed Index registering 20/100, creating a critical test for XRP's market structure and liquidity profile.

Market structure suggests this unlock mirrors historical supply-side pressure events seen during previous bear market phases. Similar to the 2021 correction where large token unlocks coincided with liquidity drains, the current environment features parallel institutional movements. For instance, recent Tether's Bitcoin accumulation and Coinbase's USDC transfers indicate sophisticated players positioning during fear cycles. Ripple's escrow mechanism, detailed in their official escrow documentation, follows a predictable monthly schedule, but the timing amidst extreme fear creates amplified technical implications.

Whale Alert's blockchain surveillance data confirms the transaction occurred on January 1, 2026, moving 500 million XRP from Ripple's escrow wallets to operational addresses. This represents approximately 0.5% of XRP's total circulating supply. The unlock is part of Ripple's structured escrow program initiated in 2017 to manage XRP's supply schedule, but market analysts note the coincidence with the current Fear & Greed Index reading of 20/100 creates unique pressure dynamics.

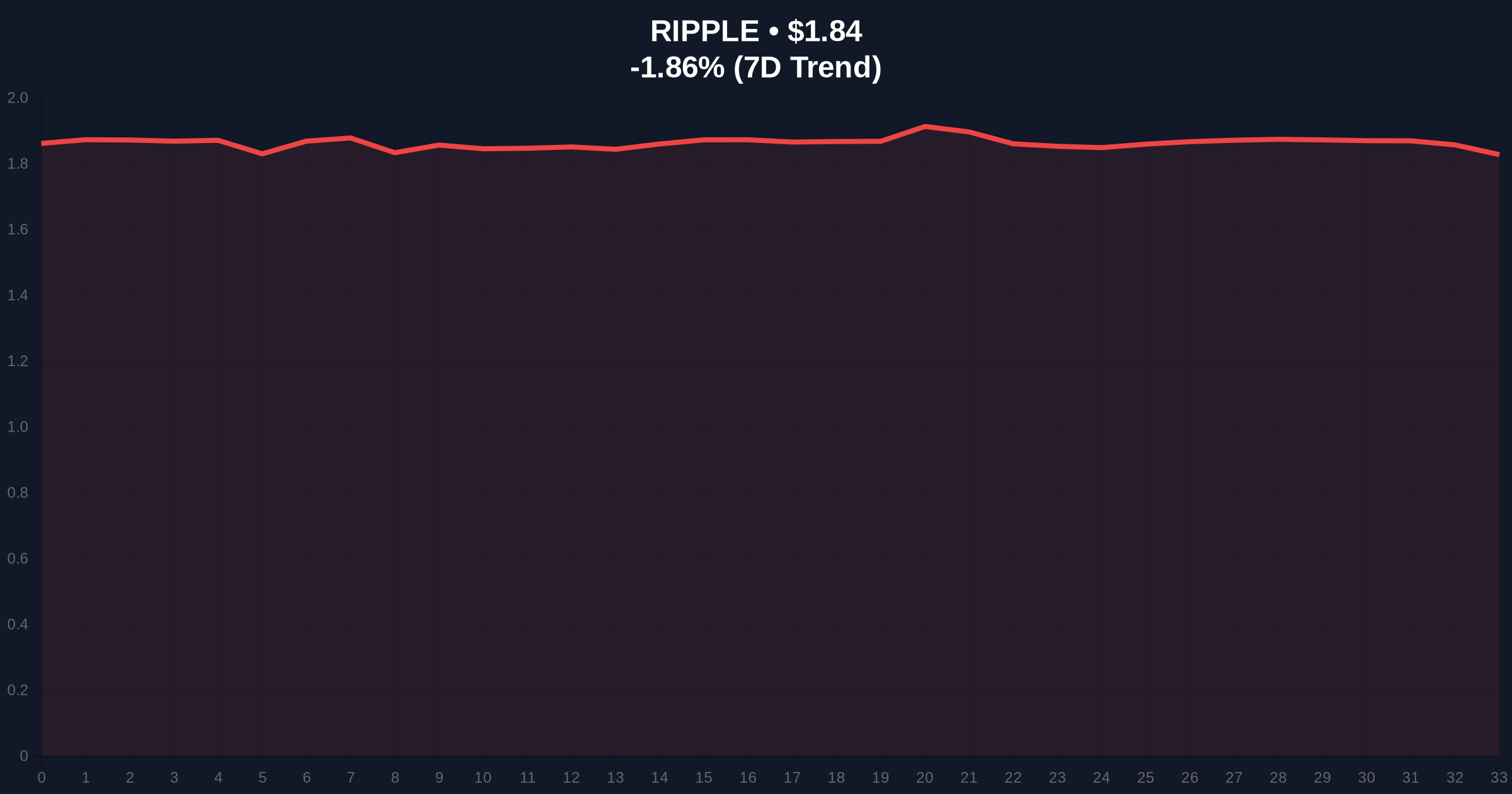

XRP currently trades at $1.84, down 1.87% in the last 24 hours. Volume profile analysis indicates weak buying interest below the $1.90 level, creating a potential Fair Value Gap (FVG) between $1.78 and $1.85. The 200-day moving average at $1.88 acts as immediate resistance, while Fibonacci retracement levels from the 2025 high show critical support at $1.72 (61.8% level). Market structure suggests the unlock creates a liquidity grab opportunity, with order blocks forming around the $1.75 zone. Bullish invalidation occurs if price breaks and closes below $1.72, while bearish invalidation requires a sustained move above the $1.95 resistance cluster.

| Metric | Value |

|---|---|

| XRP Unlocked Amount | 500,000,000 XRP |

| Current XRP Price | $1.84 |

| Unlock Value (USD) | $920,000,000 |

| 24-Hour Price Change | -1.87% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| XRP Market Rank | #5 |

For institutional portfolios, this unlock tests XRP's correlation with broader market fear cycles. The simultaneous extreme fear reading and supply increase create a gamma squeeze scenario where volatility expectations mismatch actual price movement. Retail traders face increased selling pressure near resistance levels, while institutions monitor whether this event triggers a breakdown below key Fibonacci supports. The timing coincides with regulatory uncertainty, as highlighted in recent congressional testimony about regulatory overreach, adding fundamental pressure to technical factors.

Market analysts on X/Twitter note the unlock's timing with extreme fear creates "perfect storm" conditions for testing support levels. One quantitative trader observed, "The 500M XRP unlock at Fear 20 creates a textbook liquidity test—if $1.72 holds, we see consolidation; if not, we retest $1.55." Another analyst referenced the parallel with recent legal developments dismissing class-action suits as creating contradictory fundamental signals amid technical pressure.

Bullish Case: If XRP holds the $1.72 Fibonacci support and absorbs the unlocked supply without breaking structure, a reversal toward $2.10 becomes probable. This scenario requires the Fear & Greed Index improving above 40 and sustained buying volume above 500 million XRP daily.

Bearish Case: If the unlock triggers a breakdown below $1.72 with increasing selling volume, the next support cluster at $1.55-$1.60 becomes the target. This would confirm the extreme fear sentiment is driving a broader market structure breakdown, potentially pushing XRP toward its 2025 lows.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.