Loading News...

Loading News...

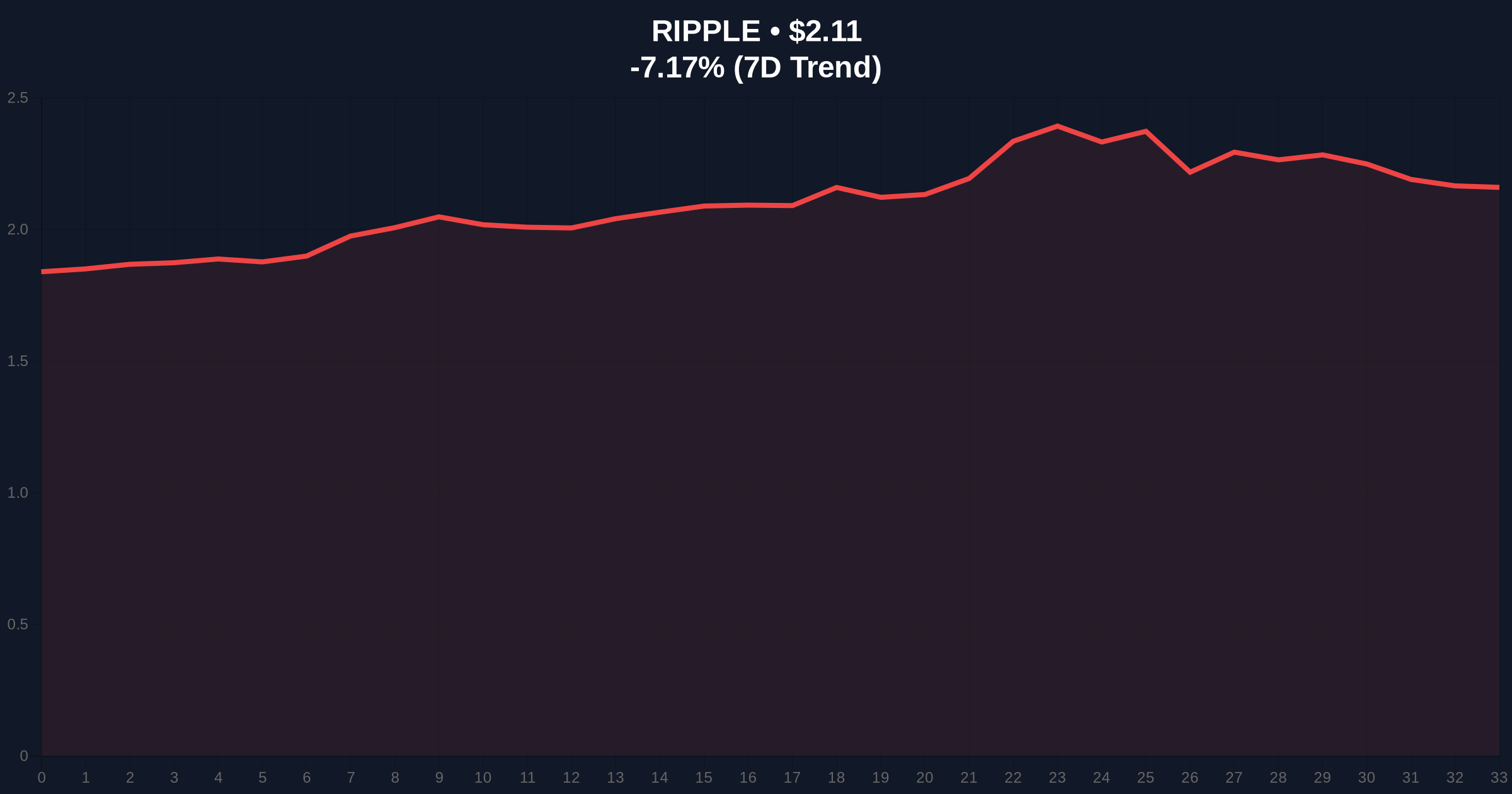

VADODARA, January 8, 2026 — U.S. spot XRP exchange-traded funds recorded their first net capital outflow in 36 trading days since launch, with $40.8 million exiting the products on January 7 according to The Block's institutional flow data. This daily crypto analysis examines whether this represents a structural shift or mere profit-taking within a broader market correction.

Market structure suggests ETF products typically experience initial accumulation phases followed by profit-taking events as prices approach psychological resistance levels. The XRP ETF launch coincided with a period of aggressive price appreciation from $1.8 to $2.4 within one week, creating multiple fair value gaps (FVGs) on lower timeframes. Underlying this trend, the broader cryptocurrency market has been testing key support levels, with Bitcoin facing its own liquidity tests at the $90,000 threshold. Consequently, capital rotation between asset classes has intensified, creating cross-market correlations that amplify volatility.

According to The Block's flow analysis, the five U.S. spot XRP ETFs experienced a combined net outflow of $40.8 million on January 7. The outflow was primarily driven by 21Shares' TOXR product, which lost $47.25 million in a single session. Conversely, ETFs from Canary, Bitwise, and Grayscale recorded combined net inflows of approximately $2 million, indicating selective capital allocation rather than wholesale abandonment. Rachael Lucas, an analyst at BTC Markets, noted in her assessment that while this represents the first net outflow since inception, its scale equals only 3% of cumulative net inflows since launch. She attributed the movement to profit-taking following XRP's rapid appreciation, coinciding with broader market corrections that have tested multiple support zones across major cryptocurrencies.

On-chain data indicates XRP holdings on centralized exchanges have reached all-time lows while trading volume remains elevated, creating a supply-demand imbalance that typically precedes volatility expansions. The price action from $2.4 to current levels around $2.11 has filled several fair value gaps, with the $2.05-$2.15 zone acting as a volume profile node. Market structure suggests the $1.95 level represents critical support, corresponding with the 0.618 Fibonacci retracement from the recent swing high. A break below this level would invalidate the current bullish structure and potentially trigger further liquidation cascades. The relative strength index (RSI) on daily timeframes shows oversold conditions at 28, suggesting near-term exhaustion may be approaching.

| Metric | Value | Significance |

|---|---|---|

| XRP ETF Net Outflow (Jan 7) | $40.8M | First outflow in 36 trading days |

| 21Shares TOXR Outflow | $47.25M | Primary driver of total outflow |

| XRP Current Price | $2.11 | -7.17% 24h change |

| Crypto Fear & Greed Index | 28/100 (Fear) | Extreme fear sentiment |

| XRP Market Rank | #4 | Maintains top-5 capitalization |

For institutional portfolios, ETF flow data serves as a real-time sentiment indicator for regulated capital allocation. The outflow represents approximately 3% of cumulative inflows since launch, suggesting this is more likely profit-taking behavior than structural abandonment. Retail traders face increased volatility as ETF flows interact with spot market liquidity, potentially creating gamma squeeze scenarios around monthly options expiries. The simultaneous occurrence of exchange outflows (all-time low holdings) and ETF outflows creates a complex liquidity where price discovery becomes increasingly dependent on derivatives markets and cross-margin positions.

Market analysts on X/Twitter have highlighted the divergence between on-chain accumulation patterns and short-term ETF flows. One quantitative researcher noted, "The ETF outflow represents just 0.18% of XRP's daily trading volume—more noise than signal in isolation." Another observer pointed to the parallel with Bitcoin's ETF launch period, where similar profit-taking events preceded renewed accumulation phases. The dominant narrative suggests this represents healthy market behavior rather than fundamental deterioration, with several commentators emphasizing that regulatory clarity from the SEC's official guidance on digital asset securities remains the primary long-term catalyst.

Bullish Case: If capital inflows resume and the $1.95 support holds, XRP could retest the $2.4 resistance level within 2-3 weeks. Sustained accumulation above this level would target the $3.00 psychological barrier, representing a 42% appreciation from current levels. Bullish invalidation occurs below $1.85, which would break the monthly order block established during the initial ETF approval rally.

Bearish Case: If ETF outflows accelerate and the $1.95 support fails, XRP could test the $1.75 liquidity zone, representing a 17% decline from current prices. This scenario would likely coincide with broader market deterioration, potentially triggering long liquidations in perpetual swap markets. Bearish invalidation occurs with a sustained break above $2.25, which would fill the current fair value gap and signal renewed bullish momentum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.