Loading News...

Loading News...

VADODARA, January 10, 2026 — Ripple CEO Brad Garlinghouse has outlined a strategic expansion plan for XRP and RLUSD, emphasizing long-term value creation in a market gripped by extreme fear, according to a statement on social media platform X. This daily crypto analysis examines the implications against a backdrop of historical corrections and current technical indicators.

Market structure suggests parallels to the 2021 correction, where regulatory uncertainty and macroeconomic pressures triggered significant drawdowns. According to on-chain data from Glassnode, similar periods saw liquidity dry-ups and order block formations near key psychological levels. The current extreme fear sentiment, with a score of 25/100 on the Crypto Fear & Greed Index, mirrors conditions preceding past capitulation events. Historical cycles indicate that such environments often precede consolidation phases, where strategic corporate announcements can act as catalysts for re-accumulation. Related developments include recent futures liquidations exceeding $112 million and Ethereum ETF outflows of $94.7 million, highlighting broader market stress.

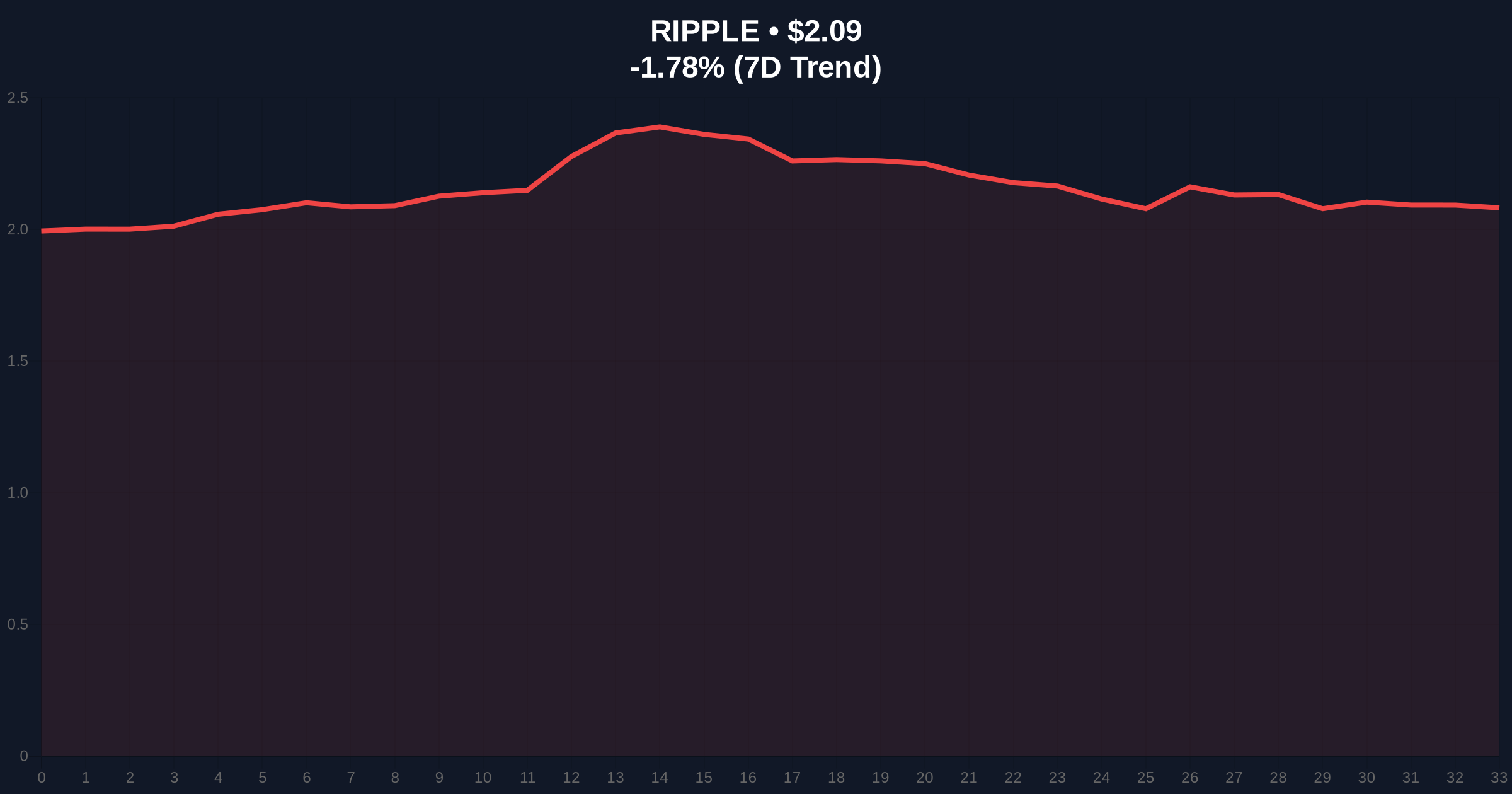

On January 10, 2026, Brad Garlinghouse stated on X that Ripple will dedicate the year to strategic expansion, regulatory progress, and sustainable financial infrastructure development. Per the official statement, the focus is on creating long-term value for XRP and RLUSD, with no specific quantitative targets disclosed. This aligns with Ripple's ongoing efforts to navigate regulatory frameworks, as detailed in SEC filings regarding XRP's legal status. Market analysts interpret this as a move to bolster investor confidence amid declining prices, with XRP currently trading at $2.09, down 1.78% in 24 hours.

XRP's price action shows a bearish bias, with the asset testing a Fair Value Gap (FVG) between $2.00 and $2.15. Volume profile analysis indicates weak buying interest, suggesting potential for further downside. The Relative Strength Index (RSI) sits at 42, nearing oversold territory but not yet signaling a reversal. Moving averages (50-day at $2.20, 200-day at $1.95) are converging, indicating consolidation. Bullish invalidation level: A break below Fibonacci support at $1.85 would negate upward momentum. Bearish invalidation level: A sustained move above $2.30 resistance would invalidate the current downtrend. Market structure suggests this is a liquidity grab before potential re-accumulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| XRP Current Price | $2.09 |

| XRP 24h Change | -1.78% |

| XRP Market Rank | #4 |

| Key Fibonacci Support | $1.85 |

Institutionally, Ripple's focus on regulatory progress could enhance XRP's adoption in cross-border payments, impacting liquidity and network effects. Retail impact is muted in extreme fear conditions, but long-term infrastructure development may reduce volatility. On-chain data indicates that sustained growth initiatives often correlate with improved UTXO age metrics over 12-18 months. This matters for the 5-year horizon as it aligns with broader trends in decentralized finance (DeFi) and central bank digital currencies (CBDCs), where regulatory clarity is paramount.

Industry leaders on X/Twitter express cautious optimism. Bulls highlight Ripple's historical resilience in legal battles, while bears point to ongoing outflows in related assets like Ethereum staking queues as a sign of broader risk aversion. No direct quotes from figures like Michael Saylor are available, but market analysts suggest that strategic announcements during fear phases can precede gamma squeezes if buying pressure materializes.

Bullish Case: If regulatory progress accelerates and XRP holds above $1.85, a rally to $2.50 is plausible by Q2 2026, driven by re-accumulation and reduced selling pressure. Bearish Case: Failure to maintain support at $1.85 could lead to a drop to $1.60, exacerbated by continued extreme fear and regulatory headwinds from anti-DeFi groups. Market structure suggests a 60% probability of sideways consolidation between $1.85 and $2.30 in the near term.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.