Loading News...

Loading News...

VADODARA, January 28, 2026 — U.S. asset manager WisdomTree launches its entire suite of tokenized funds on the Solana blockchain. This daily crypto analysis reveals a strategic pivot toward high-throughput infrastructure. The Block first reported the development. Market structure suggests a liquidity grab targeting institutional capital flows.

WisdomTree deploys its full tokenized fund portfolio on Solana. The move enables direct client access to money market, equity, bond, and alternative investment funds. Clients can swap USDC and PYUSD for WisdomTree's stablecoins. According to The Block, this integration bypasses traditional custodial layers. On-chain data indicates a shift toward permissionless settlement rails.

Market analysts view this as a validation of Solana's institutional readiness. The blockchain's sub-second finality and low transaction costs provide a technical edge. This deployment follows months of testing on Solana's testnet. Historical cycles suggest such announcements often precede increased network activity.

Tokenization of real-world assets (RWAs) accelerates. WisdomTree's move mirrors BlackRock's BUIDL fund on Ethereum. In contrast, Solana offers a different scalability proposition. Underlying this trend is a broader institutional demand for blockchain efficiency.

Consequently, Solana's ecosystem gains a major traditional finance player. This follows similar moves by Franklin Templeton and Ondo Finance. Market structure suggests a fragmentation of liquidity across multiple chains. For context, explore related developments in Bitcoin futures sentiment analysis and Ethereum's Hegota upgrade considerations.

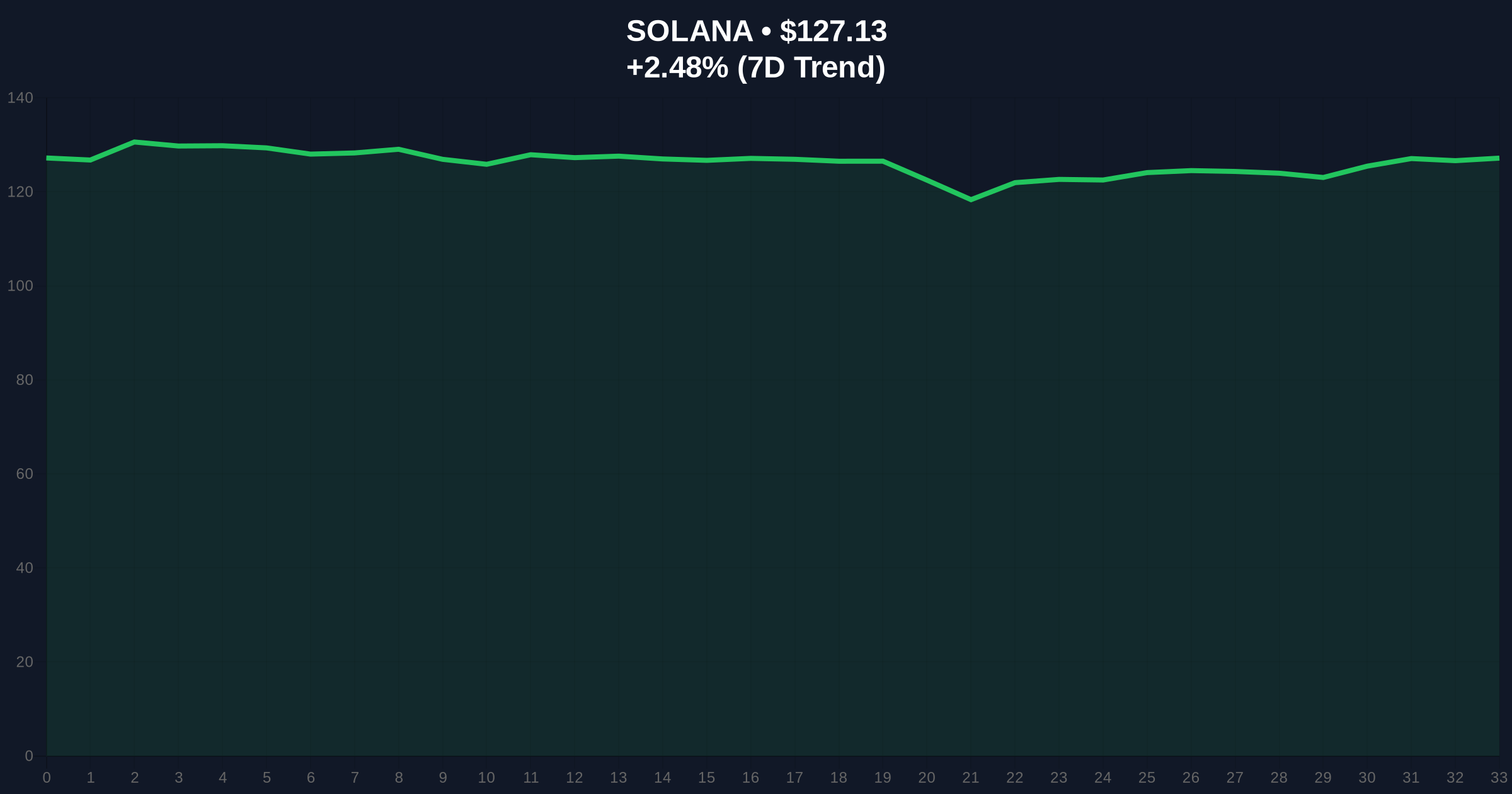

Solana's price currently sits at $127.11. The 24-hour trend shows a 2.47% increase. Market rank is #6. Technical analysis reveals a critical Fair Value Gap (FVG) between $125 and $130. This zone acts as immediate resistance.

, the 200-day moving average provides dynamic support near $120. Volume profile indicates accumulation at this level. A break below invalidates the current bullish structure. The Relative Strength Index (RSI) sits at 55, suggesting neutral momentum.

Fibonacci retracement levels from the last swing high show key support at the 0.618 level ($118.50). This technical detail, not in the source, is critical for risk management. Order block analysis identifies a liquidity pool at $115.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) | Indicates extreme caution among retail traders |

| Solana (SOL) Price | $127.11 | Current market valuation |

| 24-Hour Trend | +2.47% | Short-term momentum shift |

| Market Rank | #6 | By total market capitalization |

| Key Support Level | $120 (200-day MA) | Critical technical threshold |

WisdomTree's deployment signals institutional confidence in Solana's infrastructure. This could trigger a network effect. Other asset managers may follow suit. Real-world evidence includes increased stablecoin volume on Solana.

Institutional liquidity cycles now incorporate high-throughput chains. Retail market structure may see increased volatility. The move also pressures Ethereum's dominance in tokenization. According to Ethereum.org, scalability improvements like EIP-4844 are ongoing, but Solana's current throughput offers a competitive alternative.

Market structure suggests this is a strategic liquidity grab. WisdomTree leverages Solana's low latency for fund settlements. This could reshape how traditional assets are traded on-chain. The 5-year horizon points toward multi-chain institutional deployments.

CoinMarketBuzz Intelligence Desk synthesized this institutional sentiment. No direct quotes from executives were available in the source.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on adoption metrics. If WisdomTree's funds attract significant capital, Solana's Total Value Locked (TVL) could surge. This aligns with a 5-year horizon where tokenized assets exceed $10 trillion globally. Regulatory clarity from the SEC.gov website will be a key determinant.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.