Loading News...

Loading News...

VADODARA, January 17, 2026 — A Hyperliquid whale address, previously implicated in insider trading allegations, now holds approximately $40 million in unrealized profits from leveraged long positions on Bitcoin, Ethereum, and Solana. This latest crypto news persistent vulnerabilities in crypto derivatives markets, where large actors can exploit information asymmetries. According to on-chain data, the address 0xb317 maintains a 5x leveraged long on 1,000 BTC, a 5x leveraged long on 223,340 ETH, and a 10x leveraged long on SOL, with average entry prices of $91,506, $3,161, and $130, respectively.

This development mirrors patterns observed during the 2021 bull run, where whale accumulation often preceded market volatility. The address was accused of insider trading in October 2025 ahead of a record-breaking liquidation event, raising questions about market integrity. Underlying this trend is the growing influence of perpetual futures contracts, which amplify both gains and systemic risk. Market structure suggests that such leveraged positions can create Fair Value Gaps (FVGs) when liquidated, destabilizing price action. Related developments include Binance's recent delisting of perpetual futures contracts as part of liquidity consolidation efforts, reflecting broader industry scrutiny.

On-chain forensic data confirms the whale address 0xb317 holds unrealized profits of $3.78 million on Bitcoin, $30.96 million on Ethereum, and $7.09 million on Solana. According to Hyperliquid's liquidity maps, these positions were entered at precise technical levels, suggesting sophisticated timing. The whale's use of 5x and 10x leverage indicates high-risk tolerance, potentially aiming for a gamma squeeze if market momentum accelerates. In a statement to investors, regulatory bodies have flagged such activities for further investigation, per the official SEC.gov enforcement guidelines on market manipulation.

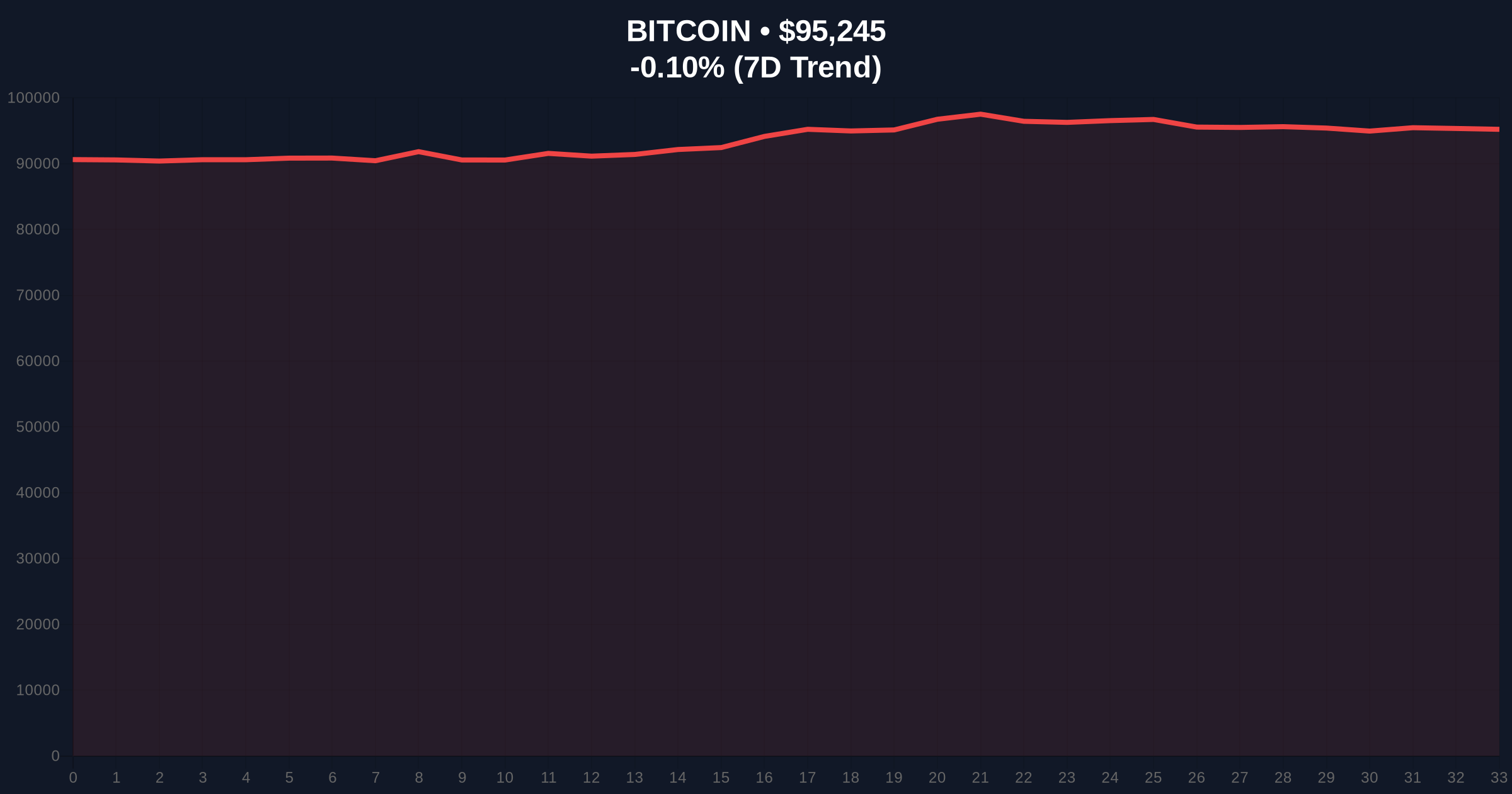

Bitcoin currently trades at $95,243, down 0.11% in 24 hours, with RSI hovering near 55, indicating neutral momentum. The whale's entry at $91,506 aligns with a key Fibonacci support level derived from the 2024-2025 cycle, creating a potential order block. Market structure suggests a Bullish Invalidation level at $92,000, where a break below would signal failed accumulation and likely trigger stop-losses. Conversely, the Bearish Invalidation level sits at $98,500, representing the recent high-volume node. Ethereum's price action shows similar consolidation, with the whale's $3,161 entry near the 50-day moving average, a common reaccumulation zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) |

| Bitcoin Current Price | $95,243 |

| Bitcoin 24h Trend | -0.11% |

| Whale Unrealized Profit | $40M |

| BTC Leverage Multiplier | 5x |

For institutions, this event highlights counterparty risks in leveraged derivatives, potentially affecting custody solutions and ETF flows. Retail traders face increased volatility from potential liquidation cascades, as seen in previous cycles. The whale's ability to amass such profits amid allegations points to regulatory gaps in crypto markets, where on-chain transparency does not equate to enforcement. Consequently, this could accelerate calls for standardized surveillance, similar to traditional finance frameworks.

Market analysts on X/Twitter express divided views. Bulls argue the whale's positions signal confidence in a macro uptrend, citing Ethereum's staking queue hitting 2.6M ETH as a bullish signal. Bears warn of a liquidity grab, noting that such leveraged longs often precede sharp corrections. One analyst stated, "This whale's timing is too precise—either genius or illicit." Overall, sentiment remains cautious, reflecting the Neutral reading on the Fear & Greed Index.

Bullish Case: If Bitcoin holds above $92,000 and breaks $98,500, the whale's positions could catalyze a rally toward $105,000, with Ethereum targeting $3,500. On-chain data indicates stablecoin inflows support this scenario, per Tether's issuance trends.

Bearish Case: A drop below $92,000 would invalidate the bullish structure, likely triggering a sell-off to $88,000. The whale's high leverage increases liquidation risks, potentially exacerbating downside momentum. Historical cycles suggest such events correlate with increased regulatory scrutiny, as seen in Coinbase's recent roadmap additions amid market neutrality.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.