Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

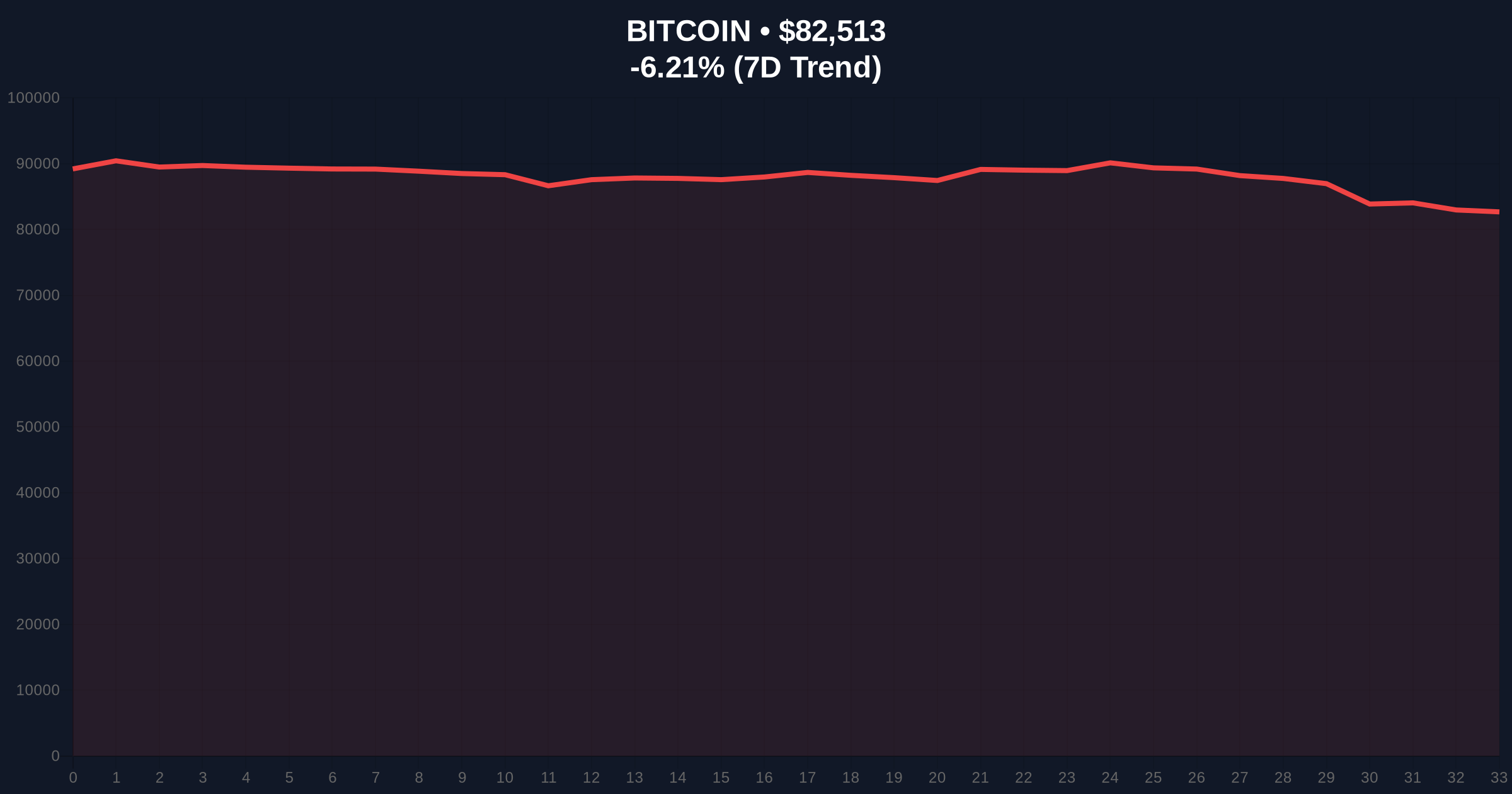

VADODARA, January 30, 2026 — The US Producer Price Index (PPI) for December surged 0.5% month-over-month, sharply exceeding the 0.2% consensus forecast. According to the U.S. Department of Labor, this key inflation gauge signals persistent upstream price pressures. This Latest crypto news event immediately triggered a liquidity grab in digital asset markets. Bitcoin plunged to test the $82,506 level.

The U.S. Department of Labor released the December PPI data on January 30, 2026. The 0.5% monthly increase doubled analyst expectations. Market structure suggests this data point acts as a leading indicator for the Consumer Price Index (CPI). Consequently, it directly influences Federal Reserve monetary policy expectations. On-chain data indicates institutional sell-side pressure intensified following the announcement. The official Bureau of Labor Statistics PPI report provides the primary data verification.

Historically, hot PPI prints precede hawkish Fed pivots. In contrast, the 2021 cycle saw similar data spikes correlate with Bitcoin corrections exceeding 20%. Underlying this trend is the liquidity correlation between traditional finance and crypto. The current Extreme Fear sentiment, scoring 16/100, mirrors the capitulation phase of Q4 2022. , the Altcoin Season Index stalling at 32 confirms broad market weakness. Related developments in this macro environment include the detailed analysis of the stalled Altcoin Season Index and Falcon Finance's $50M RWA fund launch as a hedge against volatility.

Bitcoin's price action formed a clear Fair Value Gap (FVG) between $85,000 and $87,000. The asset is now retesting the critical Fibonacci 0.618 retracement level at $82,000. This level coincides with a high-volume node on the Volume Profile. The 50-day moving average at $84,200 now acts as dynamic resistance. Market structure suggests a break below the $82k order block invalidates the current bullish higher-timeframe structure. The Relative Strength Index (RSI) on the 4-hour chart prints 38, indicating neutral momentum with a bearish bias.

| Metric | Value | Implication |

|---|---|---|

| US December PPI (MoM) | +0.5% | Exceeds 0.2% forecast; inflationary pressure |

| Crypto Fear & Greed Index | 16 (Extreme Fear) | Historically a contrarian buy signal zone |

| Bitcoin Current Price | $82,506 | Testing key Fibonacci 0.618 support |

| Bitcoin 24h Change | -6.23% | Sharp reaction to macro data |

| Altcoin Season Index | 32 | Indicates capital rotation away from altcoins |

This PPI print matters for the 5-year horizon. It signals delayed Federal Reserve rate cuts. Institutional liquidity cycles depend on the cost of capital. Higher-for-longer rates compress risk asset valuations. Retail market structure faces deleveraging pressure. Consequently, crypto volatility will likely remain elevated through Q1 2026. The gamma squeeze potential for Bitcoin options diminishes as implied volatility spikes.

The 0.5% PPI surprise creates a macro headwind. Market structure suggests Bitcoin must hold the $82k level to maintain its institutional accumulation narrative. A break below triggers a liquidity cascade toward the $78k volume gap. This data reinforces the Fed's data-dependent stance, pushing rate cut expectations further into late 2026.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook now hinges on subsequent CPI data. Historical cycles suggest that persistent PPI-CPI passthrough leads to elongated consolidation phases. Market analysts project range-bound action between $78k and $90k until Fed clarity emerges. The 5-year horizon remains bullish, but near-term volatility requires robust risk management.