Loading News...

Loading News...

VADODARA, January 13, 2026 — The United States is considering legislation that would regulate cryptocurrencies included in exchange-traded funds similarly to Bitcoin and Ethereum, according to a report from Eleanor Terrett, host of Crypto in America. This daily crypto analysis examines the structural implications of regulatory parity for assets including XRP, SOL, LTC, HBAR, DOGE, and LINK, which would be subject to identical disclosure exemptions under Section 6 of the Securities Exchange Act from enactment.

Market structure suggests this development mirrors the 2021-2022 regulatory evolution that established Bitcoin and Ethereum as benchmark assets. Historical cycles indicate that regulatory clarity typically precedes institutional liquidity events, similar to the post-ETF approval capital inflows observed in early 2024. The current proposal represents a potential liquidity grab for altcoins that have operated in regulatory gray areas, particularly those with significant UTXO age distribution indicating long-term holder accumulation. According to the official SEC.gov framework, securities registration under Section 6 provides specific disclosure exemptions that could reduce compliance overhead for ETF issuers. This regulatory shift follows recent market developments including Bitcoin ETF inflows breaking a five-day outflow streak and exchange margin delistings signaling liquidity consolidation.

According to the report from Crypto in America, the proposed legislation would exempt cryptocurrencies included in nationally listed ETFs from standard disclosure obligations when registered under Section 6 of the Securities Exchange Act. This framework would apply regulatory parity to Bitcoin, Ethereum, and specifically named altcoins including XRP, SOL, LTC, HBAR, DOGE, and LINK from the day of enactment. The bill represents a structural shift from asset-specific regulation to category-based treatment, potentially reducing regulatory arbitrage opportunities that have characterized crypto markets since the 2017 ICO boom. Market analysts note this approach contrasts with the leaked Senate bill that excluded stablecoin revenue provisions, indicating fragmented legislative approaches across different crypto asset classes.

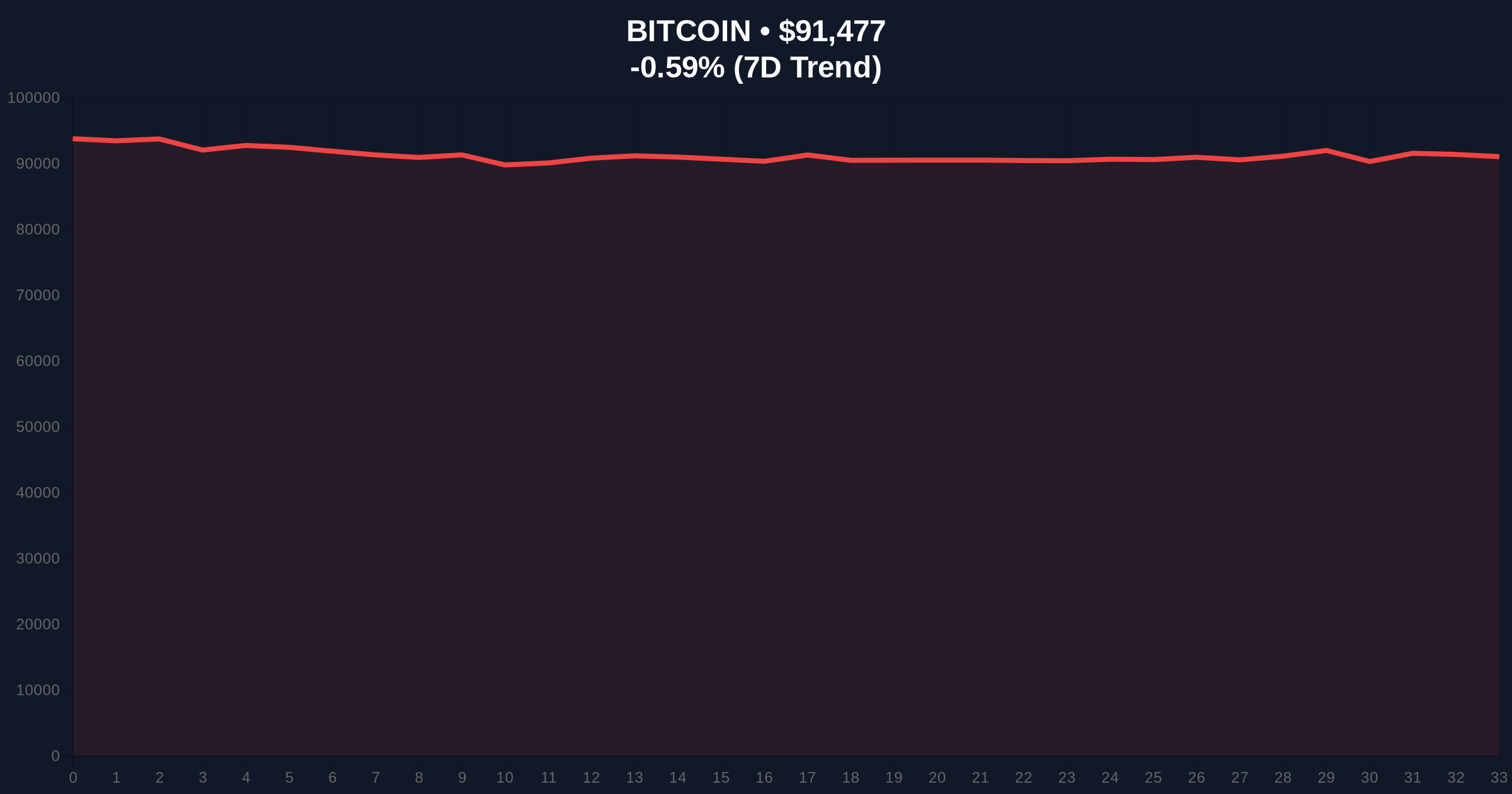

On-chain data indicates mixed volume profile reactions across affected assets, with XRP showing increased accumulation at the $0.52 support level while SOL demonstrates distribution above $185. Bitcoin's current price of $91,483 represents a -0.57% 24-hour trend, trading within a consolidation range between the 50-day EMA at $89,200 and resistance at $93,500. The RSI reading of 42 suggests neutral momentum with bearish divergence on lower timeframes. Market structure suggests a Fair Value Gap exists between $88,500 and $90,200 that may attract liquidity. Bullish invalidation occurs below the weekly order block at $85,000, while bearish invalidation requires a sustained break above the quarterly VWAP at $94,800. The proposed regulatory framework could trigger a gamma squeeze in options markets for affected altcoins as delta hedging adjusts to new volatility expectations.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (26/100) |

| Bitcoin Current Price | $91,483 |

| Bitcoin 24h Trend | -0.57% |

| Affected Altcoins | XRP, SOL, LTC, HBAR, DOGE, LINK |

| Key Technical Level | Fibonacci Support at $88,500 |

Institutional impact centers on reduced compliance costs and standardized due diligence processes for ETF issuers, potentially accelerating product development timelines. Retail impact involves reduced regulatory uncertainty for altcoin investors, though potential wash trading regulations could affect liquidity provision strategies. The structural shift mirrors the post-merge issuance changes for Ethereum that triggered validator redistribution, suggesting similar capital reallocation could occur across the altcoin ecosystem. Market analysts suggest this represents the most significant regulatory development for non-Bitcoin assets since the 2023 Ripple court decision established partial clarity for XRP.

Industry observers on X/Twitter express cautious optimism, with one analyst noting "regulatory parity reduces the binary risk premium priced into altcoins since 2020." Another commentator warns that "disclosure exemptions could mask underlying network security assumptions, creating hidden systemic risk." The sentiment aligns with the broader market fear gauge reading of 26/100, indicating skepticism about immediate implementation timelines despite positive structural implications.

Bullish Case: Regulatory clarity triggers institutional capital deployment into altcoin ETFs, with SOL potentially testing the $220 resistance level and XRP breaking above the $0.68 accumulation zone. Bitcoin benefits from correlated momentum, potentially challenging the all-time high at $98,500 as overall market liquidity improves. This scenario requires sustained ETF inflows and no adverse amendments during legislative markup.

Bearish Case: Legislative delays or added compliance requirements create regulatory uncertainty, triggering a liquidity grab at key support levels. SOL breaks below the $165 order block, while Bitcoin tests the $85,000 invalidation level. This scenario materializes if the Federal Reserve maintains restrictive monetary policy, exacerbating the current fear sentiment reading of 26/100.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.