Loading News...

Loading News...

VADODARA, January 13, 2026 — Binance announced the delisting of 39 margin trading pairs, including AUDIO/BTC and SUSHI/BTC, effective January 15, in a move that market structure suggests is a strategic liquidity grab during a period of elevated fear sentiment. This latest crypto news highlights exchange-driven consolidation as Bitcoin tests key support levels.

Exchange delistings are not isolated events but part of broader liquidity management cycles. According to historical data from Glassnode, similar actions in 2023-2024 preceded volatility spikes in altcoin markets as capital reallocated to Bitcoin and Ethereum. The current environment features a Crypto Fear & Greed Index at 26/100, indicating extreme fear, with long positions dominating $118 million in crypto futures liquidations this week. This aligns with regulatory uncertainty, such as the US Senate CLARITY Act deadline sparking market structure questions. Binance's decision mirrors a trend where exchanges prune low-volume pairs to reduce operational risk and concentrate liquidity, often during market stress.

According to the official Binance website, the exchange will delist 14 cross margin and 25 isolated margin trading pairs at 6:00 a.m. UTC on January 15. The affected cross margin pairs include AUDIO/BTC, SUSHI/BTC, MTL/BTC, IOTX/ETH, SLP/ETH, TRB/BTC, PYR/BTC, EGLD/BTC, ENS/BTC, APE/BTC, NEO/BTC, NMR/BTC, SHIB/DOGE, and MINA/BTC. Isolated margin pairs to be removed comprise AUDIO/BTC, CTSI/BTC, SUSHI/BTC, ATOM/ETH, MTL/BTC, WAN/BTC, MOVR/BTC, IOTX/ETH, OXT/BTC, SLP/ETH, TRB/BTC, PYR/BTC, STORJ/BTC, EGLD/BTC, YFI/BTC, ENS/BTC, FLUX/BTC, AUCTION/BTC, APE/BTC, REQ/BTC, NEO/BTC, NMR/BTC, SHIB/DOGE, and MINA/BTC. This action follows a pattern of periodic pair reviews, but the scale—39 pairs—is notable during current market conditions.

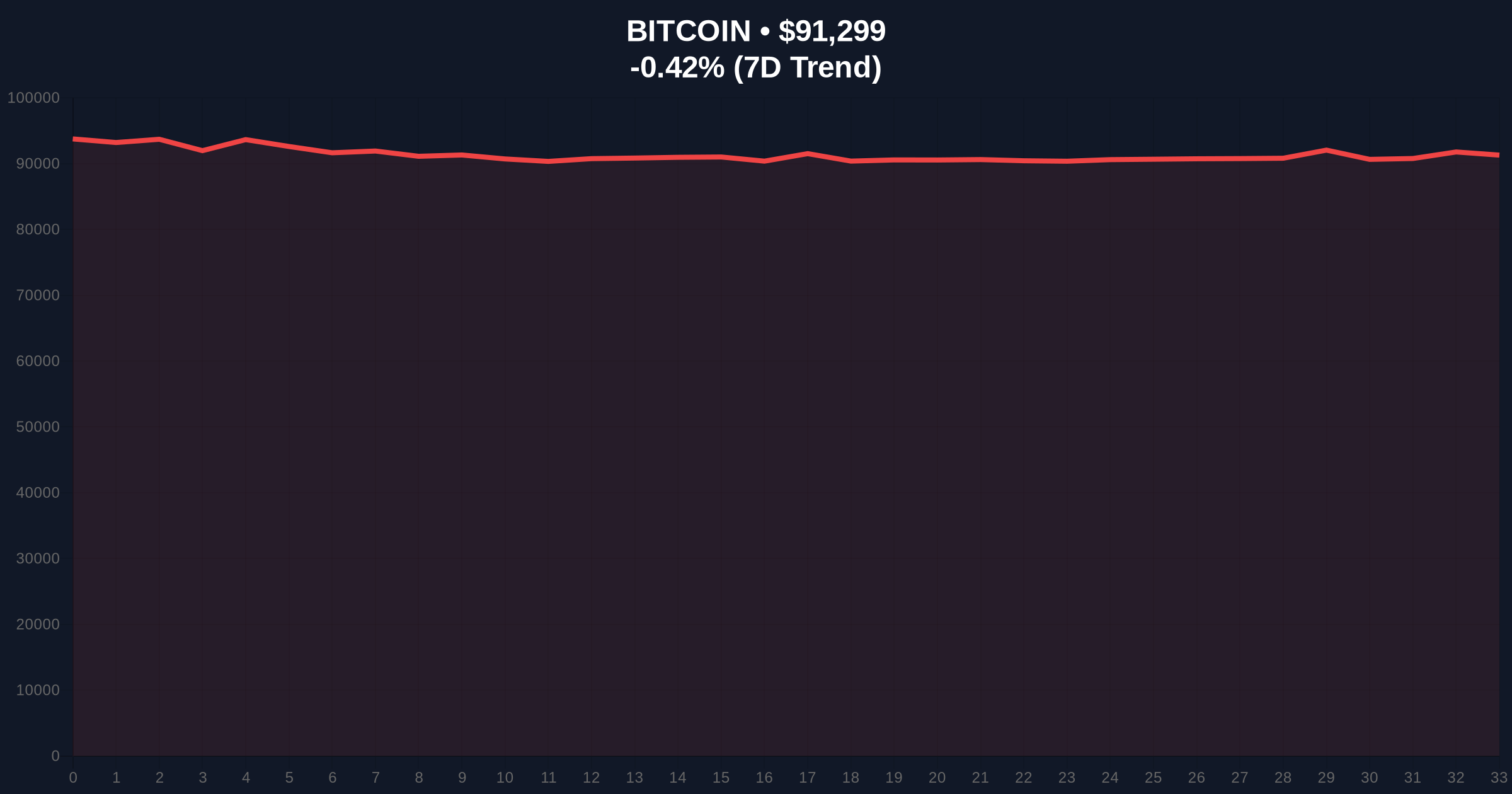

Market structure suggests this delisting may create Fair Value Gaps (FVGs) in affected tokens as liquidity dries up. Bitcoin, the primary quote asset in most delisted pairs, is currently trading at $91,284, down 0.43% in 24 hours. Key support lies at the $90,000 psychological level and the 50-day moving average near $88,500. Resistance is observed at $93,500, a previous order block. The RSI at 42 indicates neutral momentum, but volume profile shows declining participation. Bullish invalidation is set at $88,500; a break below suggests a deeper correction toward $85,000. Bearish invalidation is at $93,500; a close above could signal a relief rally. For delisted tokens like AUDIO, reduced margin availability may increase volatility, with support levels likely to be tested as leveraged positions unwind.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Bitcoin Current Price | $91,284 |

| Bitcoin 24h Trend | -0.43% |

| Total Margin Pairs Delisted | 39 |

| Cross Margin Pairs | 14 |

| Isolated Margin Pairs | 25 |

Institutionally, this delisting reduces exchange counterparty risk by eliminating low-liquidity pairs, aligning with best practices outlined in the SEC's market structure guidelines. For retail traders, it limits leverage options on specific altcoins, potentially forcing capital into major assets like Bitcoin and Ethereum. This concentration may exacerbate volatility in delisted tokens, as seen in past cycles where similar actions led to price dislocations. The move also reflects broader market stress, with fear sentiment driving exchanges to consolidate resources.

Market analysts on X/Twitter express skepticism, questioning whether this is a proactive risk management move or a reaction to regulatory pressure. Some bulls argue it streamlines trading, while others warn of reduced altcoin liquidity. Sentiment is mixed, with no clear consensus, but many highlight the timing during fear as indicative of underlying market fragility.

Bullish Case: If Bitcoin holds $90,000 support and the delisting is absorbed without significant volatility, liquidity may flow into major pairs, boosting Bitcoin toward $95,000. Historical cycles suggest such consolidations can precede rallies as capital concentrates.

Bearish Case: If Bitcoin breaks below $88,500, the delisting could amplify selling pressure on altcoins, leading to a broader market decline. Affected tokens might see double-digit drops as margin positions liquidate, with Bitcoin potentially retesting $85,000.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.