Loading News...

Loading News...

- Upbit announces suspension of all Ethereum network deposits and withdrawals starting January 6, 2026 at 11:00 p.m. UTC

- Market structure suggests potential liquidity vacuum during hard fork transition period

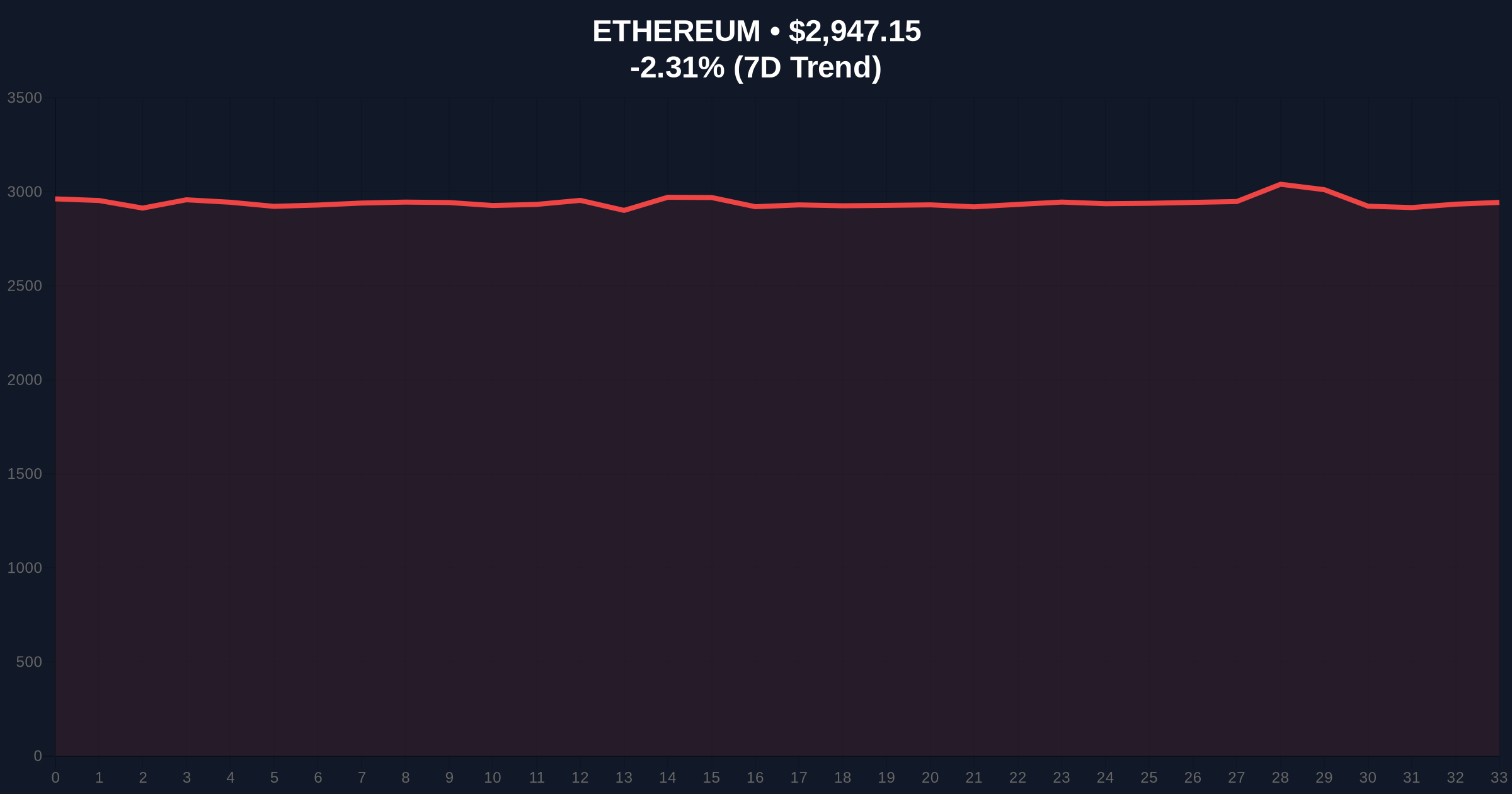

- Ethereum trading at $2,946.79 with 24-hour decline of -2.33% amid Extreme Fear sentiment

- Technical analysis identifies critical support at Fibonacci 0.618 level of $2,850

VADODARA, December 30, 2025 — South Korean cryptocurrency exchange Upbit has announced a temporary suspension of all digital asset deposits and withdrawals on the Ethereum network to support an upcoming hard fork, creating immediate implications for market liquidity and price discovery mechanisms. This latest crypto news arrives as global crypto sentiment registers at "Extreme Fear" with a score of 23/100, according to market intelligence data.

Exchange suspensions during network upgrades represent standard operational procedure, yet their timing within broader market conditions creates amplified effects. The current Extreme Fear sentiment, measured at 23/100, indicates retail capitulation and institutional hesitation. Underlying this trend is a broader pattern of exchange-led liquidity management during volatile periods. Market structure suggests that such suspensions often precede short-term price dislocations as arbitrage opportunities diminish and cross-exchange flows constrict.

Related developments in the current market environment include Bithumb's recent warnings about specific assets and Coinone's similar risk flagging, both occurring within the same Extreme Fear context. These actions collectively point to heightened risk management across Korean exchanges.

According to official communications from Upbit, the exchange will suspend all deposits and withdrawals for digital assets on the Ethereum network beginning at 11:00 p.m. UTC on January 6, 2026. The suspension specifically supports an upcoming Ethereum hard fork, though the exchange did not specify which upgrade iteration. This operational pause affects all ERC-20 tokens and native ETH transactions through the exchange's infrastructure.

Historical data from previous hard forks indicates that such suspensions typically last between 2-6 hours, though Upbit has not provided an estimated restoration time. The timing coincides with Ethereum trading at $2,946.79, representing a 24-hour decline of -2.33% against a broader market downturn.

Ethereum's current price action shows consolidation within a descending channel, with immediate resistance at the $3,050 level and support at the Fibonacci 0.618 retracement level of $2,850. The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions but leaning toward bearish momentum. The 50-day moving average at $3,120 provides overhead resistance, while the 200-day moving average at $2,780 establishes longer-term support.

Volume profile analysis reveals diminished trading activity in Asian sessions, suggesting the Upbit suspension could exacerbate existing liquidity thinness. Market structure suggests that the hard fork itself represents a potential catalyst for volatility, particularly if the upgrade includes significant protocol changes like those seen in previous transitions such as EIP-4844 implementation.

Bullish Invalidation Level: A sustained break below $2,780 (200-day MA) would invalidate the current consolidation structure and suggest further downside toward $2,600.

Bearish Invalidation Level: A decisive close above $3,120 (50-day MA) with accompanying volume would negate the current bearish bias and target $3,300 resistance.

| Metric | Value |

|---|---|

| Ethereum Current Price | $2,946.79 |

| 24-Hour Price Change | -2.33% |

| Market Rank | #2 |

| Fear & Greed Index Score | 23/100 (Extreme Fear) |

| Suspension Start Time | Jan 6, 2026, 11:00 p.m. UTC |

For institutional participants, the suspension creates operational friction during a critical network transition. Custodial flows between cold storage and trading accounts will halt, potentially forcing larger market participants to pre-position assets or seek alternative venues. This could create temporary Fair Value Gaps (FVGs) between Upbit and other global exchanges like Binance or Coinbase.

For retail traders, the immediate impact is reduced arbitrage opportunities and potential slippage on large orders. The suspension period may see increased volatility as market makers adjust their quoting behavior in response to reduced liquidity. Historical patterns indicate that such events often create short-term Order Blocks that later become significant support or resistance zones.

Market analysts on social platforms have expressed mixed reactions. Some emphasize the routine nature of such suspensions, noting that "exchanges must ensure network stability during upgrades." Others point to the timing within Extreme Fear conditions, suggesting potential for exaggerated price movements. According to on-chain data, Ethereum whale accumulation has increased slightly in the past 48 hours, indicating some large holders view current levels as accumulation zones despite the suspension announcement.

Bullish Case: If the hard fork executes smoothly and includes meaningful scalability improvements, Ethereum could reclaim the $3,200 level within two weeks post-upgrade. A successful transition might trigger a short squeeze as sidelined capital re-enters the market. The Extreme Fear reading at 23/100 represents a potential contrarian signal, similar to historical bottoms where sentiment reached similar extremes.

Bearish Case: Technical breakdown below the $2,780 support could trigger algorithmic selling and push Ethereum toward $2,500. The suspension period might create a liquidity vacuum that exacerbates downward momentum, particularly if broader market conditions deteriorate further. According to derivatives data, put option volume has increased at the $2,800 strike, indicating hedging against further downside.

1. Why is Upbit suspending Ethereum network transactions? Upbit is temporarily suspending all Ethereum network deposits and withdrawals to ensure stability and security during an upcoming hard fork upgrade.

2. How long will the suspension last? The exchange has not specified an exact duration, but similar historical suspensions typically last 2-6 hours during network upgrades.

3. Will trading of Ethereum and ERC-20 tokens continue during the suspension? Trading will likely continue, but deposits and withdrawals on the Ethereum network will be paused, potentially affecting liquidity and arbitrage opportunities.

4. How does this affect other exchanges? Other exchanges may experience increased volume as traders seek alternative venues, potentially creating price discrepancies during the suspension period.

5. What should traders do before the suspension? Traders should ensure any necessary deposits or withdrawals are completed before the 11:00 p.m. UTC January 6 deadline and monitor for potential volatility around the suspension period.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.