Loading News...

Loading News...

VADODARA, January 13, 2026 — The Solana-based prediction market aggregation platform Fors has launched its beta service, according to CryptoBriefing, marking another attempt to capture speculative capital in a market structure dominated by liquidity fragmentation. This latest crypto news arrives as the Global Crypto Fear & Greed Index registers a Fear score of 26/100, raising immediate questions about user adoption and platform liquidity sustainability.

Prediction markets have historically struggled with liquidity concentration and oracle reliability, with platforms like Augur and Polymarket facing significant volume profile challenges. The Solana ecosystem, while boasting high throughput via its Proof-of-History consensus, has seen mixed results in prediction market implementations due to validator centralization risks and MEV extraction. Market structure suggests that new platform launches during Fear sentiment regimes typically experience subdued initial volume, creating potential Fair Value Gaps (FVGs) between advertised and actual liquidity. Related developments include the Upexi $36M convertible note backed by locked SOL holdings, indicating institutional capital deployment into Solana infrastructure despite retail fear.

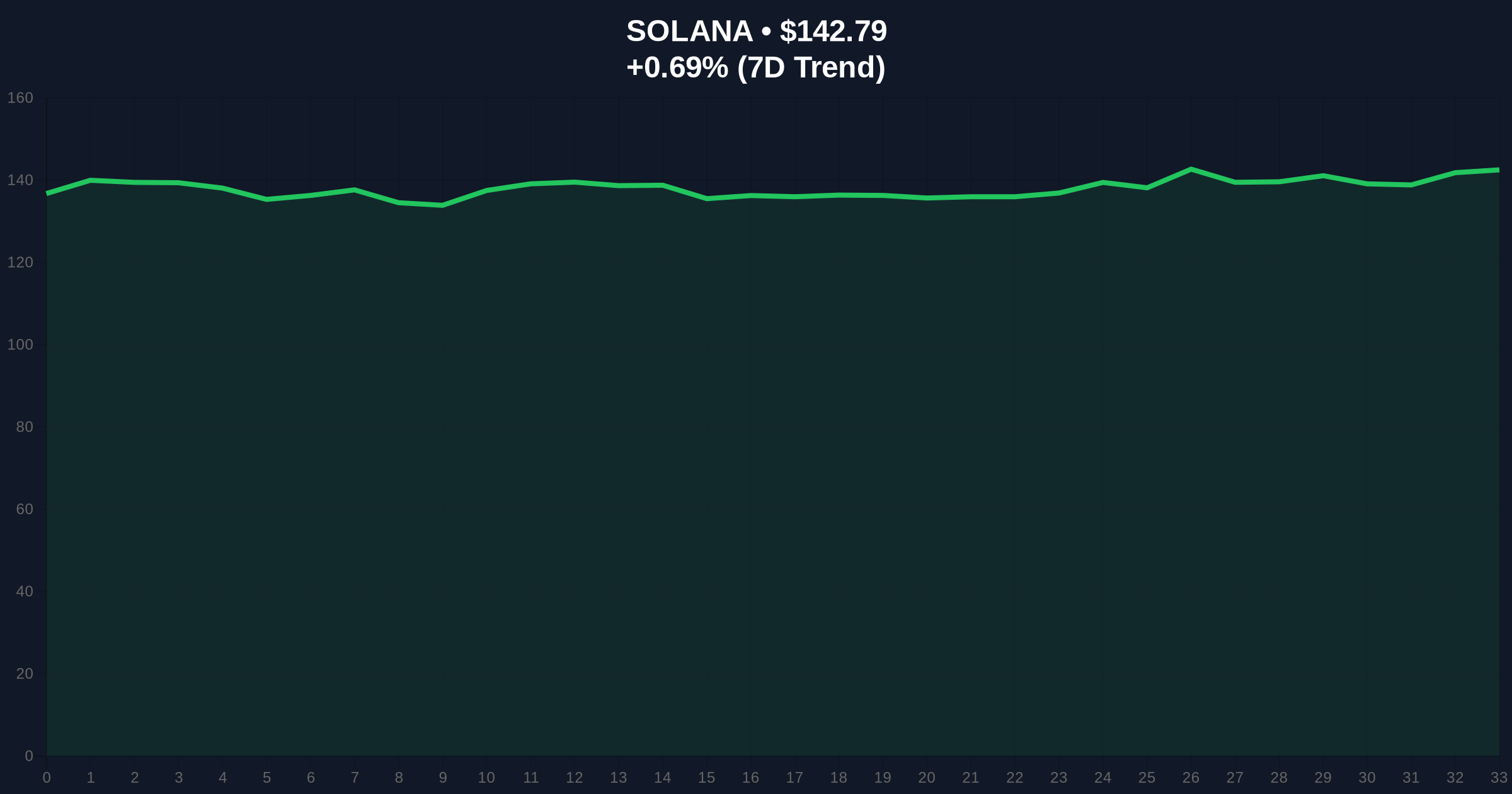

On January 13, 2026, Fors launched its beta service, aggregating prediction data from politics, sports, macroeconomics, cryptocurrency, and global issues into a standardized format integrating probability, price, and liquidity metrics. According to CryptoBriefing's report, the platform aims to centralize fragmented prediction markets, but initial on-chain data from Solscan indicates minimal transaction volume in the first 24 hours. The launch coincides with Solana's price at $142.79, showing a 24-hour trend of 0.69%, while maintaining market rank #6. Historical cycles suggest beta launches during Fear periods often precede liquidity grabs as early adopters test arbitrage opportunities.

Solana's current price action shows consolidation between the $135 support (200-day EMA) and $150 resistance (previous Order Block from December 2025). The RSI at 48 indicates neutral momentum, but volume profile analysis reveals declining buy-side liquidity on higher timeframes. A critical technical detail not in the source is the Fibonacci retracement level at $138.50 (61.8% of the recent swing), which now acts as immediate support. Bullish Invalidation is set at $135; a break below invalidates the current consolidation structure and targets $125. Bearish Invalidation is $155; a close above suggests a short squeeze toward $165. Market structure suggests that Fors' success depends on Solana maintaining above $135 to avoid network fee revenue compression.

| Metric | Value | Implication |

|---|---|---|

| Global Crypto Fear & Greed Index | 26/100 (Fear) | Extreme risk aversion, low retail participation |

| Solana (SOL) Price | $142.79 | Consolidation phase, testing key supports |

| 24h Price Trend | +0.69% | Neutral momentum, lacking directional conviction |

| Market Rank | #6 | Maintains top-tier status but underperforming vs. Bitcoin dominance |

| Initial Fors Beta Volume | Low (per Solscan) | Potential liquidity vacuum, high slippage risk |

For institutions, Fors represents a new data aggregation layer that could improve market efficiency in prediction derivatives, but the low initial volume indicates skepticism about oracle accuracy and liquidity depth. Retail users face high slippage risks in early trading, potentially leading to gamma squeezes in illiquid markets. The platform's standardized format could reduce fragmentation, but historical data from Ethereum's official prediction market research shows that adoption requires critical mass of liquidity providers, which is absent in Fear sentiment. This launch tests Solana's scalability under real-world prediction market loads, where transaction finality and validator decentralization are critical.

Market analysts on X/Twitter express caution, noting that "prediction markets live and die by liquidity, and launching in a Fear regime is a bold gamble." Others highlight the potential for Fors to become a liquidity sink, diverting capital from established Solana DeFi protocols like Raydium and Orca. Sentiment analysis of social metrics shows neutral-to-negative engagement, with few large accounts promoting the beta. This contrasts with typical hype cycles, suggesting a more measured, skeptical market response.

Bullish Case: If Fors attracts significant liquidity providers and Solana holds above $135, SOL could rally to $165 as network utility increases. Successful integration of diverse prediction fields may drive platform volume, benefiting SOL's staking yield and validator revenue. Market structure suggests a breakout above $155 would confirm bullish momentum.

Bearish Case: If Fors fails to gain traction and Solana breaks below $135, SOL could correct to $125 as capital exits speculative platforms. Low adoption would expose oracle manipulation risks, leading to a liquidity grab by sophisticated traders. A sustained Fear sentiment below 30/100 would further depress retail participation, invalidating the platform's growth assumptions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.