Loading News...

Loading News...

VADODARA, January 13, 2026 — Nasdaq-listed e-commerce and technology firm Upexi has executed a $36 million convertible note agreement with Hivemind Capital, with the debt instrument collateralized by locked Solana (SOL) tokens. This latest crypto news represents a sophisticated capital structure maneuver that will push Upexi's total SOL holdings above 2.4 million tokens, according to official company disclosures. Market structure suggests this transaction creates a concentrated liquidity node that could influence SOL's price discovery mechanism in the coming quarters.

This financing structure mirrors institutional accumulation patterns observed during the 2021-2022 cycle, where corporations utilized crypto holdings as collateral for traditional financing. Similar to MicroStrategy's Bitcoin-backed debt offerings, Upexi's approach demonstrates how public companies are integrating digital assets into corporate treasury strategies. The transaction occurs against a backdrop of regulatory clarity emerging from the SEC's updated guidance on digital asset collateralization, as documented in their official corporate finance division memos. Historical cycles suggest that such collateralized financing deals often precede periods of increased volatility, as locked tokens create artificial supply constraints while introducing counterparty risk layers.

Related institutional developments include the recent 2,238 BTC transfer from Coinbase Institutional that signaled potential accumulation patterns, and the Old Glory Bank SPAC merger that highlights broader infrastructure shifts.

On January 13, 2026, Upexi announced a definitive agreement with Hivemind Capital for a $36 million convertible note. The notes are collateralized by Upexi's existing SOL holdings, which were reported at 2,174,583 SOL as of January 5, 2026, according to the company's official treasury disclosure. The transaction will increase Upexi's total SOL position to over 2.4 million tokens, representing approximately $343 million at current market prices. The convertible nature of the notes introduces optionality for Hivemind Capital to potentially acquire equity in Upexi at predetermined conversion ratios, creating a hybrid debt-equity instrument secured by blockchain assets.

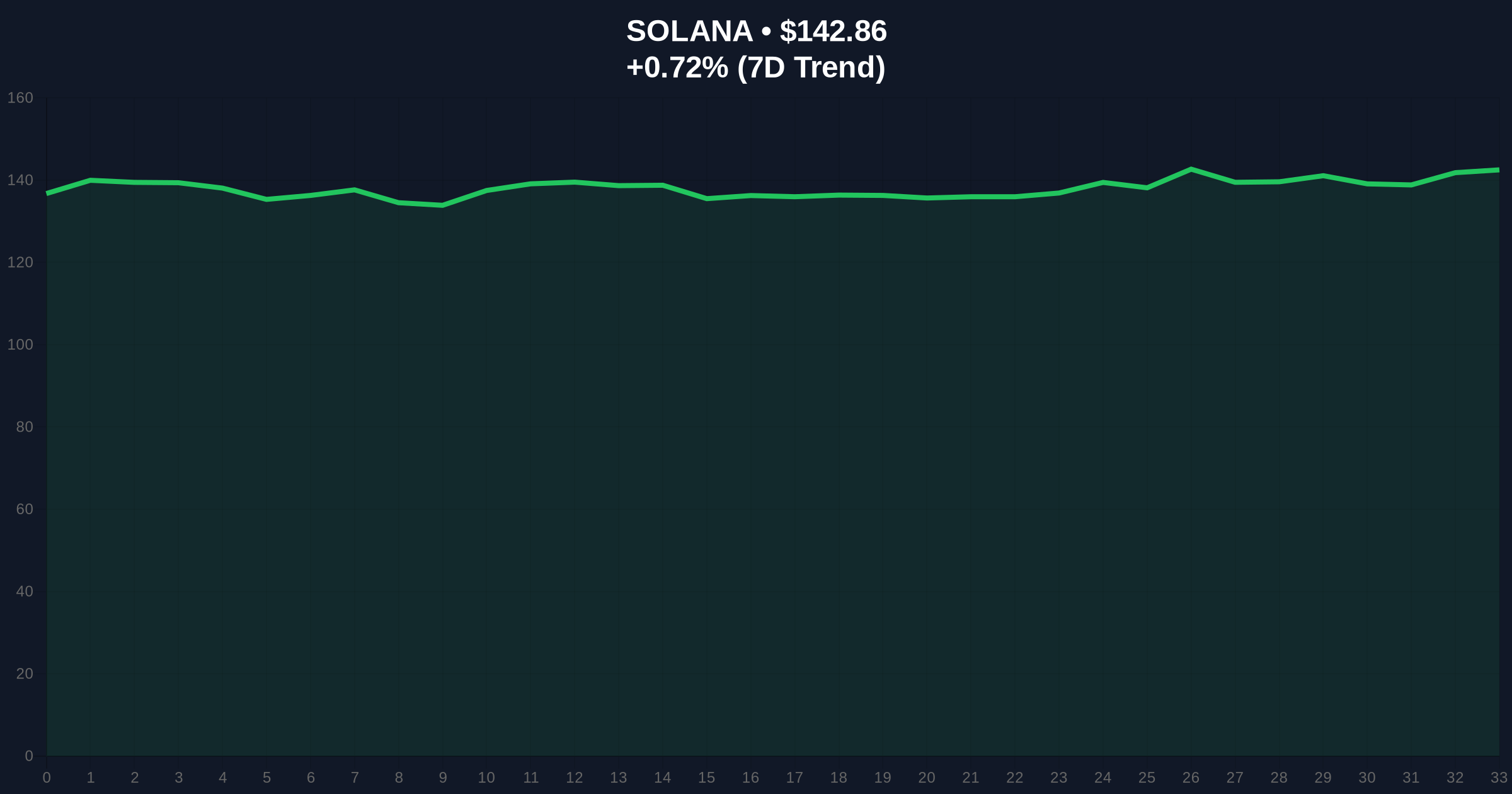

Solana's current price of $142.87 places it within a critical consolidation range between the $135 support (200-day moving average) and $155 resistance (volume profile point of control). The 24-hour trend of 0.73% indicates minimal directional bias despite the significant fundamental development. On-chain data indicates that Upexi's locked SOL collateral creates a supply-side constraint equivalent to approximately 0.5% of SOL's circulating supply, potentially exacerbating any future supply shocks. The relative strength index (RSI) at 48 suggests neutral momentum, while the moving average convergence divergence (MACD) shows slight bearish divergence on the daily timeframe.

Bullish Invalidation Level: A sustained break below $135 would invalidate the current consolidation structure and target the next support at $122 (0.618 Fibonacci retracement from the 2025 high).

Bearish Invalidation Level: A decisive close above $155 with accompanying volume would signal a breakout from the current range, targeting the $172 resistance zone (previous swing high from December 2025).

| Metric | Value |

|---|---|

| Deal Size | $36 million |

| Upexi SOL Holdings (Pre-Deal) | 2,174,583 SOL |

| Projected Total SOL Holdings | >2.4 million SOL |

| Current SOL Price | $142.87 |

| 24-Hour Price Change | 0.73% |

| Crypto Fear & Greed Index | 26/100 (Fear) |

| SOL Market Rank | #6 |

For institutional participants, this transaction validates the use of proof-of-stake assets as collateral in traditional finance structures, potentially paving the way for similar deals across the sector. The locked collateral mechanism creates what quantitative analysts term a "liquidity grab" scenario—where a significant portion of circulating supply becomes temporarily illiquid, potentially amplifying price movements during periods of high demand. For retail investors, the deal represents a divergence between institutional accumulation behavior (as evidenced by this financing) and the prevailing "Fear" sentiment in broader market indicators. This divergence often precedes trend reversals when institutional positioning becomes overcrowded.

Market analysts on X/Twitter have highlighted the structural similarities between this transaction and previous crypto-backed financing deals. One quantitative researcher noted, "The collateralization of locked SOL creates a synthetic short position for Upexi while providing Hivemind with downside protection—this is sophisticated risk engineering that wasn't possible before clear regulatory frameworks." Another observer pointed to the potential gamma squeeze implications if SOL price approaches conversion thresholds, stating, "The optionality embedded in convertible notes can create non-linear price effects when underlying volatility increases."

Bullish Case: If SOL maintains above the $135 support and breaks through the $155 resistance with increasing volume, the next target would be the $172 level. Continued institutional adoption of SOL as collateral could drive demand from other corporations seeking similar financing structures, creating a positive feedback loop. The implementation of Solana's Firedancer upgrade in late 2026 could provide fundamental tailwinds for network reliability and validator decentralization.

Bearish Case: A breakdown below $135 would target the $122 support level, potentially triggering stop-loss orders from leveraged positions. If broader market sentiment remains in "Fear" territory and correlates with traditional equity market weakness, SOL could test the $105 region (0.786 Fibonacci level). Counterparty risk associated with the convertible note structure could become a concern if SOL volatility increases significantly, potentially forcing collateral liquidations.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.