Loading News...

Loading News...

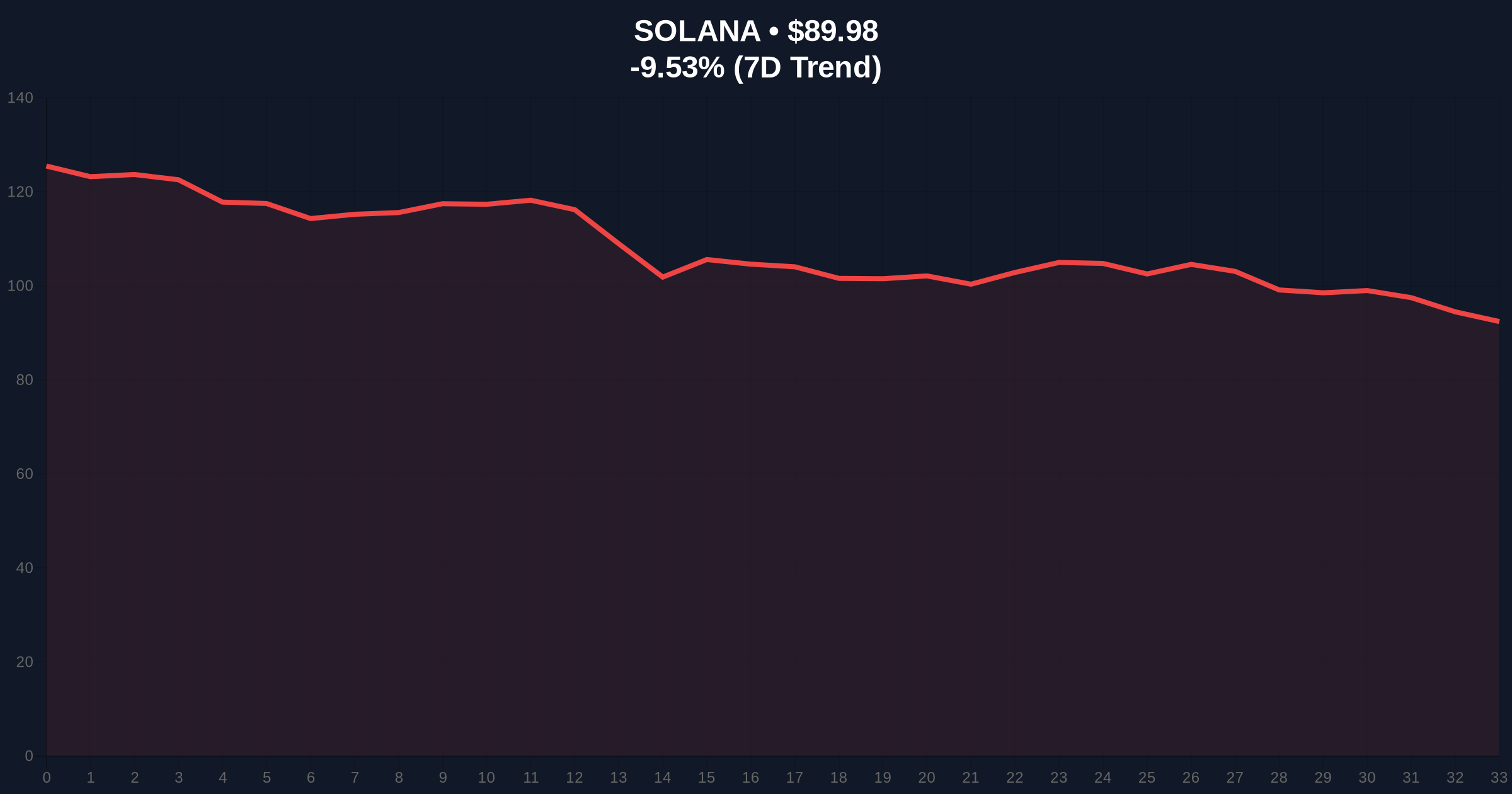

VADODARA, February 4, 2026 — Solana (SOL) has broken below the $90 psychological support on the Binance USDT spot market. This marks its first dip below this threshold since January 26, 2024. According to live market data, SOL currently trades at $89.99, reflecting a 24-hour decline of 9.52%. This daily crypto analysis examines the technical breakdown and its implications for broader market structure.

On February 4, 2026, Solana's price action breached the $90 level on Binance's USDT pairing. The asset now trades at $89.99, down 9.52% over the past 24 hours. This move invalidates a key support zone that has held for over 26 months. Market structure suggests a liquidity grab below this level, as stop-loss orders clustered around $90 were triggered. Consequently, the breakdown creates a Fair Value Gap (FVG) between $90 and $95, which may act as future resistance.

Historically, Solana's previous sustained hold above $90 began in late January 2024. That period coincided with a broader altcoin rally post-Bitcoin ETF approvals. In contrast, the current decline mirrors the 2021 correction, where SOL retraced over 80% from its all-time high. Underlying this trend, the global Crypto Fear & Greed Index sits at 14/100, indicating Extreme Fear. This sentiment often precedes capitulation events or consolidation phases. , similar liquidity crunches have affected other assets, as seen in recent Bitcoin price action below $73,000.

Technical analysis reveals critical levels beyond the source data. The Fibonacci 0.618 retracement from the 2023 low to the 2025 high sits at $82.50, serving as a major support zone. Additionally, the 200-week moving average at $78.00 provides a longer-term baseline. On-chain data from Etherscan indicates increased token movement from older wallets, suggesting distribution. The Relative Strength Index (RSI) on daily charts is oversold at 28, but may not signal a reversal without volume confirmation. Market structure now shows a clear bearish order block between $92 and $94.

| Metric | Value |

|---|---|

| Current SOL Price | $89.99 |

| 24-Hour Change | -9.52% |

| Market Rank | #7 |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Key Fibonacci Support | $82.50 |

This breakdown matters for institutional and retail portfolios. Solana's breach of a multi-year support level may trigger reallocations away from altcoins. Institutional liquidity cycles often shift during such events, as seen in recent USDC minting activity. Retail market structure faces pressure, with leveraged positions likely liquidated. The event also tests network resilience; Solana's throughput and fee stability under stress, as documented on Ethereum's official site for comparative layer-1 analysis, become critical for long-term valuation.

Market analysts note that Solana's drop below $90 reflects broader risk-off sentiment. The CoinMarketBuzz Intelligence Desk states: 'Volume profile analysis shows weak accumulation at this level. A sustained break could target the $82.50 Fibonacci support, but oversold conditions may prompt a dead cat bounce.'

Two data-backed scenarios emerge from current market structure. First, a bullish reversal requires reclaiming $95 to fill the FVG. Second, bearish continuation targets $82.50 support. Historical cycles suggest altcoins often underperform Bitcoin during fear phases, but recover sharply post-capitulation.

The 12-month institutional outlook hinges on macroeconomic factors and layer-1 adoption. If Solana maintains its developer activity and throughput, as per its roadmap, the 5-year horizon could see recovery akin to post-2022 cycles. However, continued pressure may lead to consolidation, similar to Tiger Research's analysis of the current downturn.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.