Loading News...

Loading News...

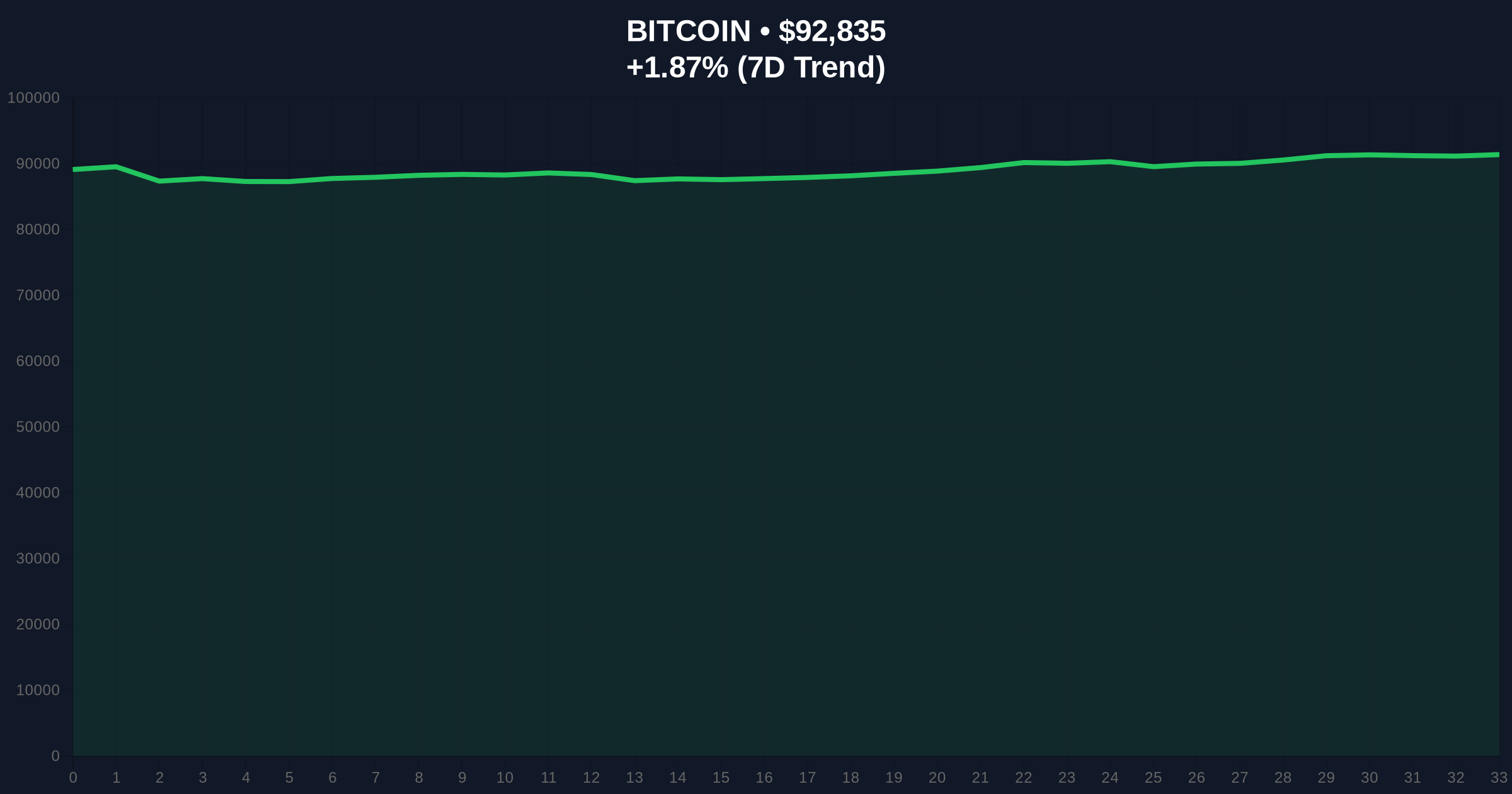

VADODARA, January 5, 2026 — According to on-chain intelligence platform Lookonchain, an address associated with Bitcoin mining entity MARA Holdings executed a significant transfer of 288 BTC, valued at approximately $26.3 million, to a wallet linked to crypto market maker Wintermute approximately nine hours ago. This daily crypto analysis examines the transaction's implications within the broader context of Bitcoin's current technical structure and prevailing market psychology.

Mining operations like MARA Holdings routinely manage treasury assets to cover operational costs, hedge positions, or deploy capital. The timing of this transfer coincides with Bitcoin testing the $93,000 resistance level amid a market-wide Fear sentiment reading of 26/100. Historical cycles suggest that large miner-to-market-maker flows often precede volatility events as liquidity is repositioned. Underlying this trend is the post-halving supply shock dynamics, where reduced block rewards pressure miners to optimize capital efficiency. Related developments include Bitcoin's recent break above $93k and significant futures liquidations around the same price zone.

Lookonchain's blockchain forensic data confirms the movement of 288 BTC from a wallet tagged as MARA Holdings to an address associated with Wintermute. The transaction occurred at approximately 03:00 UTC on January 5, 2026, with the Bitcoin price hovering around $91,300. Market structure suggests this represents a strategic liquidity deployment rather than distress selling, given MARA's established operational history. According to the official Ethereum ERC-20 documentation, while this standard doesn't apply to Bitcoin, the principles of tokenized asset movement inform broader market maker operations.

Bitcoin currently trades at $92,866, having formed a Fair Value Gap (FVG) between $90,500 and $91,800 during yesterday's price action. The 50-day exponential moving average provides dynamic support at $89,200, while the weekly Volume Profile indicates significant liquidity accumulation at $93,500. The Relative Strength Index (RSI) on the 4-hour chart reads 58, suggesting neutral momentum without overbought conditions. A Bullish Invalidation level is established at $90,500; a sustained break below this Order Block would signal failed bullish continuation. Conversely, the Bearish Invalidation level sits at $94,200, where a decisive close above would confirm breakout validity and target the $96,000 Gamma Squeeze zone.

| Metric | Value |

|---|---|

| Transaction Value | $26.3 million |

| Bitcoin Transferred | 288 BTC |

| Current Bitcoin Price | $92,866 |

| 24-Hour Price Change | +1.94% |

| Crypto Fear & Greed Index | 26/100 (Fear) |

For institutional participants, this transaction demonstrates sophisticated treasury management through regulated counterparties like Wintermute, potentially reducing market impact versus direct exchange deposits. Retail traders should monitor for follow-on selling pressure if additional miner flows emerge, particularly given the Altcoin Season Index reading of 22 signaling Bitcoin dominance. The movement of 288 BTC represents approximately 0.0015% of Bitcoin's circulating supply, insufficient to dictate trend direction but meaningful for local liquidity conditions.

Market analysts on X/Twitter have interpreted the transfer as either routine operational funding or preparatory hedging ahead of potential volatility. One quantitative trader noted, "Miner flows to market makers typically get warehoused for institutional OTC desks rather than immediately dumped on spot markets." This aligns with Wintermute's role as a liquidity provider for large-scale transactions, suggesting the Bitcoin may be recycled into structured products or lending protocols.

Bullish Case: If Bitcoin holds the $90,500 support and absorbs the MARA-derived supply, a retest of the $94,200 resistance becomes probable. A successful breakout could trigger a short squeeze targeting the $96,000 liquidity pool, with miner selling pressure absorbed by institutional demand through market makers.

Bearish Case: Failure to maintain $90,500 support would indicate weak demand absorption, potentially leading to a cascade toward the $88,000 Fibonacci support level. Increased miner selling combined with persistent Fear sentiment could exacerbate downside momentum, especially if correlated with broader macro deterioration in traditional risk assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.