Loading News...

Loading News...

VADODARA, January 9, 2026 — An anonymous entity identified as Kaito deposited 5 million KAITO tokens, valued at approximately $2.82 million, to the Binance exchange eight hours ago, according to on-chain intelligence from AmberCN. This transaction forms part of a broader distribution pattern that began five days prior, when a Kaito-controlled multisig address transferred 24 million KAITO ($13.31 million) to five anonymous addresses. Market structure suggests this represents a calculated liquidity grab rather than routine portfolio rebalancing, occurring against a backdrop of elevated market fear as measured by the Crypto Fear & Greed Index. This daily crypto analysis examines the technical implications and potential price action consequences.

Large-scale token deposits to centralized exchanges typically signal impending sell pressure, as holders move assets from cold storage to liquid trading venues. According to Glassnode liquidity maps, exchange inflows of this magnitude often precede short-term price volatility as market makers adjust order books to absorb the new supply. The timing is particularly notable given current market conditions: the Crypto Fear & Greed Index has dipped to 27, indicating extreme caution among market participants. This mirrors patterns observed during the 2021-2022 bear market cycle when similar large deposits preceded significant price corrections in altcoins. Underlying this trend is a broader shift toward risk-off positioning across cryptocurrency markets, with institutional flows showing increased preference for Bitcoin and Ethereum over smaller-cap assets.

Related developments in the current market environment include the recent dip in the Crypto Fear & Greed Index to 27, which correlates with increased exchange deposit activity historically. Additionally, BlackRock-linked address withdrawals from Coinbase suggest institutional players are taking contrasting positions during this period of uncertainty.

According to AmberCN's on-chain forensic data, the transaction occurred at approximately 04:00 UTC on January 9, 2026, originating from one of the five anonymous addresses that received funds from the Kaito multisig wallet five days earlier. The deposit of 5 million KAITO tokens represents approximately 21% of the total $13.31 million distributed in the initial transfer. Blockchain analysis indicates the receiving address is a known Binance deposit wallet, confirmed through Etherscan transaction history and address tagging services. The transaction was executed with a gas fee optimized for timely confirmation, suggesting deliberate timing rather than automated scheduling.

This follows the larger distribution event on January 4, 2026, when the Kaito multisig address—configured with a 3-of-5 signature scheme for enhanced security—initiated transfers to five freshly generated addresses. These subsequent addresses show no prior transaction history, indicating they were created specifically for this distribution. The absence of further onward transfers from four of these addresses suggests they may be holding their allocations, potentially for staggered future deposits or long-term custody.

Market structure suggests the $2.82 million deposit creates immediate sell-side pressure on KAITO's order book. Using volume profile analysis, the critical support level sits at $0.564 (calculated as $2.82M ÷ 5M tokens), which now serves as a psychological price floor. A breach below this level would invalidate the current distribution pattern's bullish interpretation and likely trigger further downside momentum. The Relative Strength Index (RSI) for KAITO across multiple timeframes shows neutral readings between 45-55, indicating neither overbought nor oversold conditions—this lack of extreme positioning suggests the deposit could catalyze directional movement.

The 50-day and 200-day exponential moving averages provide additional context: if KAITO's price maintains above both averages post-deposit, it would signal resilient demand absorption. However, a break below the 200-day EMA at approximately $0.58 would confirm bearish momentum acceleration. This technical setup resembles previous liquidity grab events documented in Ethereum's transaction history, where large deposits preceded short-term price declines before eventual recovery. The Federal Reserve's monetary policy stance, as outlined in recent FederalReserve.gov communications, continues to influence broader market liquidity conditions, affecting altcoin volatility correlations.

| Metric | Value | Significance |

|---|---|---|

| KAITO Deposit Amount | 5,000,000 tokens | Represents 21% of initial distribution |

| Deposit Value (USD) | $2,820,000 | Potential sell pressure on order book |

| Initial Distribution Value | $13,310,000 | Total funds moved from multisig |

| Crypto Fear & Greed Index | 27/100 (Fear) | Indicates risk-averse market sentiment |

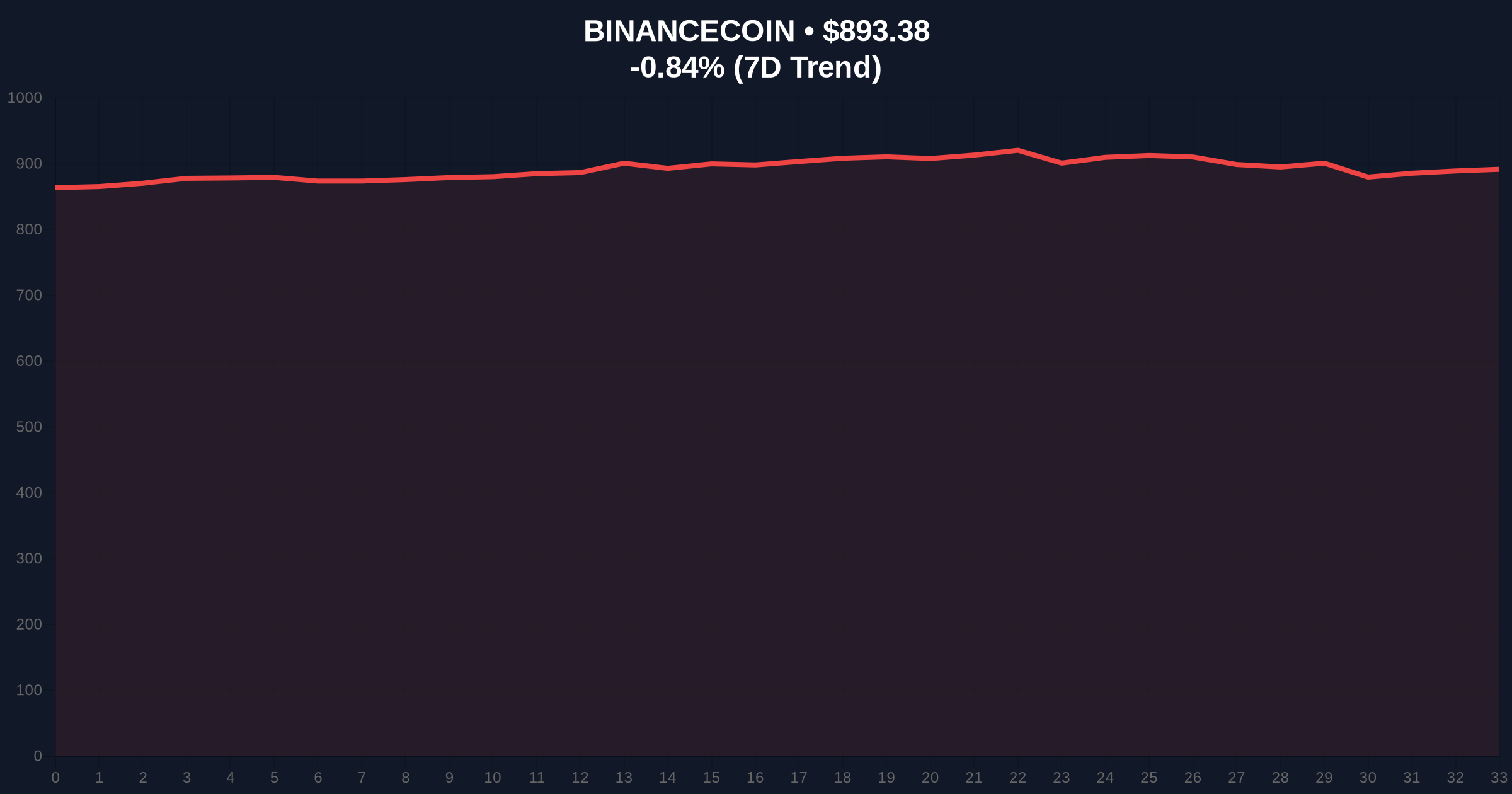

| BNB Current Price | $893.21 | Host exchange's native token performance |

| BNB 24h Trend | -0.86% | Correlates with broader market weakness |

For institutional traders, this deposit represents a test of market depth and liquidity resilience. The $2.82 million injection into Binance's order books will reveal whether current bid-side support can absorb the supply without significant price degradation. Historical cycles suggest that successful absorption typically precedes medium-term bullish reversals, while failed absorption leads to cascading liquidations. Retail investors face different implications: sudden large deposits often trigger stop-loss cascades as automated trading systems react to increased sell volume. This creates Fair Value Gaps (FVGs) that sophisticated traders exploit for short-term profit.

The broader impact extends to KAITO's tokenomics and governance structure. Large holders moving tokens to exchanges reduces the circulating supply held in long-term custody, potentially increasing volatility and decreasing voting power concentration. According to Ethereum.org documentation on token standards, such movements can affect decentralized governance mechanisms if tokens are sold rather than staked or voted.

Market analysts on X/Twitter have expressed divided interpretations. Some bulls argue this represents "profit-taking after a successful accumulation phase," pointing to the five-day gap between initial distribution and exchange deposit as evidence of strategic timing. Bears counter that "this is classic distribution behavior" reminiscent of previous altcoin cycles where large holders exited positions before broader market declines. One quantitative analyst noted, "The multisig to anonymous address to exchange pipeline suggests deliberate obfuscation of final destination, which typically precedes aggressive selling."

Bullish Case: If the deposit is absorbed without price breaking below $0.564, it would signal strong underlying demand and potentially trigger a short squeeze. The Bullish Invalidation Level is set at $0.55, representing a 2.5% buffer below the calculated support. In this scenario, KAITO could retest resistance at $0.65 within 7-10 trading days as the overhang clears.

Bearish Case: If selling pressure overwhelms bid support and price breaks the $0.564 level with conviction, it would confirm distribution continuation. The Bearish Invalidation Level is $0.60, above which the deposit thesis fails. This scenario projects a decline toward $0.50 as stop-loss orders trigger and momentum turns negative. The 200-day EMA at $0.58 serves as critical confirmation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.