Loading News...

Loading News...

VADODARA, January 31, 2026 — Xu Mingxing, founder of the crypto exchange OKX, has publicly attributed the sharp market downturn on October 10, 2025, to Binance. In a post on X, Xu argued that irresponsible marketing practices by certain companies triggered tens of billions in forced liquidations. This latest crypto news deep structural flaws in the digital asset ecosystem.

According to Xu Mingxing's statement, the crash originated from Binance offering a 12% annual interest rate for USDe deposits. Binance accepted USDe as collateral on par with USDT and USDC. Xu considers USDe more akin to a tokenized hedge fund product than a traditional stablecoin. This incentive structure encouraged users to repeatedly convert stablecoins to USDe. They then used it as collateral to borrow more USDT, rapidly amplifying systemic leverage.

When market volatility spiked on October 10, USDe de-pegged from its intended value. This de-peg triggered a cascade of forced liquidations across leveraged positions. Xu claims these actions fundamentally damaged the crypto market's microstructure. He expects significant false information and organized FUD targeting OKX following his criticism. He stressed that speaking honestly about systemic risks remains necessary despite potential backlash.

Historically, similar leverage-induced cascades have defined crypto bear markets. The 2021 correction saw over $2.5 billion in liquidations in a single day due to over-leveraged futures markets. In contrast, the October 10 event appears centered on novel collateral mechanisms. The integration of algorithmic stablecoin-like assets into major lending pools represents a new vector of contagion.

Market structure suggests this mirrors the 2022 Terra/LUNA collapse in its dependency on unsustainable yield. However, the scale differed, with centralized exchange policies acting as the catalyst. Underlying this trend is a persistent hunt for yield in a low-interest-rate environment. This drives platforms to adopt riskier collateral types to attract capital.

Related developments include ongoing scrutiny of exchange practices, as seen in Binance's denial of causing the October flash crash. , shifting capital flows are evident, with a UNI whale exiting a $10.6M position after a 5-year hold, signaling potential DeFi rotation amid these structural concerns.

On-chain data indicates the liquidation cascade created a massive Fair Value Gap (FVG) on October 10. This FVG spanned from $68,000 to $72,000 for Bitcoin, acting as a future liquidity grab zone. The event invalidated several key support levels, including the 200-day moving average and the 0.618 Fibonacci retracement level from the 2024 low.

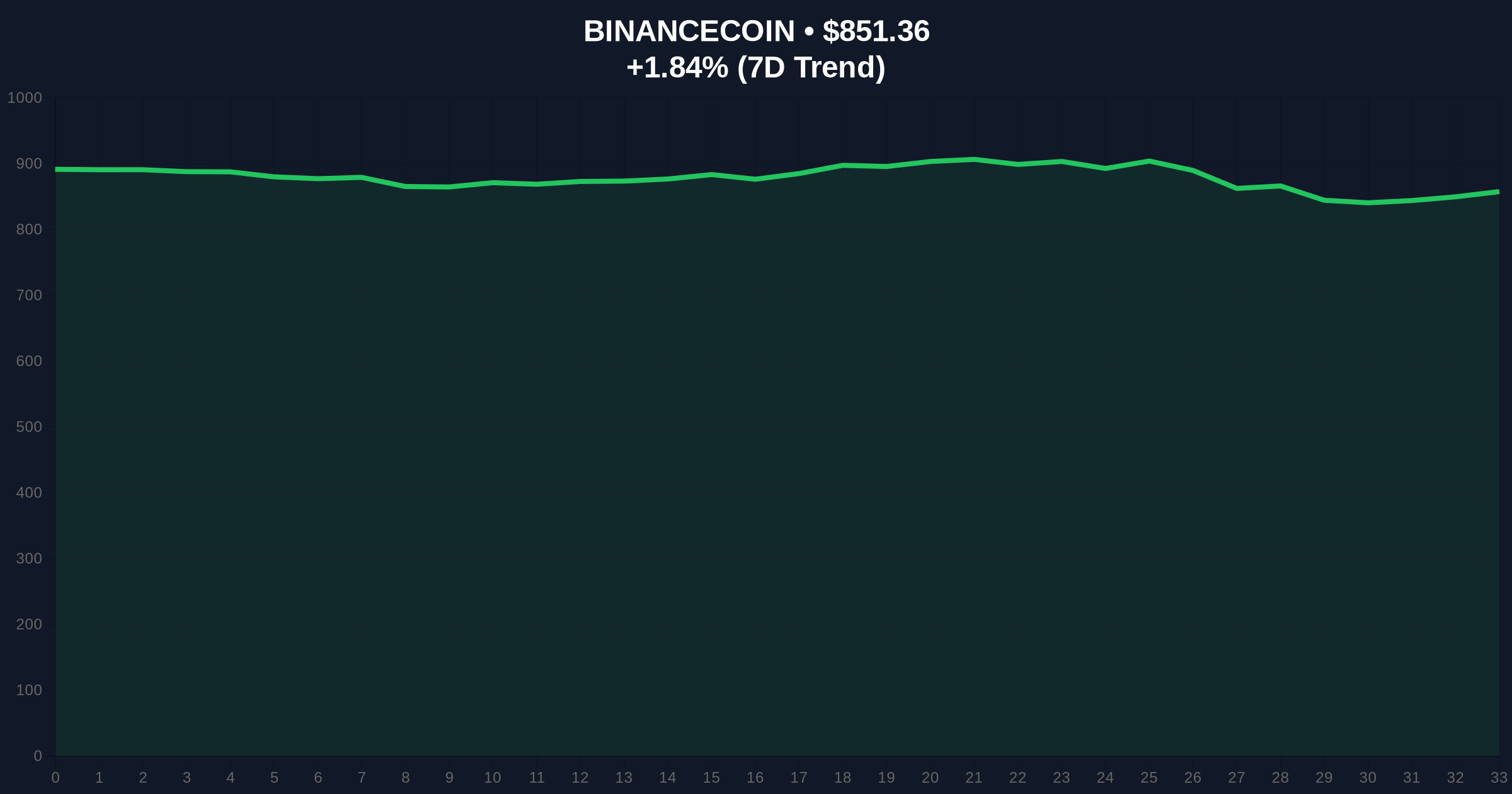

For BNB, Binance's native token, price action shows a critical Order Block formed between $820 and $850. This zone now serves as the Bearish Invalidation Level. A break below $820 would signal a failure of the current consolidation structure. The Relative Strength Index (RSI) on weekly charts remains in a bearish divergence, suggesting underlying weakness.

Market analysts note that similar to the 2021 correction, recovery requires a reclaim of the Volume Profile Point of Control (POC). For Bitcoin, this level sits near $78,000. Until then, the market remains in a distribution phase. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, continues to influence macro liquidity conditions, adding another layer of complexity.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Indicates severe market pessimism, similar to post-crash levels in 2022. |

| BNB Current Price | $851.35 | Down 1.71% in 24h, testing key support. |

| BNB Market Rank | #4 | Maintains top-5 status despite allegations. |

| Estimated Liquidations (Oct 10) | Tens of billions USD | Per Xu Mingxing's claim; exact figures unverified. |

| USDe Promoted Yield | 12% APY | Cited as primary incentive for leverage buildup. |

This accusation matters because it highlights a critical failure in risk management protocols at the institutional level. Accepting untested collateral assets like USDe at parity with established stablecoins introduces asymmetric risk. Retail traders often mimic these institutional behaviors, amplifying systemic fragility.

, the event damages trust in centralized exchanges as neutral liquidity providers. It suggests that marketing incentives can override prudent financial engineering. For the 5-year horizon, this the need for robust, transparent collateral frameworks. These frameworks must withstand volatility shocks without triggering cascading liquidations.

Market structure suggests that the integration of high-yield, novel assets into core lending pools without adequate stress testing is a recipe for disaster. The October 10 cascade was not a black swan but a predictable outcome of misaligned incentives. Historical cycles show that such events reset leverage across the system, often leading to prolonged consolidation phases.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires a sustained reclaim of the $78,000 POC for Bitcoin, signaling absorption of overhead supply. The bearish scenario involves a breakdown below the BNB Order Block at $820, potentially triggering another liquidation wave.

The 12-month institutional outlook remains cautious. Regulatory scrutiny on exchange practices will likely intensify, as seen in global trends. Platforms may face pressure to enhance collateral transparency. This could slow innovation but improve long-term stability. The market must reconcile yield hunger with risk management, a balance historically achieved only through painful corrections.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.