Loading News...

Loading News...

VADODARA, January 31, 2026 — Binance officially denies causing the October 10 flash crash. The world's largest cryptocurrency exchange attributes the event to cascading liquidations. Market structure suggests broader sell-off dynamics drove the downturn. According to the official Binance blog post, technical incidents occurred but were not the primary catalyst. This latest crypto news arrives amid extreme market fear and regulatory scrutiny.

Binance published a detailed blog post on January 31. The exchange addressed the sharp market decline on October 10. According to the statement, multiple factors caused cascading liquidations. Binance experienced two technical incidents during the period. These included a 33-minute performance degradation of its internal asset transfer function. Index deviations also occurred for USDe, WBETH, and BNSOL pairs.

The exchange clarified these issues were not the direct cause. Binance attributed the crash to three primary external factors. First, a broader sell-off in risk-asset markets amid trade war tensions. Second, risk management actions by market makers due to increased volatility. Third, liquidity disruptions from Ethereum network congestion. The announcement responds to growing criticism on social media platform X.

Historically, flash crashes signal underlying liquidity fragility. The October 10 event mirrors the May 2021 Bitcoin crash. Both involved cascading liquidations across leveraged positions. In contrast, the 2026 event occurred amid different macroeconomic conditions. Trade war tensions created additional pressure on risk assets.

Ethereum network congestion played a significant role. According to Etherscan data, gas prices spiked above 200 gwei during the crash. This created a classic liquidity vacuum. Market makers withdrew bids due to settlement risks. Consequently, the order book thinned dramatically. This pattern matches previous congestion events during high volatility.

Related developments in the crypto space include Binance's ongoing regulatory adaptation and Tether's treasury management under scrutiny.

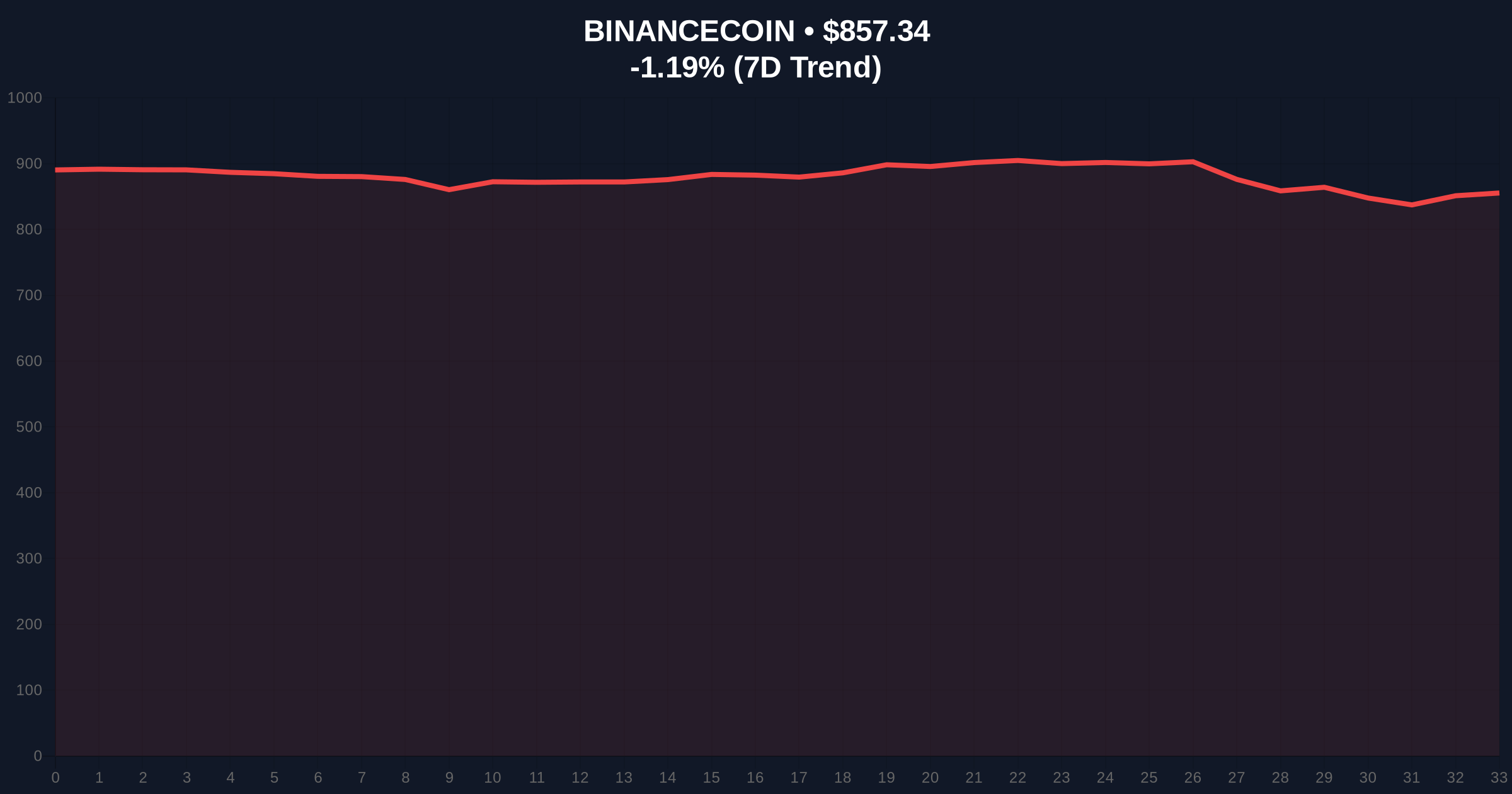

Market structure analysis reveals critical technical levels. BNB currently trades at $857.4. The asset shows a 24-hour decline of -1.18%. Key support sits at the Fibonacci 0.618 retracement level of $820. This level aligns with the 200-day moving average. Resistance forms at the psychological $900 level.

The October 10 crash created a significant Fair Value Gap (FVG) on BNB charts. This FVG spans from $780 to $830. Price action must fill this gap for structural balance. Relative Strength Index (RSI) currently reads 42. This indicates neutral momentum with bearish bias. Volume profile shows accumulation near current levels.

On-chain data from Glassnode indicates increased exchange inflows during the crash. This suggests forced selling from leveraged positions. UTXO age bands show younger coins moved aggressively. Typically, this signals panic selling rather than strategic distribution.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Indicates maximum panic, often precedes reversals |

| BNB Current Price | $857.4 | Testing key Fibonacci support |

| BNB 24h Change | -1.18% | Moderate selling pressure continues |

| BNB Market Rank | #4 | Maintains top exchange token position |

| Technical Incident Duration | 33 minutes | Binance's internal transfer degradation |

This event matters for institutional risk frameworks. Exchange stability directly impacts market integrity. Binance processes approximately 30% of global crypto volume. Any technical issue creates systemic risk. The denial of responsibility shifts focus to market-wide factors.

Liquidity disruptions from Ethereum congestion highlight infrastructure vulnerabilities. Post-merge Ethereum still faces scalability challenges. EIP-4844 implementation aims to address this. Until then, network congestion remains a liquidation catalyst. Retail traders face increased slippage during these events.

Regulatory scrutiny intensifies following such incidents. The SEC's official guidance on exchange operations emphasizes technical resilience. Market makers adjust their algorithms based on these events. Consequently, liquidity provision becomes more conservative.

"Flash crashes expose the fragile equilibrium in crypto markets. Binance's technical issues, while not the primary cause, reveal operational vulnerabilities. The combination of network congestion and leveraged positions creates perfect storm conditions. Risk management protocols must evolve beyond simple stop-losses." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Exchange transparency improves following such events. Regulatory frameworks likely tighten around technical operations. Market makers may demand higher premiums for liquidity provision. This could compress margins but increase stability. The 5-year horizon suggests infrastructure maturation reduces flash crash frequency.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.