Loading News...

Loading News...

VADODARA, February 10, 2026 — A public spat between OKX CEO Star Xu and Binance founder Changpeng Zhao (CZ) has erupted on social media platform X, highlighting deep-seated differences in exchange values and listing philosophies. Xu explicitly stated, "We have long held fundamentally different values from Binance," emphasizing that centralized exchange (CEX) listing decisions must carry responsibility. This clash occurs amid a market gripped by Extreme Fear, with the Crypto Fear & Greed Index at 9/100, and follows recent controversies over memecoin listings at both exchanges. Our daily crypto analysis dissects the technical and market implications of this escalating tension.

According to public statements on X, OKX CEO Star Xu directly criticized Binance's approach to exchange operations. Xu argued that CEXs play a distinct role from decentralized exchanges (DEXs), requiring greater accountability in token listings. His comments responded to a post from CZ earlier today, where the Binance founder defended exchange listing frameworks against criticism from crypto analyst Benjamin Cowen. CZ questioned whether DEX listings are inherently superior to CEX listings, noting all exchanges have criteria and suggesting critics might be biased if their preferred tokens aren't listed.

This exchange follows Binance facing public scrutiny over its memecoin listing policies and alleged involvement in an October 10 market crash. Meanwhile, OKX confronted controversy last year regarding its listing of Pi Network (PI). The timing is critical, as market structure suggests exchange governance directly impacts liquidity flows and investor confidence during volatile periods.

Historically, public clashes between major exchanges often precede regulatory scrutiny or market corrections. Similar to the 2021 correction, when exchange-related controversies contributed to a 50% drawdown in altcoin markets, current tensions amplify existing fear. The Crypto Fear & Greed Index at 9/100 indicates panic selling and low confidence, a sentiment mirrored in broader market movements. For instance, recent Bitcoin price action saw BTC drop below $68,000 amid similar extreme fear, highlighting how exchange drama can exacerbate downtrends.

Underlying this trend is a shift from the 2017-2021 bull run, where aggressive listings drove hype cycles. Today, institutional demand for rigorous due diligence, as seen in EU regulatory proposals, pressures exchanges to adopt more conservative frameworks. Xu's emphasis on responsibility aligns with this macro trend, contrasting with Binance's historically more permissive stance.

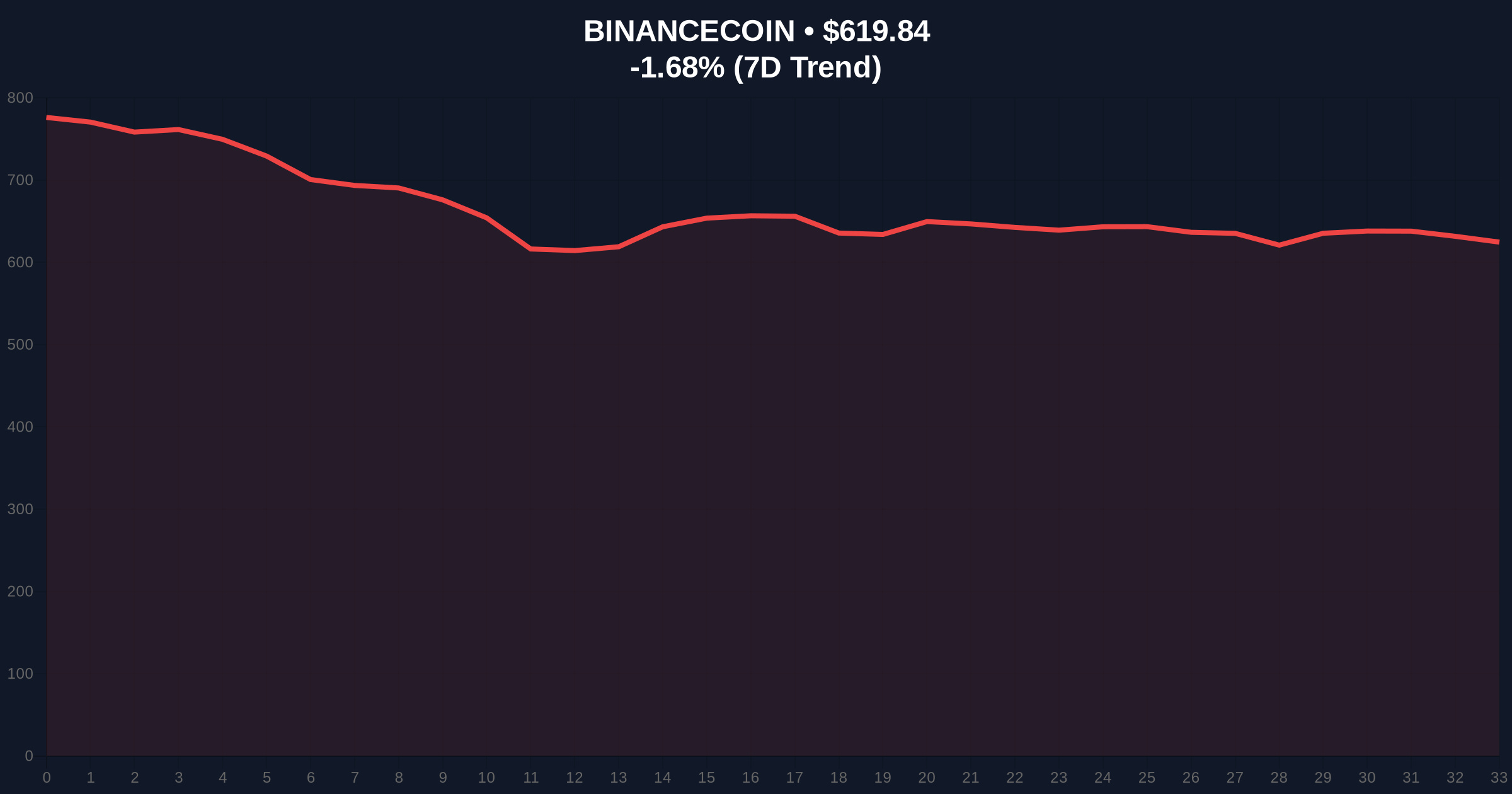

Market structure suggests exchange tokens like BNB are highly sensitive to governance controversies. BNB currently trades at $619.6, down 1.59% in 24 hours, reflecting the negative sentiment. Technical analysis indicates a critical support zone at the $600 psychological level, which aligns with the 0.618 Fibonacci retracement from its 2025 high. A break below this level could invalidate the current consolidation phase, targeting lower supports near $580.

On-chain data from Etherscan shows reduced exchange inflows for BNB, suggesting holders are cautious amid the clash. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum but leaning bearish. , UTXO age bands reveal older coins are moving, often a precursor to increased selling pressure if fear persists. This technical setup mirrors past cycles where exchange drama triggered liquidity grabs below key moving averages.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Panic selling, low investor confidence |

| BNB Current Price | $619.6 | Down 1.59% in 24h, testing key support |

| BNB Market Rank | #5 | High sensitivity to exchange news |

| RSI (BNB) | 42 | Neutral-bearish momentum |

| Key Support Level | $600 | Psychological and Fibonacci level |

This clash matters because exchange listing policies directly influence market liquidity and token valuations. Centralized exchanges control significant order flow; irresponsible listings can create Fair Value Gaps (FVGs) that harm retail investors. According to Glassnode liquidity maps, memecoin listings often correlate with short-term volume spikes followed by sharp corrections, exacerbating market fear. Institutional players, as noted in Federal Reserve reports on financial stability, monitor exchange governance for systemic risks.

, the debate over CEX vs. DEX roles touches on core blockchain principles like decentralization and accountability. Xu's stance may push other exchanges toward stricter frameworks, potentially reducing speculative bubbles. Historically, such shifts have led to healthier long-term growth, as seen after the 2018 cleanup of low-quality ICOs.

"Exchange values are not just philosophical; they translate into real market structure. When a major CEX emphasizes responsibility, it signals a maturation phase that could reduce volatility and attract institutional capital. However, in the short term, these clashes often create uncertainty that tests technical supports." – CoinMarketBuzz Intelligence Desk

Based on current market structure, two primary scenarios emerge for exchange tokens and broader crypto markets.

Over the next 12 months, institutional outlook hinges on whether exchanges adopt more rigorous listing standards. If OKX's approach gains traction, it could reduce meme-driven volatility and support a steadier bull run. Conversely, persistent controversy may delay mainstream adoption. This aligns with a 5-year horizon where regulatory clarity, as discussed on SEC.gov, becomes increasingly critical for market stability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.