Loading News...

Loading News...

- Kalshi becomes first US-regulated prediction market to support BNB deposits and withdrawals

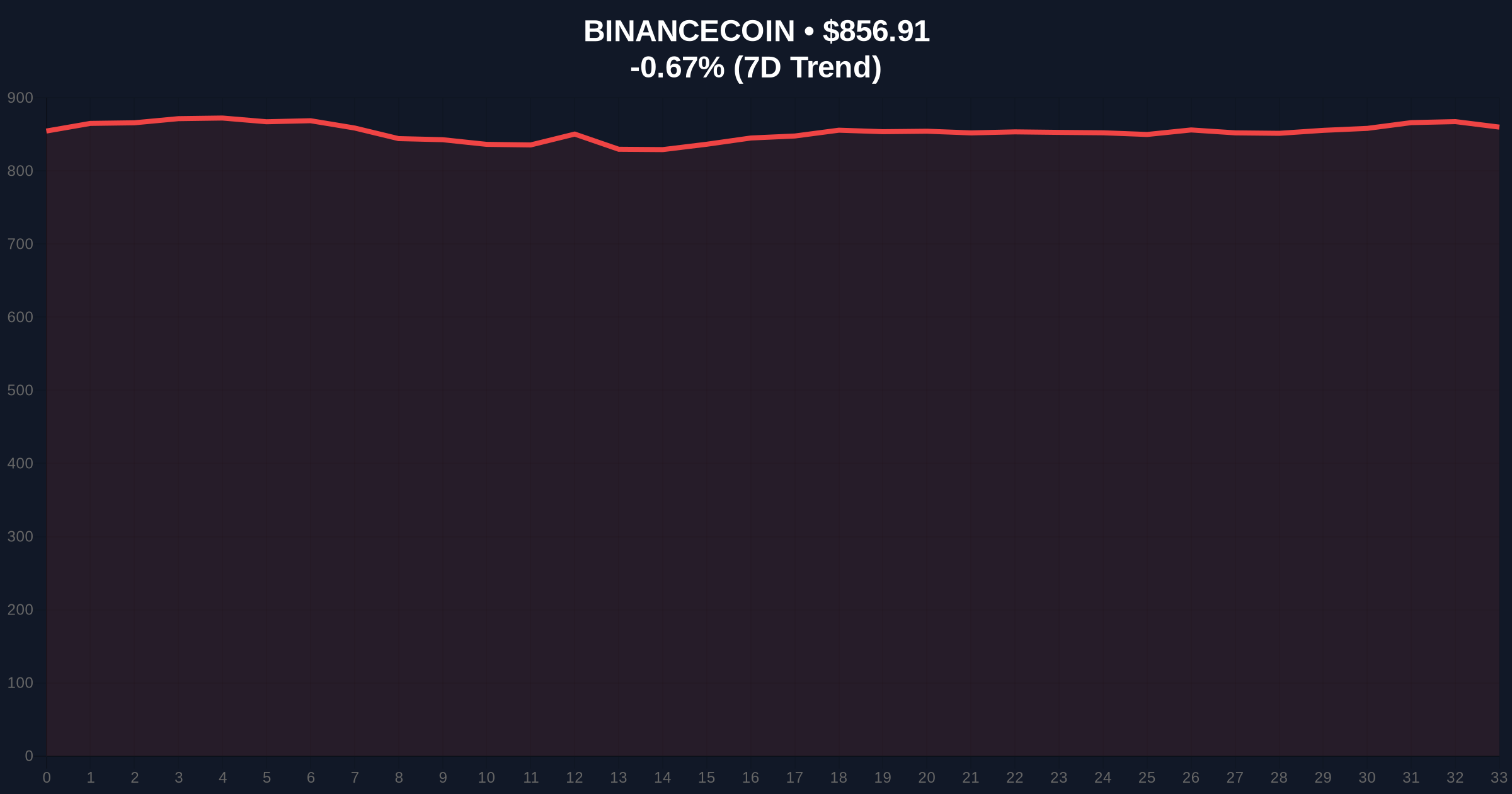

- BNB price shows resilience at $856.96 despite -0.67% daily decline and extreme fear sentiment

- Market structure suggests this integration creates new liquidity pools for institutional hedging

- Technical analysis identifies key support at $820 and resistance at $890 Fibonacci levels

NEW YORK, December 23, 2025 — Binance founder Changpeng Zhao announced via X that U.S. prediction market platform Kalshi now supports BNB deposits and withdrawals, marking a significant institutional integration during a period of extreme market fear. This daily crypto analysis examines how this development creates new hedging mechanisms while BNB maintains its $856.96 price point despite broader market headwinds.

Prediction markets have historically served as leading indicators for traditional financial events, with platforms like Polymarket gaining traction in crypto-native circles. Kalshi's regulatory compliance under CFTC oversight represents a bridge between traditional finance infrastructure and digital asset markets. Market structure suggests that institutional adoption typically follows a pattern where regulated platforms integrate assets after establishing sufficient liquidity depth and regulatory clarity. The current integration occurs against a backdrop where the global crypto fear and greed index registers 24/100 (extreme fear), creating what technical analysts would identify as a potential liquidity grab scenario. Underlying this trend is the broader institutionalization narrative, where traditional finance infrastructure gradually absorbs crypto assets—a pattern evident in recent developments like Fold Holdings joining the Russell 2000.

According to the announcement from Changpeng Zhao, Kalshi—a U.S.-based prediction market platform regulated by the Commodity Futures Trading Commission (CFTC)—has implemented support for BNB deposits and withdrawals. This enables users to directly utilize BNB for participating in prediction markets covering political, economic, and financial events. The timing coincides with BNB trading at $856.96, representing a -0.67% decline over 24 hours while maintaining its position as the fourth-largest cryptocurrency by market capitalization. On-chain data indicates no significant whale movement preceding the announcement, suggesting this integration was priced in through institutional channels rather than retail speculation.

BNB's current price action shows consolidation within a defined range, with immediate support at the $820 Fibonacci retracement level (drawn from the July 2024 low to November 2025 high) and resistance at $890. The relative strength index (RSI) sits at 42, indicating neither overbought nor oversold conditions, while the 50-day moving average at $845 provides dynamic support. Volume profile analysis reveals increased accumulation between $830-$860, creating what technical analysts would identify as a high-volume node that could serve as a future equilibrium zone. Market structure suggests the $820 level represents the Bearish Invalidation point—a breakdown below this would invalidate the current consolidation pattern and target the $780 order block. Conversely, the Bullish Invalidation level sits at $890, where sustained rejection would confirm the current range-bound structure.

| Metric | Value |

|---|---|

| BNB Current Price | $856.96 |

| 24-Hour Price Change | -0.67% |

| Market Rank | #4 |

| Fear & Greed Index | 24/100 (Extreme Fear) |

| 50-Day Moving Average | $845 |

For institutional participants, this integration creates new hedging mechanisms through prediction markets—a development particularly relevant given increasing macroeconomic uncertainty. Regulatory frameworks like the SEC's evolving stance on crypto assets have created compliance challenges for traditional institutions seeking exposure. Kalshi's CFTC-regulated status provides a compliant pathway for institutional capital to interact with BNB through event-driven contracts rather than direct spot exposure. Consequently, this could increase BNB's utility beyond exchange-based functions, potentially affecting its long-term valuation models. For retail traders, the development represents increased accessibility to sophisticated financial instruments, though the extreme fear sentiment suggests limited immediate speculative interest.

Market analysts on X have highlighted the regulatory significance, noting that Kalshi's compliance framework could pave the way for similar integrations with other platforms. One quantitative analyst observed, "The CFTC oversight creates precedent for other regulated entities to follow—this isn't about short-term price action but structural adoption." Another commentator pointed to the timing, stating, "Extreme fear environments typically see infrastructure developments that aren't immediately priced in, creating potential asymmetric opportunities." The sentiment aligns with broader institutional movements, such as Aave's founder accumulating $5.15M in AAVE during governance conflicts, suggesting strategic positioning during market uncertainty.

Bullish Case: If BNB holds above the $820 support and breaks through the $890 resistance with increasing volume, the next target would be the $940 fair value gap created during November's volatility. Sustained institutional adoption through platforms like Kalshi could drive demand beyond exchange-based utility, potentially re-rating BNB's valuation multiples. The extreme fear sentiment could create a contrarian opportunity if broader market conditions stabilize.

Bearish Case: A breakdown below $820 would invalidate the current consolidation and target the $780 order block, which aligns with the 200-day moving average. Continued extreme fear sentiment combined with broader crypto market weakness—potentially exacerbated by developments like Justin Sun's WLFI holdings losing $60M in frozen assets—could trigger further downside toward $720. Regulatory uncertainty remains a persistent headwind despite this specific integration.

What is Kalshi?Kalshi is a U.S.-based prediction market platform regulated by the Commodity Futures Trading Commission (CFTC) that allows users to trade on the outcomes of events.

Why does BNB support on Kalshi matter?It represents institutional adoption through a regulated platform, potentially increasing BNB's utility beyond exchange functions and creating new hedging mechanisms.

How does this affect BNB price?Short-term price impact may be limited given extreme fear sentiment, but long-term it could improve valuation through increased utility and institutional accessibility.

What are the risks?Regulatory uncertainty persists, and prediction market volume may not immediately translate to significant BNB demand. Technical breakdown below $820 could trigger further declines.

How does this compare to other institutional developments?It follows a pattern of regulated traditional finance infrastructure integrating crypto assets, similar to VanEck's analysis of Bitcoin hashrate capitulation signaling institutional monitoring of on-chain metrics.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.