Loading News...

Loading News...

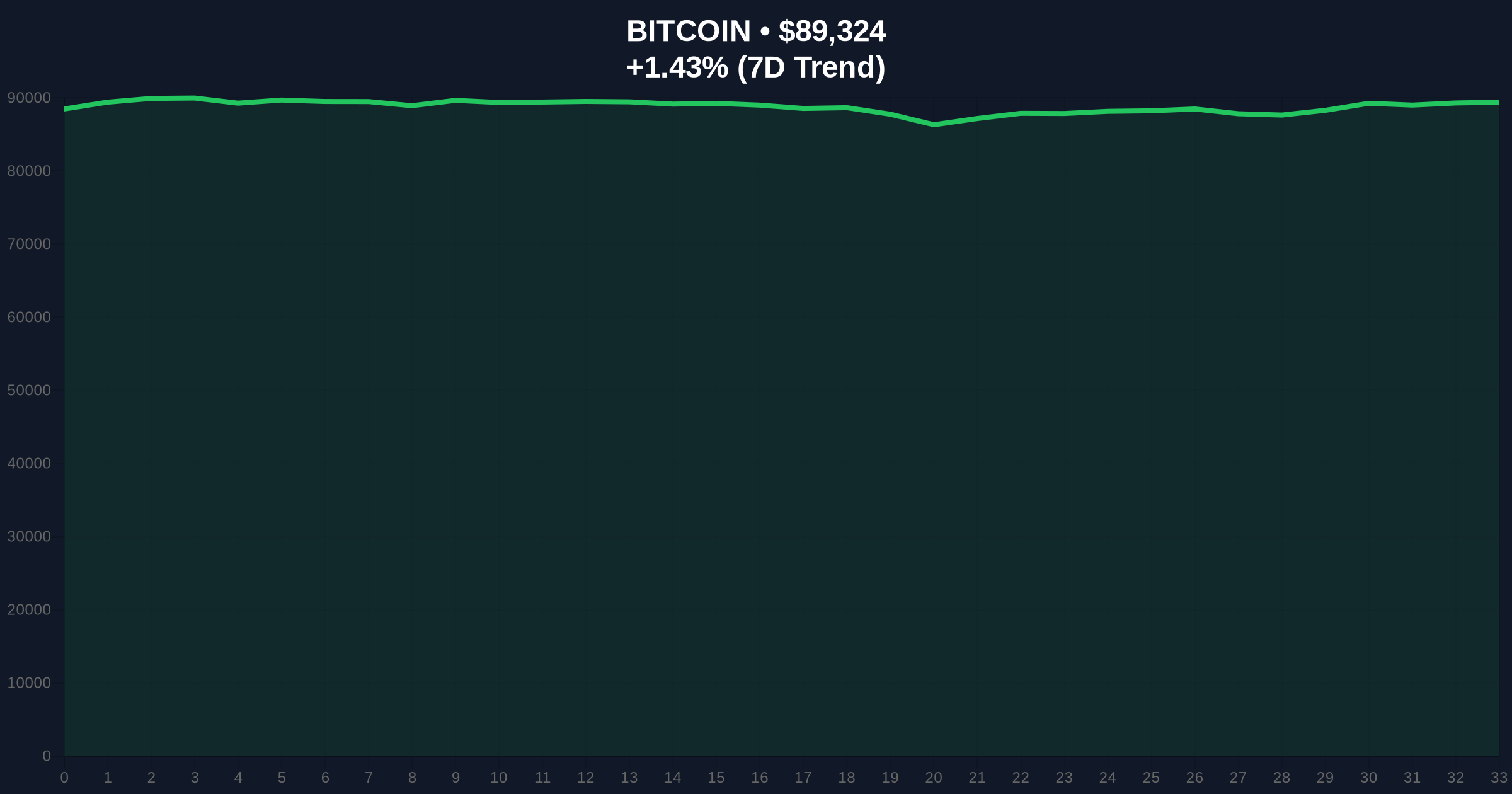

VADODARA, January 28, 2026 — The U.S. Federal Reserve's Federal Open Market Committee (FOMC) maintained its benchmark interest rate within the 3.50% to 3.75% range. This decision aligns with market expectations. Consequently, Bitcoin stabilized near $89,470. The latest crypto news highlights a macro environment of cautious stability. Market structure suggests traders priced this outcome days in advance.

According to the official FOMC statement, the committee voted to hold the federal funds rate target range steady. This marks the third consecutive meeting without a change. The decision follows months of data indicating moderated inflation. Per the Federal Reserve's official communications, the pause allows previous hikes to permeate the economy. Market analysts anticipated this outcome with 97.2% probability, as tracked by CME Group's FedWatch Tool. Consequently, price action exhibited minimal volatility post-announcement.

Historical cycles suggest such pauses often precede pivot phases. The current rate environment mirrors the 2018-2019 period. Back then, the Fed halted hikes before cutting rates. Underlying this trend is a delicate balance between inflation control and economic growth. On-chain data indicates institutional accumulation slowed during the meeting week. This reflects a wait-and-see approach from large holders.

Market context reveals a complex interplay. The Fed's current stance diverges sharply from the 2022-2024 hiking cycle. During that period, rates surged from near-zero to above 5%. That aggressive tightening catalyzed the 2022 crypto winter. In contrast, today's stability provides a neutral macro backdrop. Similar to the 2021 correction, external liquidity conditions now dictate asset performance.

, global regulatory developments create crosscurrents. For instance, Russia's advancing $4,000 annual crypto cap bill echoes China's 2021 crackdown. Such measures constrain retail participation. Meanwhile, institutional adoption continues through channels like Dubai's insurance premium crypto payments. This bifurcation defines the current market structure.

Technical architecture shows Bitcoin defending key levels. The asset currently trades at $89,470, down 1.49% over 24 hours. Market structure suggests a consolidation pattern between $85,000 and $92,000. This range represents a high-volume node on the volume profile. A critical Fibonacci support level sits at $82,000, the 0.618 retracement from the 2024 all-time high.

, the 50-day moving average converges near $90,000. This creates a dynamic resistance zone. The Relative Strength Index (RSI) on daily charts reads 48, indicating neutral momentum. Order block analysis identifies a significant liquidity pool below $85,000. This level must hold to prevent a cascade. The market exhibits classic post-FOMC compression.

| Metric | Value | Context |

|---|---|---|

| Fed Funds Rate Target | 3.50% - 3.75% | Held steady, meeting expectations |

| Bitcoin Price | $89,470 | -1.49% 24h change |

| Crypto Fear & Greed Index | 29/100 (Fear) | Extreme fear threshold is 25 |

| CME FedWatch Probability | 97.2% | Chance of hold pre-meeting |

| Key Fibonacci Support | $82,000 | 0.618 retracement level |

This matters for portfolio allocation across a 5-year horizon. The Fed's pause signals a potential end to aggressive quantitative tightening. Historically, such periods precede risk-asset rallies. However, current market sentiment remains in Fear. This divergence creates a potential fair value gap. Institutional liquidity cycles suggest capital may rotate into crypto if traditional yields stagnate.

, stable rates reduce borrowing costs for crypto-native firms. This supports development of layer-2 solutions and DeFi protocols. Retail market structure, however, shows caution. On-chain data indicates decreased exchange inflows. This suggests hodler accumulation despite price weakness. The macro environment now shifts focus to upcoming CPI prints and employment data.

Market structure suggests the Fed's decision was fully priced. Consequently, attention turns to forward guidance and balance sheet runoff. The critical level for Bitcoin remains the $82,000 weekly support. A break below invalidates the current consolidation thesis. Institutional flows into spot ETFs will likely accelerate in this neutral rate environment.

— CoinMarketBuzz Intelligence Desk

Market outlook hinges on two data-backed technical scenarios. Scenario A assumes support holds. This leads to a retest of the $95,000 resistance zone. Scenario B involves a breakdown. That triggers a sweep of the $85,000 liquidity pool.

The 12-month institutional outlook remains cautiously optimistic. Stable rates reduce systemic risk. This allows crypto to trade on its own fundamentals. Key drivers include Ethereum's Pectra upgrade and Bitcoin's post-halving supply dynamics. The Fed's next move, likely a cut in late 2026, could catalyze the next macro cycle.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.