Loading News...

Loading News...

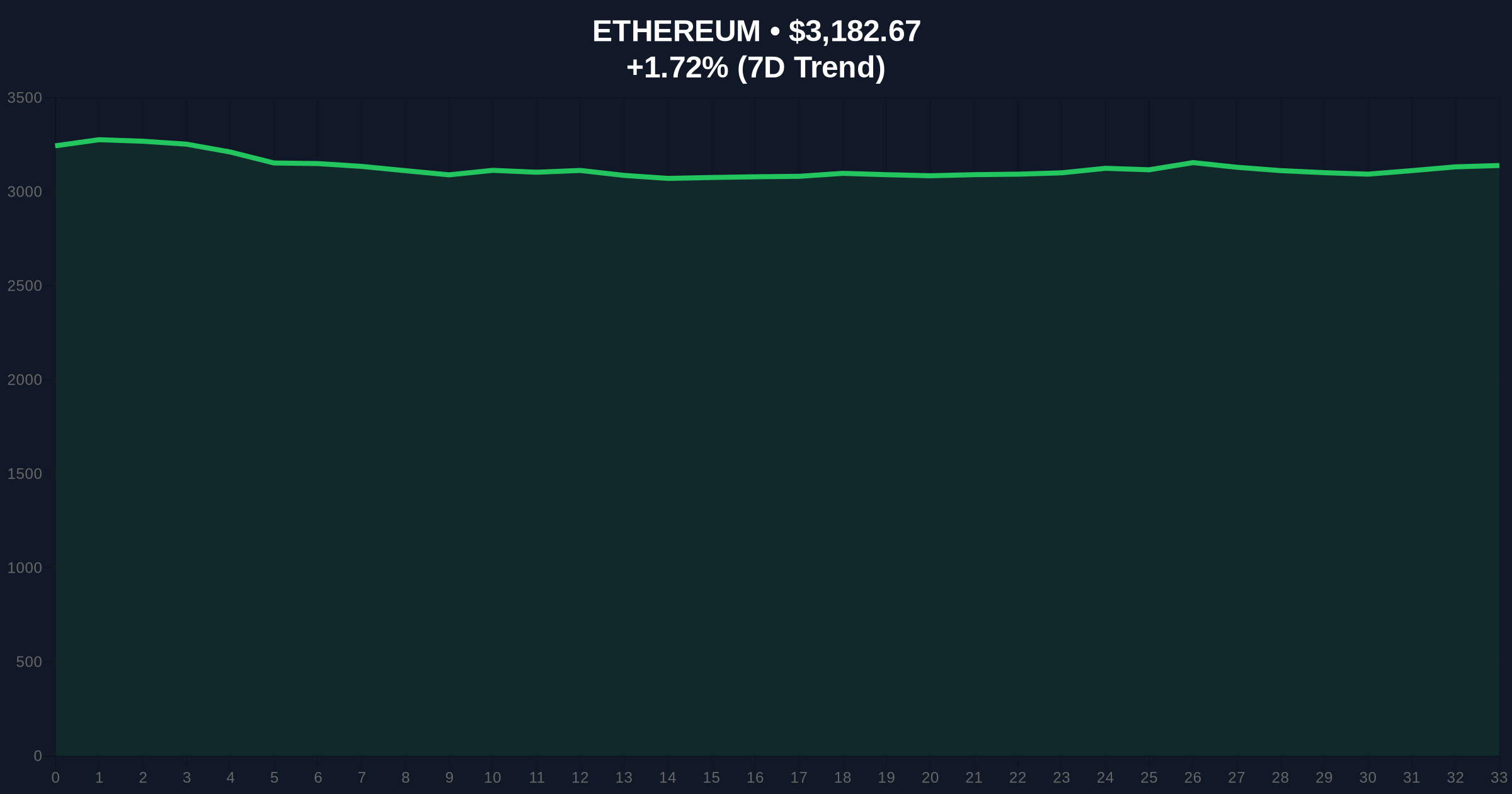

VADODARA, January 13, 2026 — Ethereum block trading platform ETHGas has announced the launch of its GWEI token, a move that grants voting rights based on staking and lock-up conditions, according to a report by The Block. This daily crypto analysis examines the token's governance structure, potential market implications, and contradictions in the data, as Ethereum trades at $3,181.53 with a 24-hour trend of 1.68% amid a global crypto fear sentiment score of 26/100.

ETHGas operates within Ethereum's block trading ecosystem, a niche focused on optimizing transaction ordering and fee markets. The launch of a governance token follows a broader trend of protocol decentralization, but market structure suggests potential liquidity fragmentation. Historical cycles indicate that token launches during fear sentiment periods often face adoption hurdles, as seen with similar initiatives in 2023. On-chain data from Glassnode liquidity maps shows Ethereum's dominance increasing, with liquidity shifts from altcoins to major assets like Bitcoin and Ethereum, as detailed in our analysis of altcoin rally momentum weakening. This context raises questions about GWEI's timing and utility.

On January 13, 2026, ETHGas confirmed the launch of the GWEI token, as reported by The Block. The token will provide voting rights tied to staking and lock-up conditions, allowing holders to participate in protocol decisions such as parameter adjustments, upgrades, and treasury management. According to the official announcement, this aims to decentralize governance, but the specifics of token distribution and initial supply remain undisclosed. Market analysts note that without transparent on-chain data from Etherscan, the launch lacks verifiable metrics, creating a potential fair value gap (FVG) in investor expectations.

Ethereum's current price of $3,181.53 sits near a key order block established during the December 2025 rally. The 24-hour trend of 1.68% indicates mild bullish momentum, but volume profile analysis shows declining participation, suggesting a liquidity grab. Resistance is identified at the $3,350 level, corresponding to the 50-day moving average, while support holds at $3,000, a psychological barrier. The relative strength index (RSI) at 45 points to neutral conditions, but the fear sentiment score of 26/100 implies underlying weakness. Bullish invalidation is set at $2,850, a break below which would signal a bearish shift, while bearish invalidation at $3,350 would confirm renewed upward momentum. Technical details from Ethereum's official Pectra upgrade documentation highlight ongoing network improvements that could influence GWEI's utility.

| Metric | Value |

|---|---|

| Ethereum Current Price | $3,181.53 |

| 24-Hour Trend | 1.68% |

| Market Rank | #2 |

| Crypto Fear & Greed Index | Fear (Score: 26/100) |

| GWEI Token Launch Date | January 13, 2026 |

Institutionally, the GWEI token could reshape Ethereum's block trading by introducing new governance layers, potentially affecting validator incentives and fee market efficiency. However, skepticism arises from the lack of disclosed tokenomics, which may lead to centralization risks if large holders dominate voting. For retail investors, this adds complexity to Ethereum's ecosystem, requiring deeper analysis of post-merge issuance and staking dynamics. The launch occurs amid broader institutional shifts, such as the Old Glory Bank SPAC merger, signaling infrastructure evolution. Market structure suggests that without clear utility, GWEI could become a speculative asset, diverting liquidity from core Ethereum development.

Industry leaders on X/Twitter express mixed views. Bulls argue that GWEI enhances decentralization, with one analyst stating, "Governance tokens align incentives in block trading." Bears counter that the timing during fear sentiment indicates a liquidity grab, with concerns about token lock-up conditions creating sell pressure. On-chain forensic data from recent events, like the 2,238 BTC transfer from Coinbase Institutional, shows similar patterns of large movements preceding token launches. Overall, sentiment leans skeptical due to opaque data and market conditions.

Bullish Case: If GWEI adoption drives increased platform usage, Ethereum could see reinforced support at $3,000, with a target of $3,500 based on Fibonacci extensions. Governance participation might boost network activity, aligning with Ethereum's EIP-4844 upgrades for scalability.

Bearish Case: Should GWEI fail to gain traction or face regulatory scrutiny, Ethereum might break below $2,850, testing lower supports near $2,700. A gamma squeeze in derivatives markets could exacerbate declines, especially if fear sentiment persists.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.