Loading News...

Loading News...

VADODARA, January 31, 2026 — Ethereum dominated cryptocurrency perpetual futures liquidations with $147 million in forced position closures over the past 24 hours, according to real-time liquidation data from major exchanges. This daily crypto analysis reveals a market structure fracture where 82.95% of ETH liquidations targeted over-leveraged long positions, while Bitcoin saw 62.6% short liquidations totaling $87.71 million. The asymmetric liquidation profile suggests divergent positioning strategies between the two largest crypto assets during a period of extreme market fear.

Market structure suggests coordinated deleveraging across perpetual futures markets created a $269 million liquidity grab. According to the source data from Coinness, Ethereum's $147 million liquidation volume represented 54.6% of the total market-wide event. The 82.95% long liquidation ratio indicates excessive bullish leverage concentrated around specific price levels that failed to hold. Bitcoin's contrasting profile—with 62.6% short liquidations—reveals bearish positioning being squeezed during the same volatility episode.

XAG (Silver Token) contributed $34.30 million with 80.26% long liquidations, mirroring Ethereum's directional pain. This correlation suggests broader risk-off behavior rather than asset-specific fundamentals driving the liquidation cascade. The data contradicts the narrative of isolated technical corrections, pointing instead to systemic leverage unwinding across multiple perpetual futures markets.

Historically, liquidation events of this magnitude precede volatility compression phases. The current extreme fear reading of 20/100 on the Crypto Fear & Greed Index typically marks local bottoms when combined with asymmetric positioning data. In contrast to the 2021 cycle where liquidations were predominantly long across all assets, the current BTC/ETH divergence suggests sophisticated institutional positioning strategies.

Underlying this trend is the broader market context of regulatory uncertainty and macroeconomic pressure. The liquidation event coincides with significant outflows from US spot cryptocurrency ETFs, as detailed in our analysis of US Spot Ethereum ETFs seeing $252.9M in net outflows. , US Bitcoin ETFs bleeding $509.7M over four days indicates institutional capital rotation rather than outright capitulation.

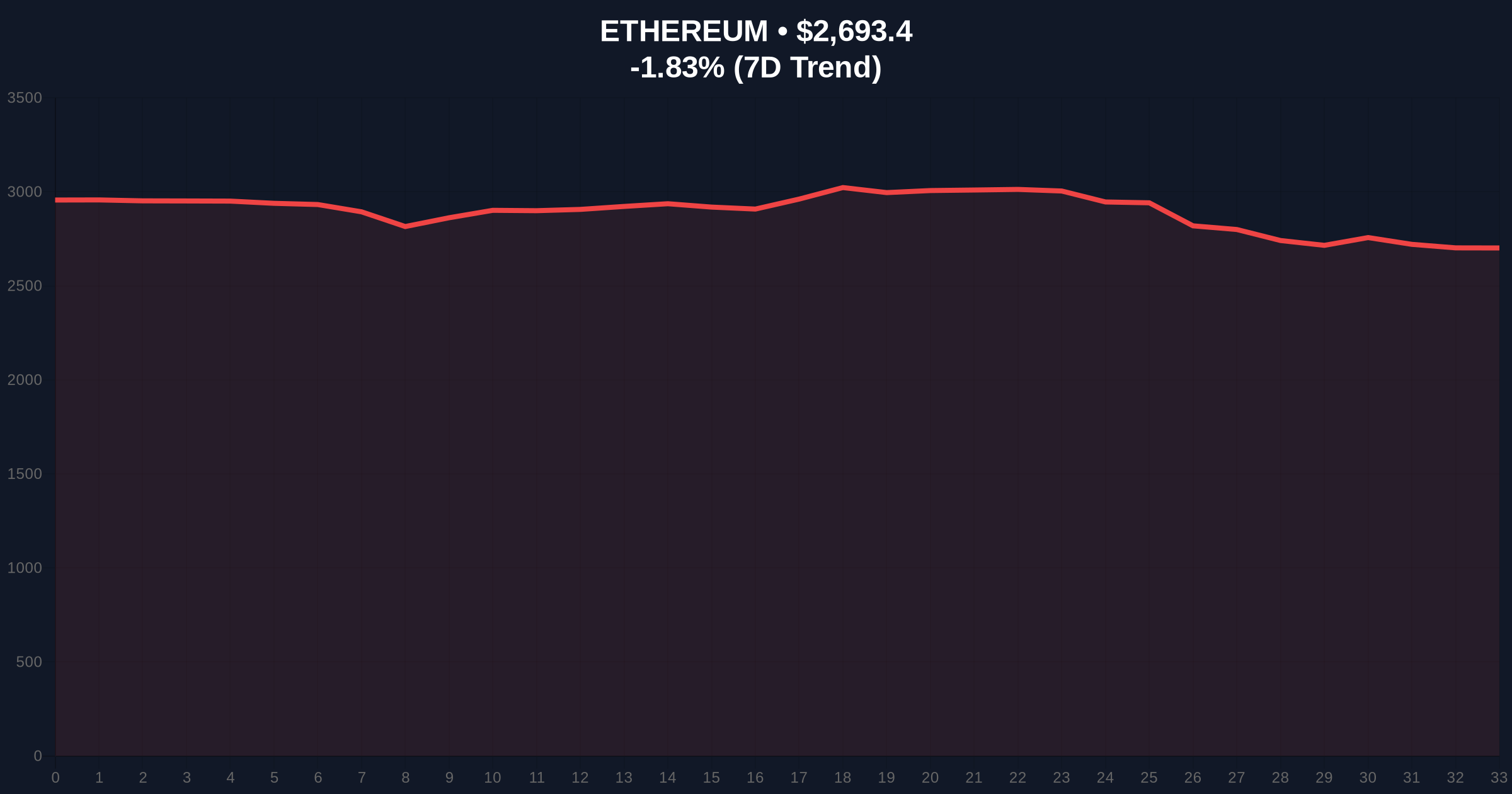

Ethereum's current price of $2,693.46 represents a -1.83% 24-hour decline, but the technical picture reveals more significant structural damage. The liquidation cluster between $2,700-$2,750 created a Fair Value Gap (FVG) that must be filled for healthy price discovery. Market structure suggests the $2,550 level—corresponding to the Fibonacci 0.618 retracement from the 2025 high—now serves as critical support.

According to Ethereum's official documentation on network upgrades, the upcoming Pectra hard fork introduces changes to execution layer economics that could impact validator profitability and staking derivatives markets. This fundamental development interacts with the technical liquidation pressure, creating a complex risk/reward calculus for leveraged positions. The 200-day moving average at $2,480 provides additional confluence for the bearish invalidation level.

| Metric | Value | Implication |

|---|---|---|

| Total Liquidations (24h) | $269M | Systemic leverage unwinding |

| ETH Liquidation Volume | $147M (82.95% long) | Bullish over-leverage punished |

| BTC Liquidation Volume | $87.71M (62.6% short) | Bearish squeeze in progress |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Contrarian signal potential |

| ETH Current Price | $2,693.46 (-1.83% 24h) | Testing critical support zones |

Liquidation events of this scale matter because they create order flow imbalances that institutional algorithms exploit for weeks afterward. The $147 million in ETH long liquidations represents not just lost capital but destroyed buying power that must be rebuilt. This impacts market depth and increases susceptibility to further downside volatility.

, the divergence between ETH (long liquidations) and BTC (short liquidations) suggests different investor cohorts with varying risk appetites. Ethereum's positioning appears dominated by retail and mid-sized institutions over-leveraged for upside, while Bitcoin's market structure shows professional traders positioned for downside being squeezed. This creates a fragmented market psychology that complicates trend establishment.

The asymmetric liquidation profile between ETH and BTC reveals fundamental differences in how market participants are positioning through this volatility cycle. Ethereum's high long liquidation ratio suggests excessive optimism around the Pectra upgrade timeline, while Bitcoin's short squeeze indicates bearish macro bets being unwound. The critical question is whether this represents healthy deleveraging or the beginning of a more significant trend change.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the liquidation data and technical levels:

The 12-month institutional outlook remains cautiously optimistic despite the liquidation event. Historical cycles suggest that extreme fear readings combined with asymmetric positioning often mark intermediate-term bottoms. However, the Federal Reserve's monetary policy trajectory, as indicated in their latest statements on interest rates, will likely determine whether this represents a buying opportunity or further downside ahead. The 5-year horizon remains positive given Ethereum's fundamental roadmap, but near-term volatility requires precise risk management.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.