Loading News...

Loading News...

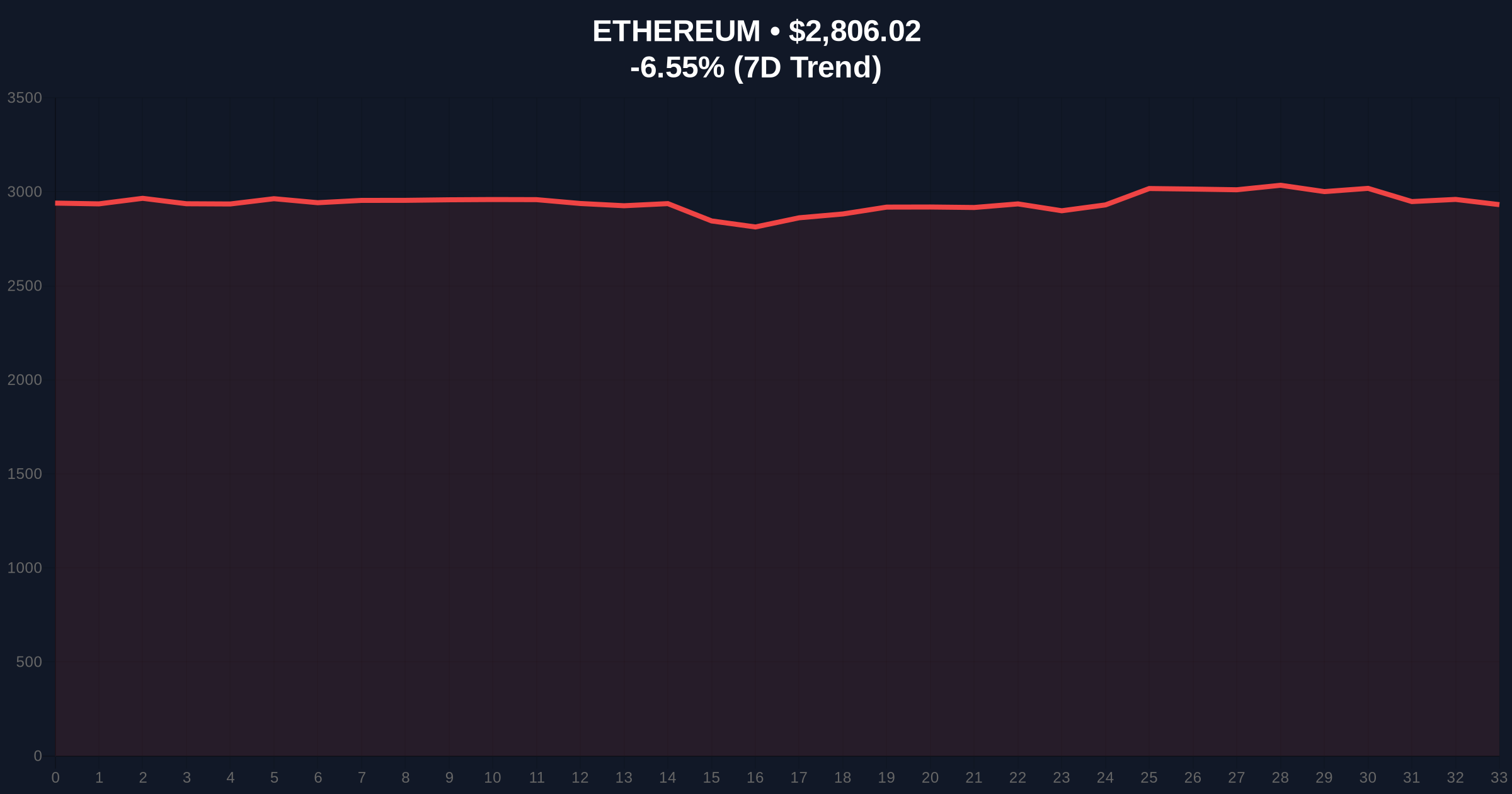

VADODARA, January 29, 2026 — The Ethereum Foundation and founder Vitalik Buterin have established a $220 million security fund using unclaimed compensation from a 2016 hack, according to Unchained. This daily crypto analysis examines the fund's creation during a period of significant market stress. The fund will support security-focused projects and stake a portion for returns. Market structure suggests this move aims to bolster Ethereum's long-term resilience. On-chain data indicates mixed reactions from institutional players.

Unchained reports the Ethereum Foundation sourced capital from unclaimed 2016 hack compensation. The fund targets security enhancement projects. A portion will be staked to generate yield. This creates a self-sustaining security mechanism. Market analysts question the timing of this announcement. Ethereum currently trades at $2,803.14 with a 24-hour decline of -6.65%. The Global Crypto Fear & Greed Index sits at 26/100. This indicates extreme fear conditions.

Historical cycles suggest such announcements often precede volatility. The 2016 hack compensation remained dormant for nearly a decade. This raises questions about fund management efficiency. According to Ethereum's official documentation on security best practices, proactive measures are critical for network integrity. The foundation's move aligns with these principles. Market context reveals contradictory signals between long-term planning and short-term price action.

Ethereum has faced multiple security challenges since its inception. The 2016 DAO hack resulted in significant losses. Compensation mechanisms have evolved slowly. In contrast, recent security upgrades like EIP-4844 have improved network robustness. This fund represents a substantial capital allocation. It mirrors past foundation initiatives that preceded market shifts.

Underlying this trend is growing institutional scrutiny. Security remains a top concern for enterprise adoption. The fund's staking component introduces yield-generation dynamics. This could impact Ethereum's post-merge issuance economics. Related developments include recent futures liquidations exceeding $268M and regulatory shifts signaled by the SEC chairman. These events compound current market uncertainty.

Market structure suggests ETH faces immediate technical headwinds. The current price of $2,803.14 tests critical support levels. A Fibonacci retracement from recent highs indicates key support at the 0.618 level near $2,750. This level must hold to maintain bullish structure. The 24-hour decline of -6.65% reflects broader market fear.

Volume profile analysis shows increased selling pressure. This creates a potential Fair Value Gap (FVG) between $2,850 and $2,900. This gap represents an imbalance that price may revisit. The Relative Strength Index (RSI) approaches oversold territory. This could signal a near-term bounce. However, order block analysis reveals resistance near $2,950. Breaking this level would require significant buying volume.

| Metric | Value |

|---|---|

| Security Fund Size | $220 million |

| ETH Current Price | $2,803.14 |

| 24-Hour Price Change | -6.65% |

| Market Rank | #2 |

| Crypto Fear & Greed Index | 26/100 (Fear) |

This fund impacts Ethereum's security posture directly. Enhanced security could reduce smart contract vulnerabilities. This matters for decentralized finance (DeFi) and institutional adoption. The staking component introduces new economic dynamics. Staked assets will generate yield for ongoing security funding. This creates a sustainable model for long-term network health.

Market evidence suggests timing raises questions. Announcing a $220 million fund during extreme fear conditions may signal strategic positioning. Institutions often accumulate during fear cycles. The fund's capital could stabilize security projects amid market volatility. This demonstrates proactive risk management. However, contradictions exist between the fund's long-term focus and immediate market reactions.

Market structure suggests this fund addresses critical security gaps. However, the timing during a fear cycle raises eyebrows. Historical data shows foundation announcements often precede volatility. The staking mechanism introduces interesting yield dynamics. This could impact Ethereum's overall issuance schedule. We monitor the Fibonacci support at $2,750 closely.

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Enhanced security could boost developer confidence. This aligns with Ethereum's roadmap for scalability improvements. The fund's yield generation may attract institutional capital. However, near-term price action depends on broader market sentiment. The 5-year horizon suggests security investments pay dividends during adoption cycles.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.