Loading News...

Loading News...

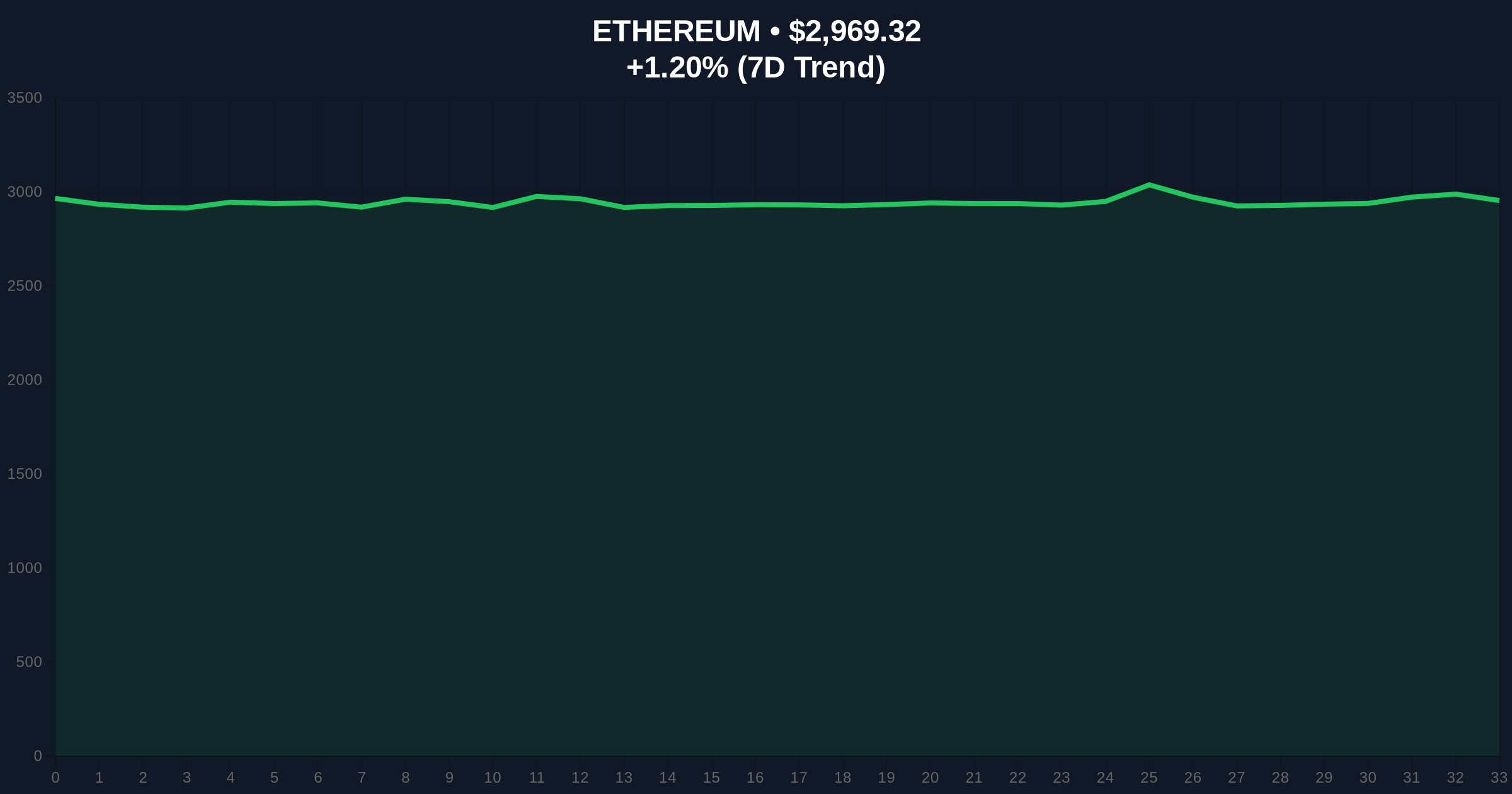

VADODARA, December 31, 2025 — An address presumed to belong to mining giant Bitmain has staked an additional 118,944 ETH worth approximately $352.16 million, bringing the entity's total staked Ethereum to an estimated 461,504 ETH valued at $1.37 billion. This daily crypto analysis examines the strategic implications of this massive institutional move during a period of extreme market fear, where the Crypto Fear & Greed Index sits at 23/100. According to on-chain data from Onchain Lens, the transaction represents one of the largest single-entity staking operations in Ethereum's history, executed while ETH trades at $2,968.92 with a 1.18% 24-hour gain.

Market structure suggests institutional accumulation during fear periods often precedes significant price movements. The current extreme fear environment, with a score of 23/100, mirrors conditions seen during the March 2020 liquidity crisis and the November 2022 FTX collapse. Underlying this trend is the maturation of Ethereum's staking ecosystem following the Shanghai upgrade, which enabled withdrawals and created a more predictable yield environment. Consequently, large-scale validators like Bitmain can now deploy capital with reduced execution risk. This institutional behavior contrasts with retail sentiment, creating a classic divergence that quantitative analysts monitor for potential trend reversals. The staking occurs alongside other market developments, including Bitcoin's recent decline below $88,000 and Coinbase's listing of LIGHTER during similar fear conditions.

On December 31, 2025, blockchain analytics firm Onchain Lens identified a transaction where an address associated with Bitmain staked 118,944 ETH. The transaction was valued at approximately $352.16 million based on prevailing market prices. Separately, a new address also believed to be owned by Bitmain received 32,938 ETH ($97.8 million) from institutional exchange FalconX approximately one hour prior to the staking event. This brings Bitmain's total identified staked Ethereum to 461,504 ETH, representing approximately 0.38% of all staked ETH and making the mining hardware manufacturer one of the largest single validators on the network. The timing is notable given Ethereum's current market rank of #2 and the broader cryptocurrency sentiment reading of "Extreme Fear."

Ethereum's price action shows ETH testing the $2,950 support level, which aligns with the 50-day exponential moving average. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with slight bearish bias. Volume profile analysis reveals significant accumulation between $2,900 and $3,000, creating a potential order block that institutional players appear to be targeting. A Fair Value Gap (FVG) exists between $3,150 and $3,250 from the December 15th sell-off, which represents a likely resistance zone. The $2,800 level corresponds with the 0.618 Fibonacci retracement from the November highs, serving as major support. Bullish invalidation occurs if ETH closes below $2,750 on a weekly timeframe, which would break the macro higher low structure. Bearish invalidation triggers above $3,300, confirming breakout from the current consolidation range.

| Metric | Value |

|---|---|

| Additional ETH Staked by Bitmain | 118,944 ETH |

| Value of Additional Stake | $352.16M |

| Total Bitmain Staked ETH | 461,504 ETH ($1.37B) |

| Current ETH Price | $2,968.92 |

| Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

This transaction matters because it demonstrates institutional conviction during retail capitulation. For institutions, the 3.5% annual staking yield represents a risk-adjusted return superior to traditional fixed income, particularly when accounting for Ethereum's technological roadmap including EIP-4844 proto-danksharding. The staking reduces circulating supply, potentially creating a gamma squeeze scenario if demand accelerates while locked ETH remains inaccessible. For retail investors, this signals that sophisticated capital views current prices as accumulation zones rather than distribution points. The move also validates Ethereum's transition to proof-of-stake, as mining hardware manufacturers traditionally tied to proof-of-work now allocate billions to the new consensus mechanism.

Market analysts on X/Twitter have noted the divergence between institutional accumulation and retail fear. One quantitative researcher observed, "Bitmain's $352M stake during extreme fear represents textbook contrarian positioning—when sentiment hits extremes, smart money accumulates." Another analyst highlighted the technical implications: "The $2,900-$3,000 range now has institutional validation. Any breakdown below becomes less probable with this volume of committed capital." Bulls point to similar patterns in 2023 when BlackRock's Bitcoin ETF filing occurred during fear periods, while bears caution that single-entity concentration creates systemic risk if validator performance issues arise.

Bullish Case: If ETH holds above the $2,800 Fibonacci support and breaks through the $3,150-$3,250 FVG resistance, technical targets project a move toward $3,600 by Q1 2026. Institutional staking reduces sell pressure while Ethereum's burn mechanism creates deflationary dynamics. The combination could trigger a liquidity grab above $3,300 as short positions cover.

Bearish Case: Failure to hold $2,800 support could lead to a test of $2,500, the 0.786 Fibonacci level. If broader market conditions deteriorate further, with Bitcoin breaking below $85,000, ETH could experience correlated selling pressure. Regulatory uncertainty around staking classification remains a tail risk, as noted in recent SEC communications.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.