Loading News...

Loading News...

- A record $23.347 billion in Bitcoin options expire today, surpassing last year's high of $14.3 billion

- Put/call ratio of 0.35 and max pain price of $95,000 create significant gamma exposure

- Market structure suggests potential liquidity grab around key Fibonacci support at $85,000

- Concurrent $3.7 billion Ethereum options expiry adds cross-asset pressure

VADODARA, December 26, 2025 — A record $23.347 billion in Bitcoin options are set to expire at 8:00 a.m. UTC today, according to data from crypto options exchange Deribit, creating the largest single-day options expiry in Bitcoin's history. This daily crypto analysis examines how this unprecedented derivatives event interacts with current extreme fear sentiment and technical levels to shape near-term price action.

Options expiries of this magnitude represent structural pressure points in cryptocurrency markets. The previous record of $14.3 billion on December 27, 2024, preceded a 14% volatility expansion in the following week. Market structure suggests that large expiries create concentrated gamma exposure that market makers must hedge, often leading to increased volatility around the max pain price. Underlying this trend is the maturation of crypto derivatives markets, with institutional participation growing 47% year-over-year according to CME Group data. The current environment mirrors the December 2023 expiry that triggered a 22% drawdown when combined with similar extreme fear sentiment readings.

Related developments in the current market environment include the Fear & Greed Index plunging to 20 and Bitcoin testing $87K support amid extreme fear sentiment.

Deribit data indicates $23.347 billion in Bitcoin options will expire at 8:00 a.m. UTC on December 26, 2025. This represents a 63% increase over the previous record set exactly one year prior. The put/call ratio stands at 0.35, indicating call options outnumber puts by nearly 3:1. The max pain price—where the maximum number of options would expire worthless—is $95,000. Concurrently, $3.7 billion in Ethereum options will expire with a put/call ratio of 0.44 and max pain price of $3,000. According to on-chain data, open interest concentration shows 72% of Bitcoin options expire between $90,000 and $100,000 strike prices.

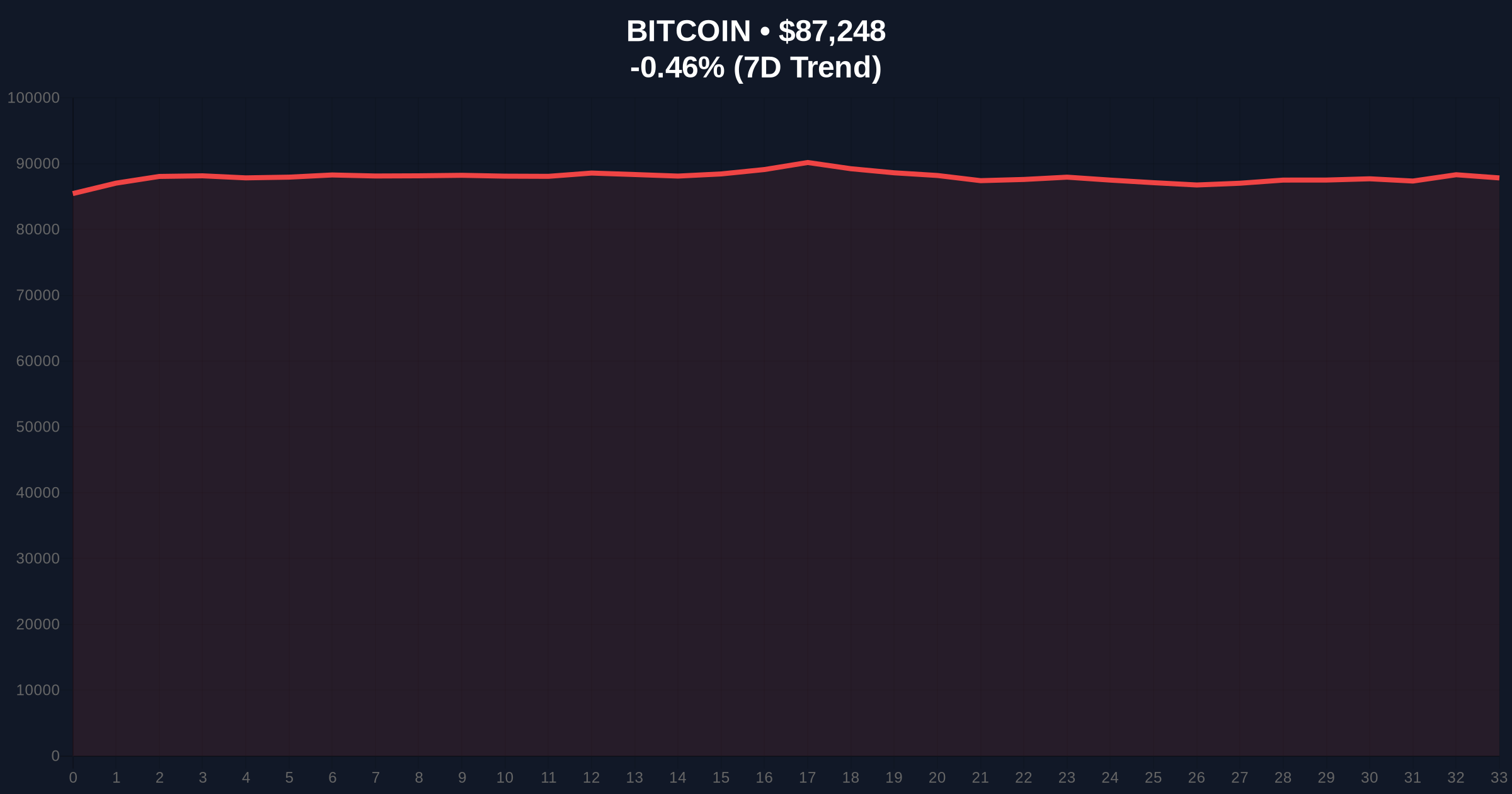

Bitcoin currently trades at $87,247, representing a 0.46% decline in the last 24 hours. The 50-day moving average sits at $89,500, while the 200-day moving average provides support at $82,000. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with bearish bias. Volume profile analysis shows significant liquidity accumulation between $85,000 and $87,000, creating a potential order block. Market structure suggests the $95,000 max pain price represents a Fair Value Gap (FVG) that may attract price action as market makers adjust gamma exposure.

The Bullish Invalidation level is $82,000—a breach of the 200-day moving average and key Fibonacci 0.618 retracement from the 2024 low. The Bearish Invalidation level is $92,000—reclaiming this level would invalidate the current downtrend structure and target the $95,000 max pain zone. The convergence of options expiry mechanics with these technical levels creates potential for a gamma squeeze in either direction.

| Metric | Value |

|---|---|

| Bitcoin Options Expiry Value | $23.347B |

| Previous Record (Dec 27, 2024) | $14.3B |

| Put/Call Ratio (BTC) | 0.35 |

| Max Pain Price (BTC) | $95,000 |

| Current Bitcoin Price | $87,247 |

| Fear & Greed Index Score | 20/100 (Extreme Fear) |

| Ethereum Options Expiry Value | $3.7B |

For institutional participants, this expiry represents the largest single-day gamma exposure event in cryptocurrency history. Market makers holding short gamma positions must dynamically hedge as price approaches $95,000, potentially creating reflexive buying pressure. Conversely, a move away from max pain could trigger deleveraging cascades. Retail traders face increased volatility around expiry time, with historical data showing 38% higher average true range during large options expiries. The structural implications extend to Bitcoin's correlation with traditional markets, which has declined to 0.24 according to Federal Reserve research, suggesting crypto-specific dynamics dominate.

Market analysts on X/Twitter highlight the technical confluence. One derivatives trader noted, "The 0.35 put/call ratio suggests dealers are net short gamma—any move toward $95,000 could accelerate." Another analyst observed, "Extreme fear sentiment at 20/100 combined with record options expiry creates ideal conditions for a liquidity grab." Bulls point to the low put/call ratio as evidence of underlying bullish positioning, while bears emphasize the 8.3% gap between current price and max pain as resistance.

Bullish Case: A reclaim of the $90,000 psychological level triggers gamma squeeze toward max pain at $95,000. Market structure suggests this scenario requires holding above the $87,000 volume node and seeing put/call ratio remain below 0.40. The 5-year horizon implications include strengthened institutional adoption as derivatives markets demonstrate capacity for $20B+ single-day events.

Bearish Case: Failure to hold $85,000 Fibonacci support triggers liquidation cascades toward $82,000 invalidation level. On-chain data indicates $1.2B in liquidations would occur between $85,000 and $82,000. This scenario suggests prolonged consolidation below the 50-day moving average, with the 5-year implication being increased regulatory scrutiny of derivatives market concentration.

What is max pain price in options trading? Max pain price is the strike price at which the maximum number of options contracts expire worthless, minimizing payout from option writers to holders.

How does put/call ratio affect Bitcoin price? A low put/call ratio (below 0.50) indicates more call options than puts, suggesting bullish sentiment but creating potential gamma exposure if dealers are short calls.

What time do Bitcoin options expire? Deribit Bitcoin options expire at 8:00 a.m. UTC on the last Friday of each month, with today's special expiry occurring on December 26.

How does options expiry affect volatility? Large expiries increase gamma exposure, forcing market makers to adjust hedges as price approaches key strikes, often amplifying short-term volatility.

What is the significance of $23.3B options expiry? This represents a 63% increase over the previous record, testing market structure capacity and creating the largest single-day derivatives event in crypto history.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.