Loading News...

Loading News...

- QCP Capital deposited 400 BTC ($35.7M) and 200 ETH ($597,000) to Binance, potentially signaling selling intent

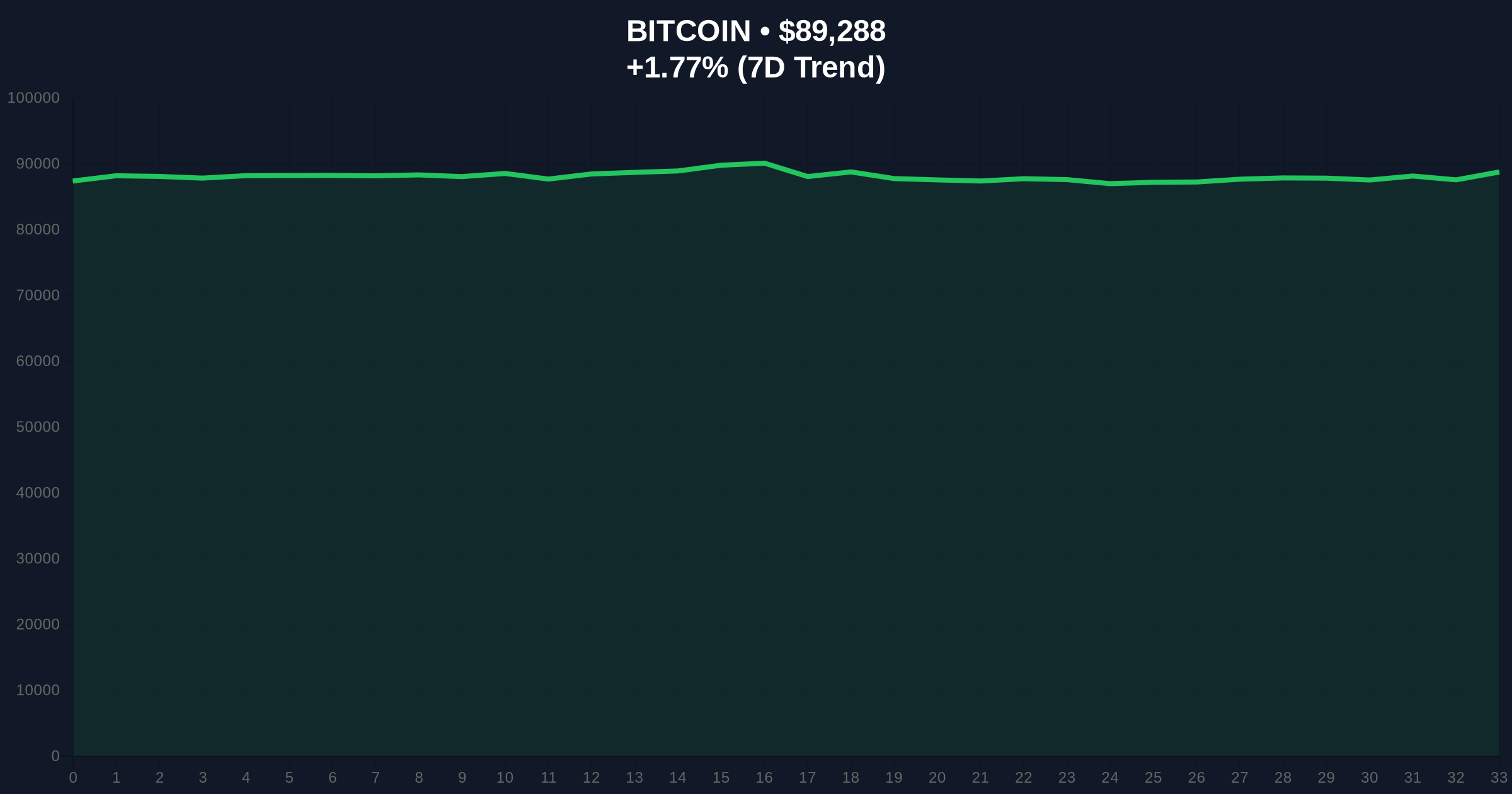

- Market sentiment at "Extreme Fear" (20/100) with Bitcoin trading at $89,285

- Technical analysis identifies $87,500 as Bullish Invalidation and $91,200 as Bearish Invalidation

- Contradiction between institutional deposit timing and extreme fear sentiment raises questions about market manipulation

VADODARA, December 26, 2025 — In a move that has captured the attention of quantitative analysts, Singapore-based trading firm QCP Capital deposited approximately $36.3 million worth of Bitcoin and Ethereum to Binance, according to on-chain data. This daily crypto analysis examines whether this represents a strategic liquidity grab or a genuine bearish signal amid current market conditions.

Market structure suggests institutional deposits to centralized exchanges often precede selling activity, as traders seek liquidity for execution. The timing of QCP Capital's move is particularly noteworthy given the current "Extreme Fear" sentiment reading of 20/100 on the Crypto Fear & Greed Index. Historical patterns indicate such sentiment extremes often coincide with capitulation events or strategic accumulation phases. The contradiction between an institutional entity potentially preparing to sell during extreme retail fear raises immediate questions about market efficiency and information asymmetry.

Related developments in this environment include Upbit's listing of ZKPass and Sberbank's crypto loan proposal, both occurring amid similar market conditions. These parallel movements suggest institutional actors are actively positioning despite retail sentiment indicators.

According to on-chain analytics provider OnchainLenz, a wallet presumed to belong to QCP Capital transferred 400 BTC (approximately $35.7 million) and 200 ETH (approximately $597,000) to Binance approximately five hours before market analysis. The total deposit value of $36.3 million represents a significant liquidity event, particularly given Bitcoin's current price of $89,285 and 24-hour trend of 1.77%. While QCP Capital has not publicly commented on the transaction, market analysts interpret such exchange deposits as potential precursors to selling activity, as they provide immediate access to trading pairs and liquidity.

Volume profile analysis reveals Bitcoin has established a consolidation range between $87,500 and $91,200 over the past seven trading sessions. The current price of $89,285 sits near the midpoint of this range, creating a potential Fair Value Gap (FVG) that could be targeted for liquidity. The 50-day exponential moving average at $88,400 provides immediate dynamic support, while the 200-day simple moving average at $85,100 represents a more significant structural level.

Relative Strength Index (RSI) readings at 48 indicate neutral momentum, neither overbought nor oversold. However, the combination of institutional deposit activity and neutral momentum creates a potential setup for directional volatility. Market structure suggests the $87,500 level represents Bullish Invalidation—a break below this support would invalidate any near-term bullish thesis and potentially trigger further selling pressure. Conversely, $91,200 serves as Bearish Invalidation—a sustained move above this resistance would challenge the narrative that QCP's deposit signals imminent selling.

| Metric | Value |

| QCP Capital BTC Deposit | 400 BTC ($35.7M) |

| QCP Capital ETH Deposit | 200 ETH ($597,000) |

| Total Deposit Value | $36.3 million |

| Bitcoin Current Price | $89,285 |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin 24h Trend | 1.77% |

For institutional participants, QCP Capital's move represents a test of market depth and liquidity availability. The $36.3 million deposit, while significant, represents only a fraction of daily Bitcoin trading volume, which typically exceeds $30 billion. However, the psychological impact of a known trading firm potentially preparing to sell during extreme fear conditions could disproportionately affect retail sentiment and order flow dynamics.

For retail traders, this event highlights the importance of monitoring on-chain flows alongside technical indicators. The contradiction between extreme fear sentiment and institutional deposit activity creates an information asymmetry that sophisticated traders may exploit. Market structure suggests retail participants often misinterpret such signals, either overreacting to potential selling pressure or failing to recognize strategic positioning opportunities.

Market analysts on social media platforms have expressed divided interpretations of QCP Capital's deposit. Some suggest the move represents "smart money" positioning for a potential downturn, citing historical patterns where institutional deposits preceded price declines. Others argue the timing during extreme fear sentiment could indicate contrarian accumulation, with the deposit serving as liquidity preparation rather than selling intent. The absence of official commentary from QCP Capital leaves room for speculative narratives, creating uncertainty in price discovery mechanisms.

Bullish Case: If Bitcoin maintains above the $87,500 Bullish Invalidation level and absorbs any selling pressure from QCP Capital's potential liquidation, market structure suggests a retest of the $91,200 resistance. A break above this level could trigger a short squeeze, particularly if extreme fear sentiment begins to reverse. Historical data from the Federal Reserve indicates monetary policy conditions remain accommodative for risk assets, potentially supporting a move toward previous all-time highs near $92,000.

Bearish Case: If QCP Capital executes selling orders and Bitcoin breaks below $87,500, technical analysis suggests a test of the 200-day moving average at $85,100. A failure to hold this level could trigger further liquidation cascades, particularly among leveraged positions. The extreme fear sentiment could amplify downward momentum, creating a potential gamma squeeze scenario where options market makers are forced to hedge dynamically, exacerbating price movements.

What does a deposit to Binance typically indicate?On-chain data indicates exchange deposits often signal preparation for trading activity, which can include selling, collateralization for derivatives positions, or participation in exchange-specific opportunities.

How significant is a $36.3 million deposit in the Bitcoin market?While representing less than 0.12% of daily Bitcoin trading volume, the psychological impact and signaling effect can disproportionately influence market sentiment and order flow dynamics.

What is the Crypto Fear & Greed Index?A sentiment indicator that aggregates multiple data sources to measure market emotion on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), currently reading 20/100.

What are Bullish and Bearish Invalidation levels?Price levels that, if broken, would invalidate the respective market thesis. In this analysis, $87,500 represents Bullish Invalidation and $91,200 represents Bearish Invalidation.

How does this relate to broader market conditions?The event occurs amid regulatory developments including Japan's FSA establishing a new crypto division and market stress events like Solana's USX stablecoin depegging, creating a complex macro environment for cryptocurrency valuation.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.