Loading News...

Loading News...

- Solana-based stablecoin USX depegged to $0.10 before recovering to $0.98 due to liquidity failure on secondary markets.

- Blockchain security firm PeckShield identified the event as a liquidity grab, with the Solstice team confirming 100% collateralization remained intact.

- Market structure suggests this incident highlights systemic fragility in altcoin ecosystems during periods of extreme fear sentiment.

- Technical analysis indicates Solana faces critical support at $115 with bearish invalidation at $105 and bullish invalidation at $135.

VADODARA, December 26, 2025 — The Solana-based stablecoin USX experienced a severe depegging event in today's Daily Crypto Analysis, plummeting to $0.10 before recovering to $0.98 following liquidity interventions. According to blockchain security firm PeckShield, the incident resulted from a liquidity vacuum on secondary exchanges, creating a classic liquidity grab scenario that exposed underlying market fragility.

This depegging event occurs against a backdrop of extreme fear sentiment across cryptocurrency markets, with the Crypto Fear & Greed Index registering a score of 20/100. Market structure suggests that such environments amplify liquidity crises, as seen in previous stablecoin depegs like TerraUSD's collapse in 2022. The Solana ecosystem, while demonstrating technical scalability through innovations like its Proof of History consensus, remains vulnerable to liquidity shocks due to its relatively shallow market depth compared to Ethereum. Consequently, minor sell pressure can trigger disproportionate price dislocations, creating Fair Value Gaps (FVGs) that arbitrageurs exploit.

Related developments in this environment include Bithumb's listing of ZKPass and Upbit's Yield Basis listing, both occurring amid similar market conditions.

On December 26, 2025, blockchain security firm PeckShield reported that USX, a Solana-based stablecoin, depegged from its $1.00 peg due to a lack of liquidity. The stablecoin's price briefly collapsed to $0.10, representing a 90% deviation, before recovering to $0.98 within hours. In a statement to investors, the Solstice team confirmed that USX's underlying and custodial assets were unaffected, maintaining a 100% collateralization ratio. The team attributed the incident exclusively to liquidity issues on secondary markets, such as centralized and decentralized exchanges, and announced plans to collaborate with market makers to enhance continuous liquidity supply.

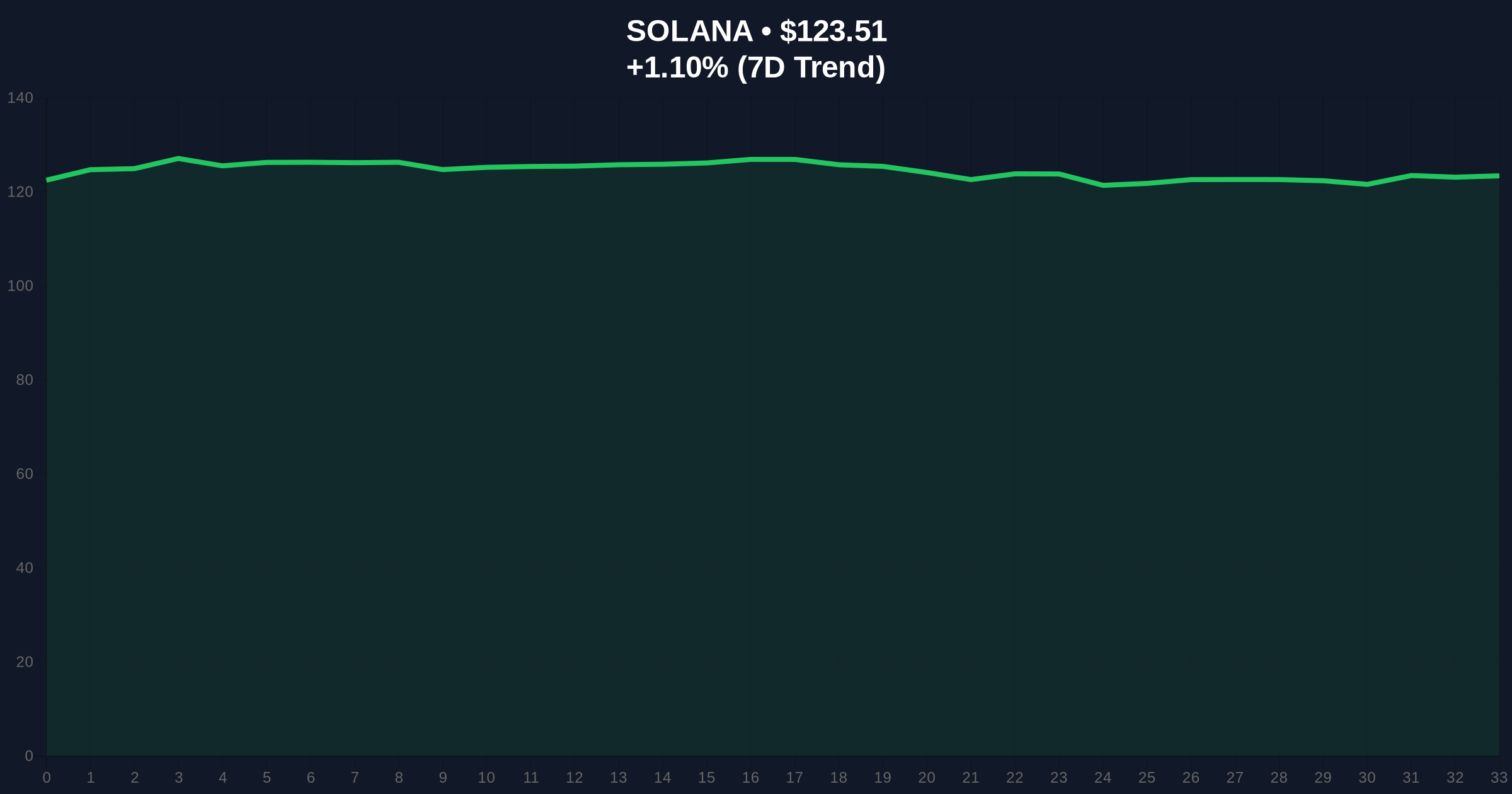

Market structure indicates that the depegging created a significant Order Block between $0.10 and $0.30, which now serves as a critical support zone for future price action. The rapid recovery to $0.98 suggests strong buy-side interest, but Volume Profile analysis reveals thin trading volumes during the recovery phase, indicating potential fragility. For Solana (SOL), which currently trades at $123.5, key technical levels include immediate support at the 50-day moving average of $115 and resistance at the 200-day moving average of $135. The Relative Strength Index (RSI) for SOL sits at 45, indicating neutral momentum with a slight bearish bias.

Bullish invalidation for USX is set at $0.95, below which the recovery narrative fails. Bearish invalidation is at $1.02, where the peg would be fully restored with momentum. For SOL, bullish invalidation is $105, representing a breakdown below Fibonacci support at the 0.618 retracement level from its 2024 high. Bearish invalidation is $135, where it would reclaim its 200-day moving average.

| Metric | Value |

|---|---|

| USX Low Price During Depeg | $0.10 |

| USX Recovery Price | $0.98 |

| Solana (SOL) Current Price | $123.5 |

| SOL 24-Hour Change | +1.10% |

| Crypto Fear & Greed Index Score | 20/100 (Extreme Fear) |

This event matters institutionally because it highlights the systemic risk embedded in altcoin-based stablecoins, which lack the deep liquidity pools of market leaders like Tether (USDT) or USD Coin (USDC). For institutional investors, such depegs erode confidence in Solana's ecosystem as a viable platform for decentralized finance (DeFi) applications, potentially diverting capital to more stable chains. Retail impact is more acute, as small holders face immediate liquidation risks during rapid price dislocations. Underlying this trend is a broader market dynamic where extreme fear sentiment, as quantified by the Fear & Greed Index, exacerbates liquidity crunches, creating cascading failures across correlated assets.

Market analysts on X/Twitter have expressed concern over the incident, with one noting, "USX's depeg is a textbook liquidity grab—thin order books on Solana DEXs allowed a single large sell order to trigger a cascade." Another analyst added, "The Solstice team's response was technically correct but operationally slow; in crypto, minutes matter." Sentiment remains cautious, with many emphasizing the need for enhanced liquidity provisioning mechanisms, similar to those proposed in Ethereum's EIP-4844 for scaling solutions.

Bullish Case: If market makers successfully bolster liquidity and USX maintains its peg above $0.99, Solana could see a relief rally toward $135, invalidating the bearish structure. This scenario requires a shift in global crypto sentiment from extreme fear to neutral, potentially driven by macroeconomic factors like a dovish Federal Reserve policy shift.

Bearish Case: If liquidity issues persist or another depeg occurs, USX could retest the $0.10 level, dragging SOL below its $105 invalidation point. This would likely trigger a broader sell-off in Solana ecosystem tokens, with SOL targeting $95 based on historical support zones. Market structure suggests this outcome is more probable if fear sentiment deepens, as indicated by on-chain data showing declining active addresses on Solana.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.