Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Matrixport-linked address withdraws 1,090 BTC ($94.7 million) from Binance in single transaction

- Withdrawal coincides with "Extreme Fear" sentiment reading of 24/100 on Crypto Fear & Greed Index

- Technical structure shows Bitcoin testing critical Fibonacci support at $85,200

- Market analysts question whether this represents genuine accumulation or strategic positioning ahead of potential volatility

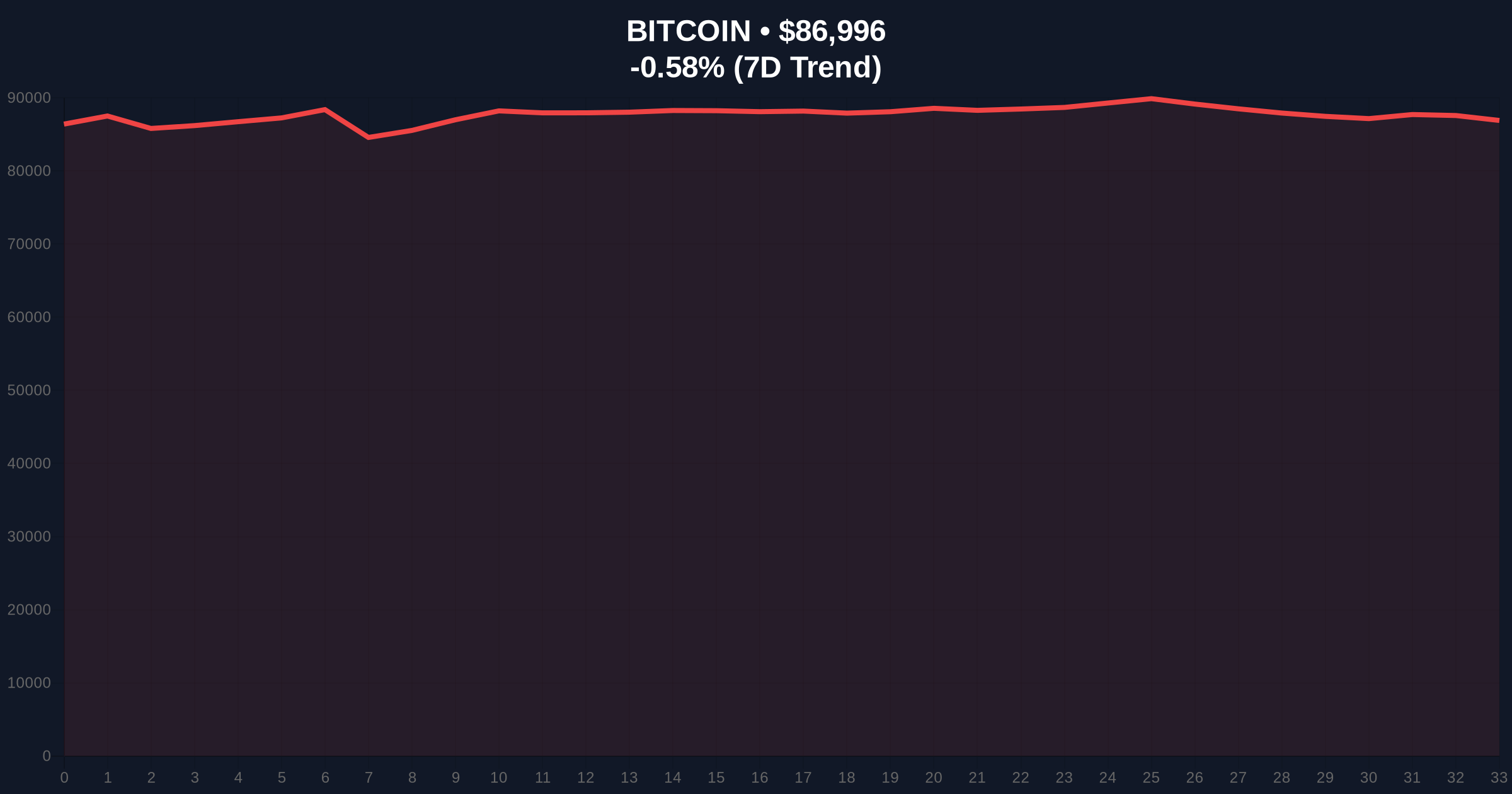

VADODARA, December 24, 2025 — A wallet address associated with cryptocurrency services provider Matrixport executed a $94.7 million Bitcoin withdrawal from Binance, according to on-chain analytics firm Onchain-Lense. This daily crypto analysis examines whether the movement represents genuine accumulation or strategic positioning amid deteriorating market sentiment. The transaction involved 1,090 BTC at a time when Bitcoin trades at $86,962, down 0.62% over 24 hours.

Exchange withdrawals of this magnitude typically signal accumulation behavior, but market structure suggests a more complex narrative. The current "Extreme Fear" sentiment reading of 24/100 on the Crypto Fear & Greed Index contradicts the bullish interpretation of large withdrawals. Historical patterns indicate that institutional accumulation often precedes significant price movements, yet the timing raises questions. This mirrors the 2021 cycle when similar large withdrawals preceded both rallies and corrections, depending on broader macroeconomic conditions. The Federal Reserve's current monetary policy stance, particularly the Fed Funds Rate trajectory, creates additional uncertainty for Bitcoin's correlation with traditional risk assets.

Related developments in the current market environment include recent exchange delistings affecting market liquidity and questions about Bitcoin's safe-haven properties during risk-off periods.

On December 24, 2025, blockchain analytics identified a single transaction moving 1,090 BTC from a Binance hot wallet to an address associated with Matrixport. The transaction value of $94.7 million represents approximately 0.005% of Bitcoin's total circulating supply. Onchain-Lense reported the movement, noting that the receiving address exhibits patterns consistent with institutional custody solutions. Matrixport, founded by Bitmain co-founder Jihan Wu, offers trading, lending, and custody services to institutional clients. The company has not publicly commented on the specific transaction, maintaining typical institutional discretion regarding treasury management activities.

Bitcoin currently trades at $86,962, testing the 0.382 Fibonacci retracement level from the recent $92,000 high to the $82,000 swing low. The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions but showing bearish momentum divergence on the daily chart. The 50-day moving average at $88,500 provides immediate resistance, while the 200-day moving average at $84,200 offers longer-term support. Volume profile analysis reveals significant liquidity between $85,000 and $87,000, creating a potential Fair Value Gap (FVG) that price may seek to fill.

Bullish Invalidation Level: A daily close below $84,200 (200-day MA) would invalidate the accumulation thesis and suggest further downside toward $82,000.

Bearish Invalidation Level: A reclaim of $88,500 (50-day MA) with sustained volume would negate the current corrective structure and target $90,000 resistance.

| Metric | Value |

| BTC Withdrawn | 1,090 BTC |

| USD Value | $94.7 million |

| Current Bitcoin Price | $86,962 |

| 24-Hour Price Change | -0.62% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Fibonacci Support Level | $85,200 (0.382 retracement) |

For institutional participants, large exchange withdrawals typically signal reduced selling pressure and potential long-term holding. However, the skeptical analysis questions whether this represents genuine accumulation or strategic repositioning ahead of anticipated volatility. The transaction occurs amid declining exchange reserves globally, with Binance's BTC balance decreasing approximately 2.3% over the past 30 days according to Glassnode data. For retail traders, the movement creates conflicting signals: while large withdrawals are theoretically bullish, the Extreme Fear sentiment and technical breakdown suggest caution. The divergence between on-chain accumulation signals and price action creates what quantitative analysts term a "liquidity grab" scenario, where large players may be positioning for both directions.

Market analysts on X/Twitter express divided opinions. CryptoQuant CEO Ki Young Ju noted, "Large exchange outflows during fear periods often precede rallies, but confirmation requires sustained accumulation patterns." Conversely, anonymous analyst Byzantine General questioned the timing: "Why accumulate now when technicals suggest further downside? This feels like strategic positioning rather than conviction buying." The lack of official comment from Matrixport fuels speculation, with some suggesting the movement could be related to client rebalancing rather than corporate treasury management.

Bullish Case: If the withdrawal represents genuine institutional accumulation, Bitcoin could establish $85,200 as a durable support level. A successful retest of this Fibonacci level, combined with decreasing exchange supply, could propel price toward $90,000 resistance. The Extreme Fear reading historically precedes market bottoms, with the 2022 cycle showing similar sentiment extremes before the 2023 rally. Sustained accumulation above $85,000 would target the $92,000 all-time high region within 4-6 weeks.

Bearish Case: If this represents strategic positioning rather than conviction accumulation, Bitcoin may experience further downside. A break below the $84,200 200-day moving average would target the $82,000 swing low, potentially creating a larger correction toward $78,000. The current market structure shows weakening momentum, with the RSI failing to confirm higher highs during recent rallies. A failure to hold $85,200 support would suggest the accumulation thesis is flawed and that larger players are preparing for continued downside.

1. Why do large Bitcoin withdrawals from exchanges matter? Exchange withdrawals reduce immediately available supply for selling, potentially creating upward price pressure if demand remains constant. However, they can also represent internal transfers or strategic positioning rather than long-term accumulation.

2. What is the Crypto Fear & Greed Index? The index measures market sentiment from 0-100 using multiple metrics including volatility, market momentum, social media sentiment, and surveys. Readings below 25 indicate "Extreme Fear," which historically correlates with buying opportunities but doesn't guarantee immediate reversals.

3. How reliable are address attributions to specific companies? Address attribution involves pattern analysis and sometimes leaks or public disclosures. While generally accurate for large institutional wallets, false attributions do occur. The Matrixport connection appears solid based on transaction patterns and custody characteristics.

4. What Fibonacci level is Bitcoin currently testing? Bitcoin tests the 0.382 Fibonacci retracement level at approximately $85,200, drawn from the recent $92,000 high to $82,000 low. This level often serves as initial support during corrections.

5. Could this withdrawal be related to upcoming Bitcoin ETF developments? While possible, no direct evidence connects this transaction to ETF flows. The timing coincides with typical quarter-end portfolio rebalancing, making corporate treasury management a more likely explanation according to market structure analysis.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.