Loading News...

Loading News...

- Bitcoin Composite Market Index (BCMI) has declined, suggesting a transition into a structural reset phase rather than a simple correction.

- Historical BCMI bottoms in 2019 and 2023 were in the 0.25-0.35 range; current levels remain elevated, indicating potential further downside.

- On-chain momentum is weakening simultaneously with price corrections, a pattern consistent with past bear market transitions.

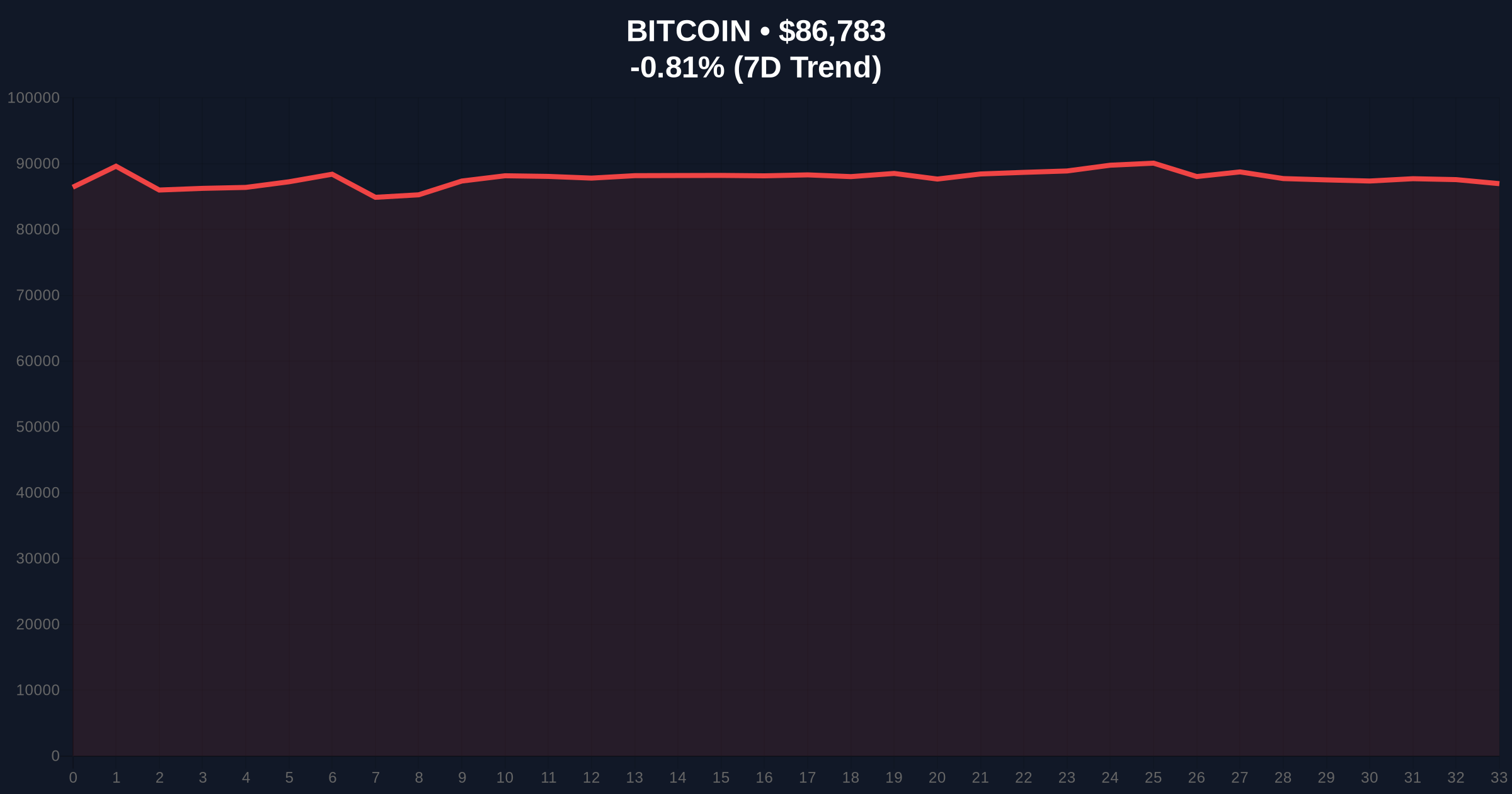

- Market structure analysis identifies critical invalidation levels at $82,000 (bullish) and $90,500 (bearish), with current price at $86,785.

VADODARA, December 24, 2025 — The Bitcoin Composite Market Index (BCMI) has declined significantly, signaling a potential shift from a correction to a structural reset phase, according to a daily crypto analysis by crypto analyst Woominkyu in a contribution to CryptoQuant. This development comes as Bitcoin trades at $86,785, down 0.81% in 24 hours, amid a global crypto sentiment score of 24/100 indicating "Extreme Fear." Market structure suggests that the simultaneous drop in price and on-chain momentum points to a deeper market transition, with historical parallels to the 2019 and 2023 bear phases.

The BCMI is a composite indicator that aggregates various on-chain and market metrics to gauge Bitcoin's overall health. Historically, it has served as a reliable barometer for market phases, with declines below key thresholds often preceding prolonged downturns. In 2019, the index bottomed at approximately 0.25, coinciding with Bitcoin's price trough near $3,200. Similarly, in 2023, it reached around 0.35 during the market lows. Underlying this trend is the index's sensitivity to liquidity flows and investor sentiment, making it a critical tool for quantitative analysis. The current decline mirrors these historical patterns, suggesting the market may be entering a reset phase rather than experiencing a temporary pullback. Related developments include recent market tests such as the Binance ETH suspension, which have added to structural pressures.

According to on-chain data from CryptoQuant, the BCMI returned to the 0.5 level on October 21, 2025, initially interpreted as a cooling-off period. However, a subsequent significant drop in Bitcoin's price and a further fall in the index have altered this assessment. Woominkyu explained that the simultaneous price correction and weakening on-chain momentum indicate the market has entered a structural reset phase. The analyst noted that while the current index is below its equilibrium line, it remains high compared to historical lows of 0.25-0.35 observed in 2019 and 2023. Consequently, if past patterns repeat, a market bottom may only form after the BCMI falls to those levels, implying the current phase is a downward transition rather than a completed reset. This analysis is supported by broader market data, including the extreme fear sentiment and recent price action.

Market structure suggests Bitcoin is currently testing a critical Fair Value Gap (FVG) between $85,000 and $88,000, with the current price at $86,785 residing within this zone. The Relative Strength Index (RSI) on daily charts is hovering near 45, indicating neutral momentum with a bearish bias, while the 50-day moving average at $89,200 acts as immediate resistance. Volume profile analysis shows increased selling pressure at higher levels, consistent with a liquidity grab by larger players. A key Fibonacci support level at $82,000, derived from the 0.618 retracement of the recent rally, serves as the Bullish Invalidation Level; a break below this could accelerate declines toward $78,000. Conversely, the Bearish Invalidation Level is set at $90,500, corresponding to the previous order block and the 200-day moving average; a sustained move above this would negate the bearish structure and suggest a false breakdown. These levels are critical for assessing the validity of the current reset phase.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $86,785 |

| 24-Hour Trend | -0.81% |

| BCMI Current Level | Below 0.5 (equilibrium) |

| Historical BCMI Lows (2019/2023) | 0.25-0.35 |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

This development holds significant implications for both institutional and retail participants. For institutions, a structural reset phase could lead to increased volatility and potential deleveraging events, affecting portfolio strategies and risk management frameworks. Regulatory scrutiny, as seen in recent actions by entities like the U.S. Securities and Exchange Commission, may intensify during such phases, impacting market accessibility. For retail investors, the transition signals a period of heightened risk, where impulsive trades could result in substantial losses. The weakening on-chain momentum, as indicated by the BCMI decline, reduces the likelihood of a swift recovery, necessitating a more cautious approach. In the broader 5-year horizon, this reset could pave the way for a healthier market foundation, similar to the 2019-2020 consolidation that preceded the 2021 bull run, but it requires navigating near-term downside risks.

Industry observers on social media platforms have echoed concerns about the BCMI decline. Market analysts highlight that the index's drop below equilibrium aligns with other bearish signals, such as reduced network activity and declining exchange reserves. Some bulls argue that the current levels are still elevated compared to historical troughs, suggesting the market may have further to fall before finding a sustainable bottom. Sentiment remains divided, with a notable shift toward caution as extreme fear grips the market. This aligns with broader trends, such as the recent $290M ETH deposit by a Bitcoin OG, interpreted by some as a liquidity grab ahead of potential downside.

Bullish Case: If the BCMI stabilizes above historical lows and Bitcoin holds the $82,000 support, a rebound toward $95,000 is plausible. This scenario would require a reversal in on-chain momentum, possibly driven by institutional inflows or positive macroeconomic developments, such as a dovish shift in the Fed Funds Rate. Market structure suggests that a break above the $90,500 bearish invalidation level could trigger a short squeeze, pushing prices higher.Bearish Case: If the BCMI continues to decline toward the 0.25-0.35 range and Bitcoin breaks below $82,000, a drop to $75,000 or lower is likely. This would indicate a full bear market transition, with prolonged consolidation and potential tests of deeper supports. On-chain data indicates that weakening momentum could exacerbate selling pressure, leading to a capitulation event similar to past cycles.

What is the Bitcoin Composite Market Index (BCMI)?The BCMI is a composite indicator that combines various on-chain and market metrics to assess Bitcoin's overall health, often used to identify market phases.

Why is the BCMI decline significant?It suggests a transition from a correction to a structural reset phase, with historical parallels to bear markets, indicating potential further downside.

What are the key price levels to watch?Critical levels include support at $82,000 (bullish invalidation) and resistance at $90,500 (bearish invalidation), with current price at $86,785.

How does this affect long-term investors?Long-term investors may view this as a buying opportunity if prices reach historical support zones, but should monitor on-chain data for confirmation of a bottom.

What other indicators support this analysis?Weakening on-chain momentum, extreme fear sentiment, and technical breakdowns in price action all align with the BCMI decline, reinforcing the reset narrative.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.