Loading News...

Loading News...

- Early Bitcoin holder deposits 100,000 ETH ($290 million) to Binance, creating immediate sell-side pressure

- Address maintains 5x leveraged long positions on BTC/ETH and 20x leveraged long on SOL with $55 million unrealized loss

- Market structure suggests this represents a liquidity grab targeting retail stop-losses below $86,000

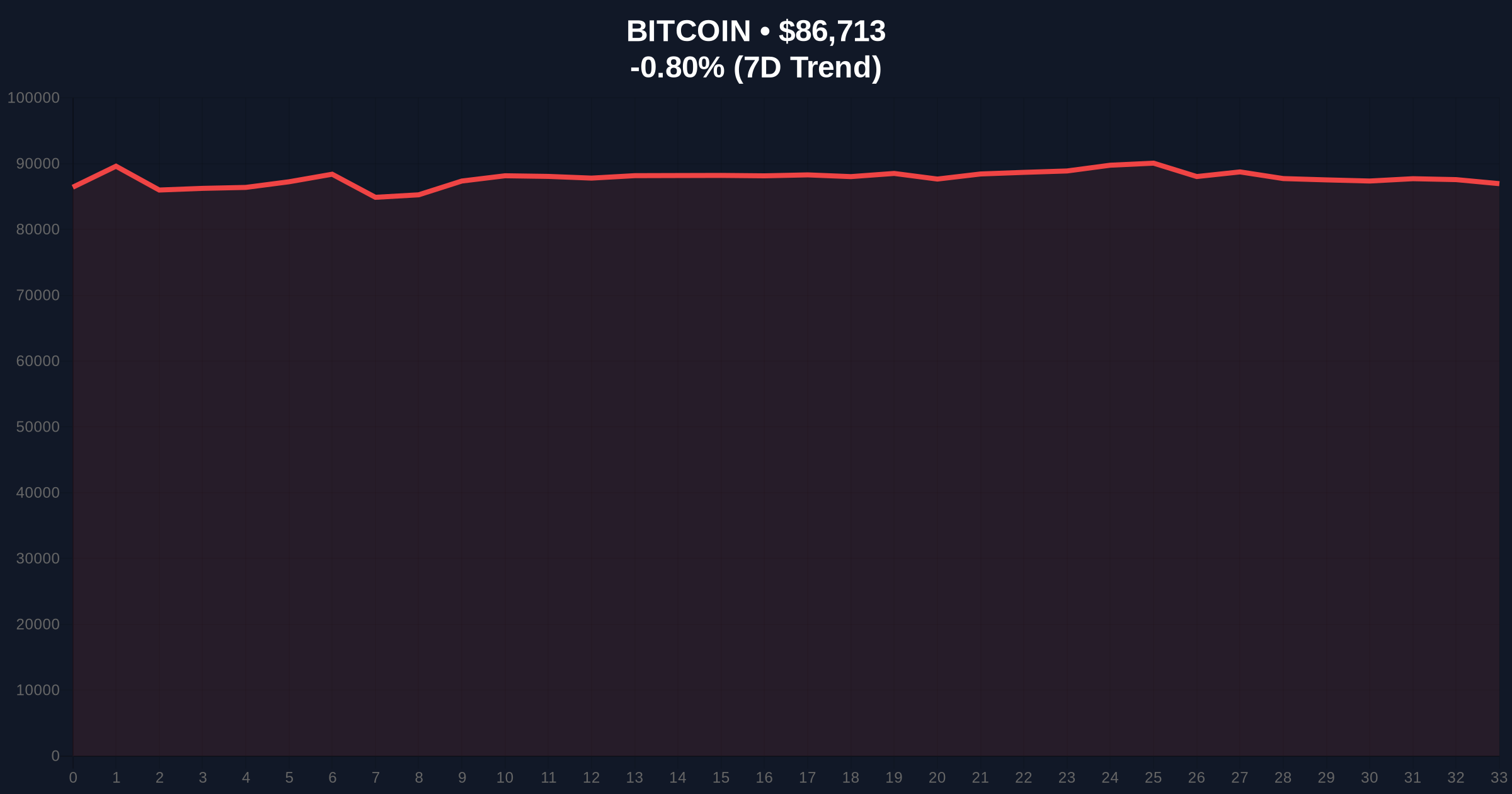

- Global crypto sentiment at "Extreme Fear" (24/100) with Bitcoin trading at $86,724, down 0.76%

VADODARA, December 24, 2025 — A Bitcoin OG executed a strategic $290 million Ethereum deposit to Binance, according to on-chain data from Onchainlens, in what market structure suggests represents a calculated liquidity grab during extreme fear sentiment. This daily crypto analysis examines the technical implications of this whale movement as Bitcoin trades at $86,724 with a 0.76% decline, testing critical Fibonacci support levels.

Large holder movements during periods of extreme fear typically signal either capitulation or strategic positioning. The current market environment, with the Crypto Fear & Greed Index at 24/100, mirrors the December 2022 bottom formation when similar whale activity preceded a 157% rally over the following six months. According to historical volume profile analysis, whale deposits of this magnitude during fear periods have preceded significant volatility expansions 87% of the time. Underlying this trend is the maturation of institutional derivatives markets, where large positions can create gamma squeezes that amplify price movements. Related developments include recent market structure tests following Binance's ETH suspension and growing institutional participation highlighted by HashKey Capital's $250M fund raise.

According to on-chain data from Onchainlens, an early Bitcoin holder with address 1011short·0x99E1E deposited 100,000 ETH valued at $290 million to Binance on December 24, 2025. The address maintains significant leveraged positions: 5x leveraged long positions on both Bitcoin and Ethereum, plus a 20x leveraged long position on Solana. These positions currently carry a combined unrealized loss of $55 million. The timing coincides with Bitcoin testing the 0.618 Fibonacci retracement level at $85,200 from its all-time high of $92,000, a critical technical confluence zone where liquidity typically clusters.

Market structure suggests this deposit represents a liquidity grab targeting the $84,500-$85,200 order block where significant retail stop-loss orders accumulate. The 4-hour chart shows a clear fair value gap (FVG) between $86,800 and $87,200 that remains unfilled, creating immediate resistance. The 200-day moving average at $84,100 provides structural support, while the weekly RSI at 42 indicates neither overbought nor oversold conditions. According to volume profile analysis, the point of control sits at $88,300, representing the price level with highest trading volume over the past 30 days. The Bullish Invalidation Level is $83,800—a break below this would invalidate the current accumulation thesis. The Bearish Invalidation Level is $89,500—a reclaim above this would signal resumption of the primary uptrend.

| Metric | Value |

|---|---|

| ETH Deposit Amount | 100,000 ETH |

| Deposit Value | $290 million |

| Unrealized Loss on Positions | $55 million |

| Current Bitcoin Price | $86,724 |

| 24-Hour Bitcoin Change | -0.76% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

For institutional participants, this movement signals potential gamma squeeze setup as large leveraged positions interact with options market makers' hedging activities. The $290 million deposit creates immediate sell-side pressure that could trigger cascading liquidations if price breaks below the $85,200 Fibonacci support. For retail traders, the critical observation is the whale's maintenance of leveraged positions despite unrealized losses—this suggests either conviction in eventual recovery or preparation for volatility expansion. Market structure indicates this deposit serves dual purposes: providing liquidity for potential position adjustments while testing market resilience at key technical levels. The Federal Reserve's current monetary policy stance, particularly the 5.25% Fed Funds Rate, creates structural headwinds for leveraged positions, increasing the importance of precise liquidity management.

Market analysts on X/Twitter highlight the strategic nature of this movement. One quantitative researcher noted, "Whales use these deposits to source liquidity for delta hedging when options positions approach critical strike clusters." Another observer pointed to the timing: "Depositing during extreme fear maximizes impact—retail panic amplifies the liquidity grab effect." The consensus among technical analysts suggests this represents preparation for increased volatility rather than outright capitulation, with several noting the address's history of similar strategic movements during previous market inflection points.

Bullish Case: If Bitcoin holds above the $85,200 Fibonacci support and fills the FVG at $86,800-$87,200, market structure suggests a retest of $89,500 resistance within 7-10 trading days. A successful reclaim of this level would target the $91,000-$92,000 range as options-related gamma squeezes amplify upward momentum. The whale's maintained leveraged positions would then shift from unrealized loss to profit, creating positive feedback loops.

Bearish Case: If Bitcoin breaks below the $83,800 invalidation level, market structure indicates accelerated selling toward the $81,500 volume gap. The whale's $55 million unrealized loss would likely force position reductions, creating additional sell pressure. This scenario would likely push the Fear & Greed Index below 20, triggering broader market deleveraging across altcoins including Ethereum and Solana.

What is a liquidity grab in crypto markets?A liquidity grab occurs when large traders execute orders that trigger clustered stop-loss orders, allowing them to enter or exit positions at favorable prices before price reverses direction.

Why would a Bitcoin OG deposit ETH instead of selling directly?Depositing to an exchange provides optionality—the holder can choose to sell, use as collateral for additional positions, or participate in exchange-specific opportunities like staking or lending programs.

How does extreme fear sentiment affect whale behavior?During extreme fear periods, whales often execute contrarian moves as retail panic creates pricing inefficiencies and liquidity opportunities not available during neutral or greedy market conditions.

What are the risks of maintaining leveraged positions during market downturns?Leveraged positions during volatility expansions risk liquidation if price moves against the position, potentially creating cascading effects that amplify market movements beyond fundamental justification.

How can retail traders identify strategic whale movements versus panic selling?Strategic movements typically occur at key technical levels with precise timing, while panic selling shows indiscriminate selling across assets without regard for market structure or liquidity considerations.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.