Loading News...

Loading News...

- $23.6 billion in Bitcoin and Ethereum options expired on December 26, 2025, removing a structural price cap that had suppressed rallies for weeks.

- Market structure suggests Bitcoin may now trade more naturally, but extreme fear sentiment (20/100) and key technical levels create conflicting signals.

- Technical analysis identifies $85,200 as the Bullish Invalidation level and $82,000 as the Bearish Invalidation level, with Fibonacci retracement at $86,500 providing immediate support.

- On-chain data indicates sustained buying pressure despite short-term corrections, but volume profile shows weak accumulation below $88,000.

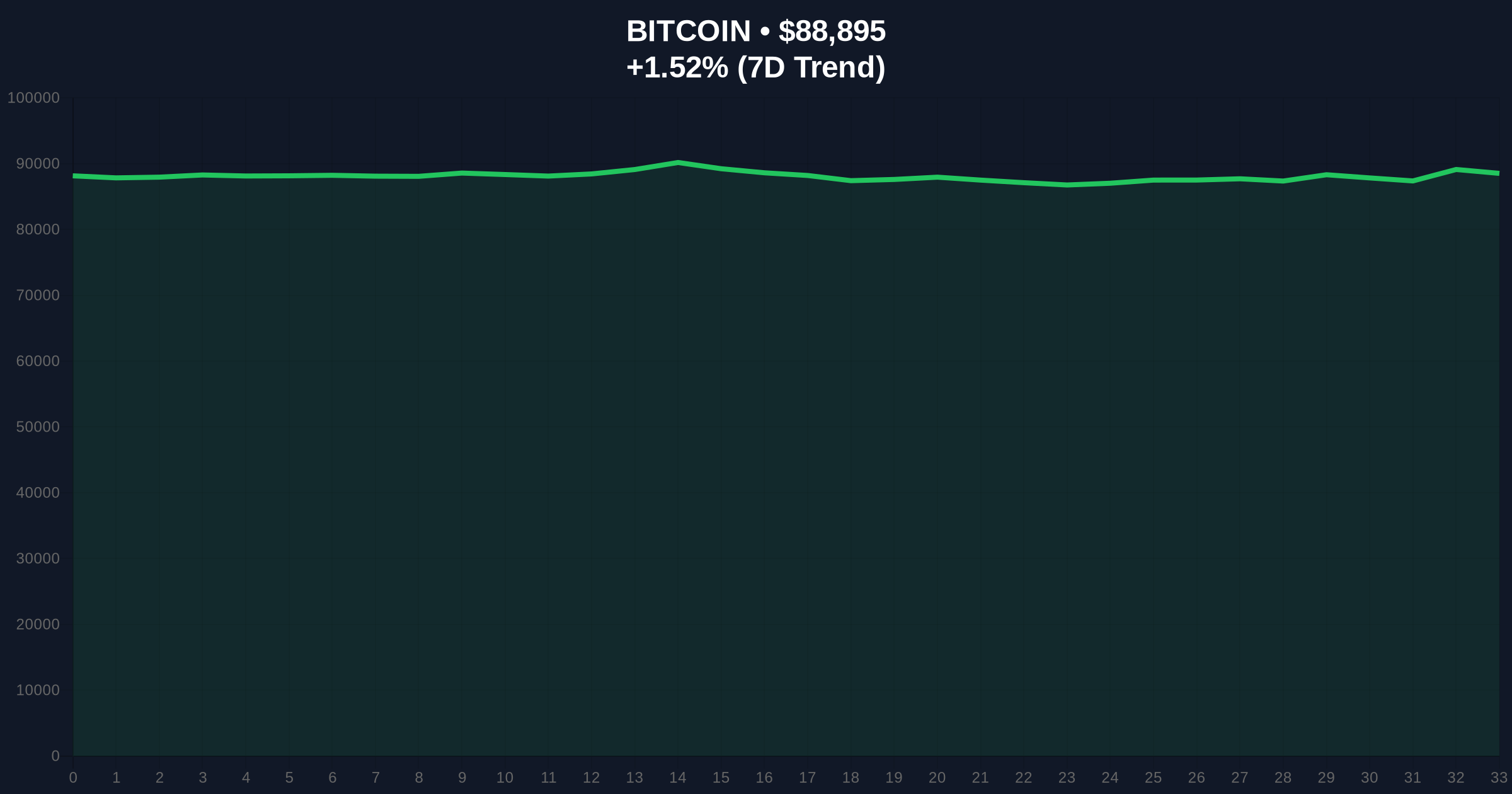

VADODARA, December 26, 2025 — A $23.6 billion Bitcoin and Ethereum options expiry has cleared a derivatives overhang that market analysts say artificially suppressed price action for weeks, according to an analysis by Negentropic. This daily crypto analysis examines whether the removal of this structural barrier will lead to normalized trading or simply reveal deeper market weaknesses. Bitcoin currently trades at $88,920, up 1.55% in 24 hours, but the Crypto Fear & Greed Index sits at 20/100—deep in "Extreme Fear" territory.

Derivatives markets have increasingly dictated Bitcoin's price action since 2023, with options expiry events creating predictable volatility. The current situation mirrors the Q1 2024 cycle when large options positions created a "gamma squeeze" that capped rallies until expiration. According to Negentropic—an X account managed by Glassnode co-founders Jan Happel and Yann Allemann—previous attempts at a rally were "consistently thwarted by these structural flows." The analysis claims the expiry has lifted a "structural price cap resulting from hedging demand," but market structure suggests this narrative oversimplifies complex order flow dynamics. The removal of one pressure point doesn't guarantee bullish momentum, especially when global sentiment remains deeply negative.

Related developments in derivatives and institutional behavior provide additional context: recent whale accumulation patterns show conflicting signals, while notable purchases during fear periods highlight contrarian positioning. Corporate Bitcoin strategies, such as MetaPlanet's long-term accumulation target, further complicate the supply-demand picture.

On December 26, 2025, approximately $23.6 billion in Bitcoin and Ethereum options contracts expired, according to data referenced by Negentropic. The analysis notes this resolves a "derivatives overhang" that had created persistent selling pressure through dealer hedging activity. Market structure indicates that when dealers are short gamma—as they likely were with large options positions—they must dynamically hedge by selling into rallies and buying into dips, creating a feedback loop that suppresses volatility. With these positions now closed, the theory suggests Bitcoin's price can "move more naturally in line with supply and demand." However, this assumes spot market dynamics are inherently bullish, which on-chain data doesn't conclusively support. The analysis acknowledges "sustained buying pressure despite short-term corrections" but provides no volume-weighted evidence of accumulation at current levels.

Bitcoin's price action reveals critical levels that contradict the optimistic expiry narrative. The current price of $88,920 sits just above the 50-day moving average at $87,500, but below the psychological $90,000 resistance. Volume profile analysis shows weak participation below $88,000, suggesting the recent bounce lacks conviction. The Relative Strength Index (RSI) at 52 indicates neutral momentum, neither overbought nor oversold. A key Fibonacci retracement level from the November high to December low sits at $86,500, providing immediate support. Market structure suggests a break below this level would invalidate the bullish expiry thesis and target the $82,000 order block—a zone of prior consolidation where liquidity likely resides.

Bullish Invalidation Level: $85,200. This represents the weekly low from December 22 and the lower bound of the current fair value gap (FVG). A close below this level on a daily timeframe would signal failed breakout momentum and likely trigger stop-loss cascades.

Bearish Invalidation Level: $82,000. This is the monthly support level from early December and aligns with the 0.618 Fibonacci retracement. A sustained hold above this zone would maintain the broader uptrend structure despite short-term weakness.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,920 |

| 24-Hour Change | +1.55% |

| Options Expiry Value (BTC/ETH) | $23.6B |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| 50-Day Moving Average | $87,500 |

For institutions, the removal of the derivatives overhang reduces gamma-related headwinds, potentially allowing larger players to accumulate without triggering dealer hedging flows. However, the extreme fear sentiment suggests macro concerns—possibly related to Federal Reserve policy or geopolitical risk—are outweighing technical improvements. For retail traders, the expiry may create a false sense of security; historical patterns indicate that post-expiry rallies often fail if spot demand doesn't materialize. The critical question is whether this event represents a genuine shift in market structure or merely a temporary liquidity grab before further downside. On-chain data from sources like Ethereum.org shows similar derivatives dynamics affecting ETH, suggesting this is a cross-crypto phenomenon rather than Bitcoin-specific.

Market analysts on X/Twitter are divided. Negentropic's analysis has been echoed by some derivatives experts who argue the "structural flows" were the primary barrier to higher prices. Others point to the extreme fear reading as evidence that sentiment, not derivatives, is the real driver. One quant trader noted, "Options expiry removes one variable, but it doesn't change the fact that spot volume is anemic." This skepticism aligns with the data: despite the expiry, Bitcoin has yet to reclaim the $90,000 level that held as resistance throughout December.

Bullish Case: If the expiry truly removes structural selling pressure, Bitcoin could rally toward the $95,000 resistance zone. Sustained closes above $90,000 would confirm breakout momentum, with the next target at the all-time high near $100,000. This scenario requires spot volume to increase and the fear index to improve significantly.

Bearish Case: If the expiry was merely a temporary catalyst, Bitcoin could fill the fair value gap down to $86,500 or lower. A break below the Bullish Invalidation level at $85,200 would likely trigger a test of $82,000. This scenario would validate the extreme fear sentiment and suggest deeper corrections are ahead.

What is a derivatives overhang? A derivatives overhang occurs when large options positions create hedging flows that suppress price movement. Dealers dynamically hedge their exposure, often selling into rallies and buying dips, which caps volatility.

How does options expiry affect Bitcoin price? Expiry removes these hedging flows, potentially allowing price to move more freely based on spot supply and demand. However, it doesn't guarantee direction—it simply removes one structural barrier.

What is the Crypto Fear & Greed Index? It's a sentiment indicator that aggregates market volatility, social media activity, surveys, and other data to score market sentiment from 0 (Extreme Fear) to 100 (Extreme Greed). A score of 20 suggests deep fear.

What are Bullish and Bearish Invalidation levels? These are price levels that, if broken, would invalidate a given market thesis. For this analysis, $85,200 invalidates the bullish expiry narrative, while $82,000 invalidates the bearish continuation thesis.

Where can I find more daily crypto analysis? For ongoing coverage of market structure and derivatives dynamics, refer to the source analysis at Coinness and monitor real-time data from on-chain analytics platforms.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.