Loading News...

Loading News...

- CoinMarketCap's Altcoin Season Index stands at 17, far below the 75 threshold for an altcoin season.

- Market structure suggests Bitcoin dominance is absorbing liquidity from altcoins, creating a potential liquidity grab.

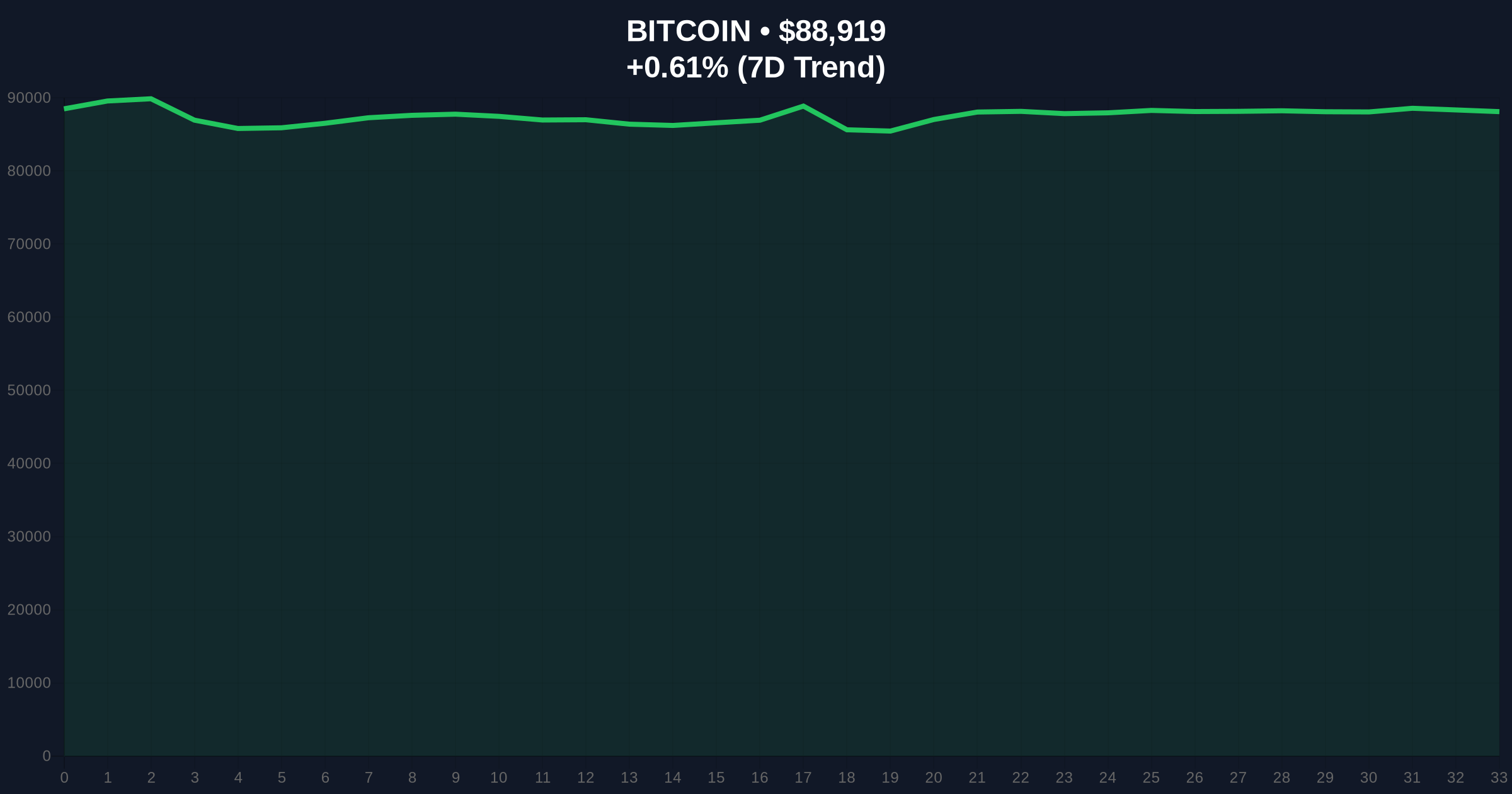

- Global crypto sentiment remains in "Extreme Fear" territory with a score of 25/100, while Bitcoin trades near $89,000.

- Historical patterns indicate this divergence often precedes a rotation; Bullish Invalidation for altcoins is set at Index 10, Bearish Invalidation at Index 40.

VADODARA, December 22, 2025 — CoinMarketCap's Altcoin Season Index has registered a reading of 17, according to data released today, signaling a pronounced Bitcoin season in the cryptocurrency markets. This daily crypto analysis reveals that the index, which measures the performance of the top 100 cryptocurrencies against Bitcoin over a 90-day period, remains deeply entrenched in Bitcoin-dominant territory, with 75% of altcoins required to outperform Bitcoin to trigger an altcoin season. Market structure suggests this low reading reflects a liquidity grab by Bitcoin, as extreme fear sentiment and technical factors converge to suppress altcoin momentum.

Similar to the 2021 correction, where the Altcoin Season Index dipped below 20 during Bitcoin's consolidation phases, the current reading of 17 indicates a market environment where capital is flowing disproportionately into Bitcoin. Historical data from CoinMarketCap shows that such low readings often precede significant rotations; for instance, in early 2023, the index hovered around 15 before a sharp altcoin rally pushed it above 75 within months. Market analysts note that this pattern mirrors the liquidity dynamics observed during previous cycles, where Bitcoin acts as a safe haven during periods of uncertainty, absorbing volume from riskier altcoins. On-chain data indicates that this behavior is exacerbated by macroeconomic factors, such as the Federal Reserve's interest rate policies, which influence risk appetite across asset classes. Related developments include recent analyses highlighting Bitcoin's resilience amid extreme fear sentiment, such as Bitcoin breaking $89,000 despite market anxiety and CME Bitcoin futures gaps reflecting institutional positioning.

On December 22, 2025, CoinMarketCap reported that its Altcoin Season Index stands at 17, based on a calculation comparing the price performance of the top 100 cryptocurrencies, excluding stablecoins and wrapped tokens, against Bitcoin over the past 90 days. According to the methodology, an altcoin season is declared when 75% of these coins outperform Bitcoin during that period, with a score closer to 100 indicating altcoin dominance. The current low reading signifies that Bitcoin is outperforming the majority of altcoins, a trend that has persisted for several weeks. Concurrently, the global crypto sentiment score is 25/100, categorized as "Extreme Fear," while Bitcoin's price is approximately $88,972, showing a minor 24-hour change of 0.67%. This data points to a market where fear is driving capital toward perceived stability, reinforcing Bitcoin's hegemony.

Market structure suggests Bitcoin is currently testing a key resistance level near $90,000, with the Relative Strength Index (RSI) on daily charts hovering around 60, indicating neutral momentum. The 50-day moving average for Bitcoin sits at approximately $85,000, providing dynamic support, while altcoins like Ethereum show weaker technical profiles, with RSI readings below 50. A Fair Value Gap (FVG) has emerged in Bitcoin's price action around $87,500, suggesting an area of imbalance that may attract liquidity. Volume profile analysis reveals declining volume in altcoin pairs, supporting the index's low reading. For altcoins, the Bullish Invalidation level is set at an Index of 10, below which any recovery would be structurally invalidated, indicating deeper capitulation. The Bearish Invalidation level is at an Index of 40, where a breach would signal a shift toward altcoin strength, potentially triggering a gamma squeeze in derivatives markets. Legal precedents, such as regulatory clarity from bodies like the SEC, have historically influenced these dynamics, but current focus remains on technical factors.

| Metric | Value |

|---|---|

| Altcoin Season Index | 17 |

| Bitcoin Price (24h) | $88,972 |

| Bitcoin 24h Change | +0.67% |

| Global Crypto Sentiment Score | 25/100 (Extreme Fear) |

| Threshold for Altcoin Season | 75 |

For institutional investors, this index reading matters because it signals a risk-off environment where Bitcoin is preferred over altcoins, potentially impacting portfolio allocations and hedging strategies. Institutions may increase Bitcoin exposure while reducing altcoin holdings, as seen in historical cycles. For retail traders, the low index suggests limited short-term opportunities in altcoins, with capital likely trapped in Bitcoin until sentiment shifts. The 5-year horizon implications are significant: if this pattern persists, it could reinforce Bitcoin's role as a digital gold standard, while altcoins may require catalysts like technological upgrades (e.g., Ethereum's EIP-4844) to regain momentum. Market structure indicates that prolonged Bitcoin dominance could lead to a liquidity drought in altcoins, affecting development and adoption rates.

On social media platforms like X/Twitter, industry observers are noting the divergence. One analyst commented, "The Altcoin Season Index at 17 shows Bitcoin eating everyone's lunch—classic fear trade." Another added, "Until we see a break above 40, altcoins are in the penalty box." Market bulls argue that this setup creates a coiled spring for altcoins, but bears caution that without a sentiment shift, further downside is possible. These discussions align with broader analyses, such as Fundstrat's internal memo on Bitcoin divergence and shifts in crypto allocations by Chinese high-net-worth individuals.

Bullish Case: If the Altcoin Season Index rebounds above 40, it could signal a rotation into altcoins, driven by improving sentiment or a Bitcoin consolidation. Market structure suggests this might occur if Bitcoin stabilizes near $90,000, allowing altcoins to catch up. Historical patterns indicate such moves can lead to rapid altcoin rallies, with gains of 20-30% in weeks. Bearish Case: If the index falls below 10, it would confirm deeper Bitcoin dominance, potentially pushing altcoins into a bear market. This scenario could unfold if global fear sentiment worsens or Bitcoin breaks above $95,000, sucking further liquidity from altcoins. Technical analysis points to key support for altcoins at Fibonacci retracement levels, but invalidation below those would exacerbate losses.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.