Loading News...

Loading News...

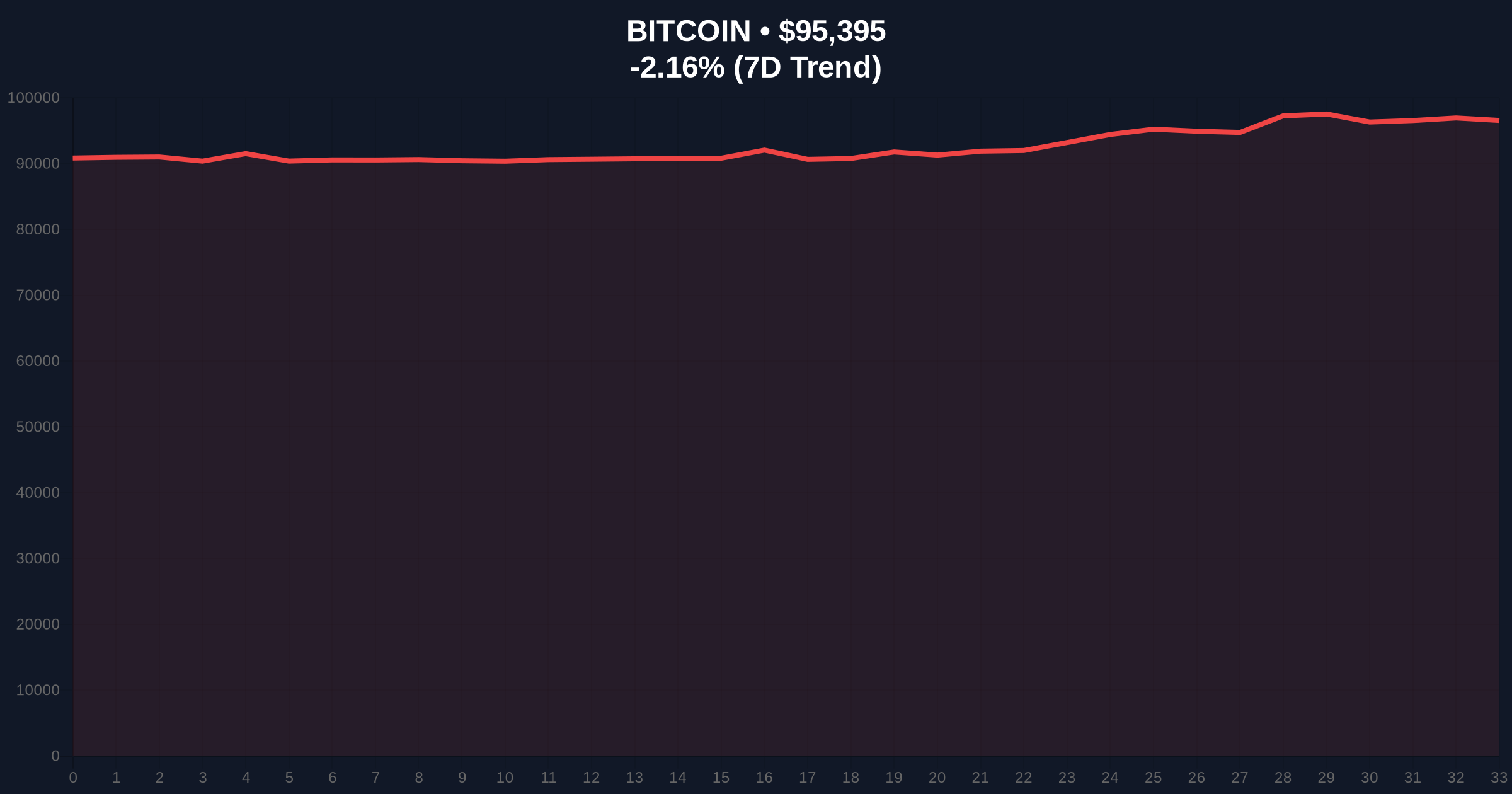

VADODARA, January 15, 2026 — Coinbase CEO Brian Armstrong told CNBC he is prepared to restart negotiations on the CLARITY Act, marking a strategic pivot for the exchange. This latest crypto news arrives as Bitcoin faces a 2.16% decline to $95,394, testing key liquidity zones amid regulatory uncertainty. Market structure suggests this legislative shift could redefine jurisdictional boundaries between the SEC and CFTC.

The CLARITY Act represents the most comprehensive U.S. crypto market structure legislation since the 2022 Lummis-Gillibrand bill. Coinbase initially withdrew support over four critical objections: de facto bans on tokenized securities, provisions threatening DeFi protocols, unlimited financial surveillance powers, and restrictions on stablecoin reward mechanisms. This reversal occurs during a Gamma Squeeze environment where derivatives positioning amplifies spot volatility. The regulatory mirrors 2021's infrastructure bill debates, where unclear language created multi-year compliance headaches.

Related developments include Interactive Brokers' recent USDC integration testing traditional finance bridges, and monetary policy uncertainty surrounding Federal Reserve leadership impacting macro liquidity conditions.

According to the CNBC interview transcript, Armstrong stated readiness to resume discussions on the crypto market structure bill. The exchange had previously cited specific concerns documented in their official withdrawal statement: potential bans on tokenized stocks, provisions blocking DeFi access, unlimited financial information access clauses, CFTC authority weakening in favor of SEC expansion, and stablecoin reward function restrictions. No specific timeline or negotiation parameters were disclosed. The statement represents a calculated risk management adjustment as regulatory pressure intensifies globally.

Bitcoin's current price action shows a Fair Value Gap (FVG) between $94,800 and $96,200 created during Monday's liquidation cascade. The 200-day moving average at $91,500 provides structural support. RSI readings at 42 indicate neutral momentum with bearish divergence on higher timeframes. The critical Order Block from December's rally sits at $92,000, representing the Bullish Invalidation level. A break below this zone would trigger algorithmic selling toward $88,500 liquidity pools. Bearish Invalidation rests at $97,800, where short positions face maximum pain.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Elevated risk appetite despite volatility |

| Bitcoin Price (24h Change) | $95,394 (-2.16%) | Testing critical support zone |

| CLARITY Act Objections | 4 primary concerns | Regulatory compromise complexity |

| 200-Day Moving Average | $91,500 | Long-term trend support |

| Volume Profile POC | $93,800 | Highest traded volume level |

For institutions, regulatory clarity could unlock billions in trapped capital currently sidelined by compliance uncertainty. According to Ethereum.org's governance documentation, clear jurisdictional boundaries reduce smart contract deployment risks. For retail, compromise legislation might create structural vulnerabilities in DeFi protocols and stablecoin mechanisms. The SEC's historical enforcement approach suggests any CFTC authority dilution could increase litigation risks for cross-chain bridges and liquidity pools.

Market analysts on X/Twitter highlight the timing coincidence with Bitcoin's technical breakdown. "Regulatory negotiations during price weakness creates maximum leverage for compromise," noted one derivatives trader. Bulls emphasize potential for ETF expansion under clearer guidelines, while bears warn of DeFi protocol migration offshore if surveillance provisions remain. No official statements from other exchanges have emerged.

Bullish Case: Successful CLARITY Act negotiations establish clear commodity/security distinctions. Bitcoin holds $92,000 support and fills the FVG toward $98,500. Institutional inflows accelerate through compliant channels. Ethereum's Pectra upgrade implementation benefits from regulatory certainty.

Bearish Case: Legislative stalemate continues. Bitcoin breaks $92,000 Order Block, triggering cascade toward $85,000 liquidity grab. DeFi TVL contracts by 30% as protocols preemptively restrict U.S. access. Stablecoin regulation uncertainty triggers USDC/USDT decoupling events.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.