Loading News...

Loading News...

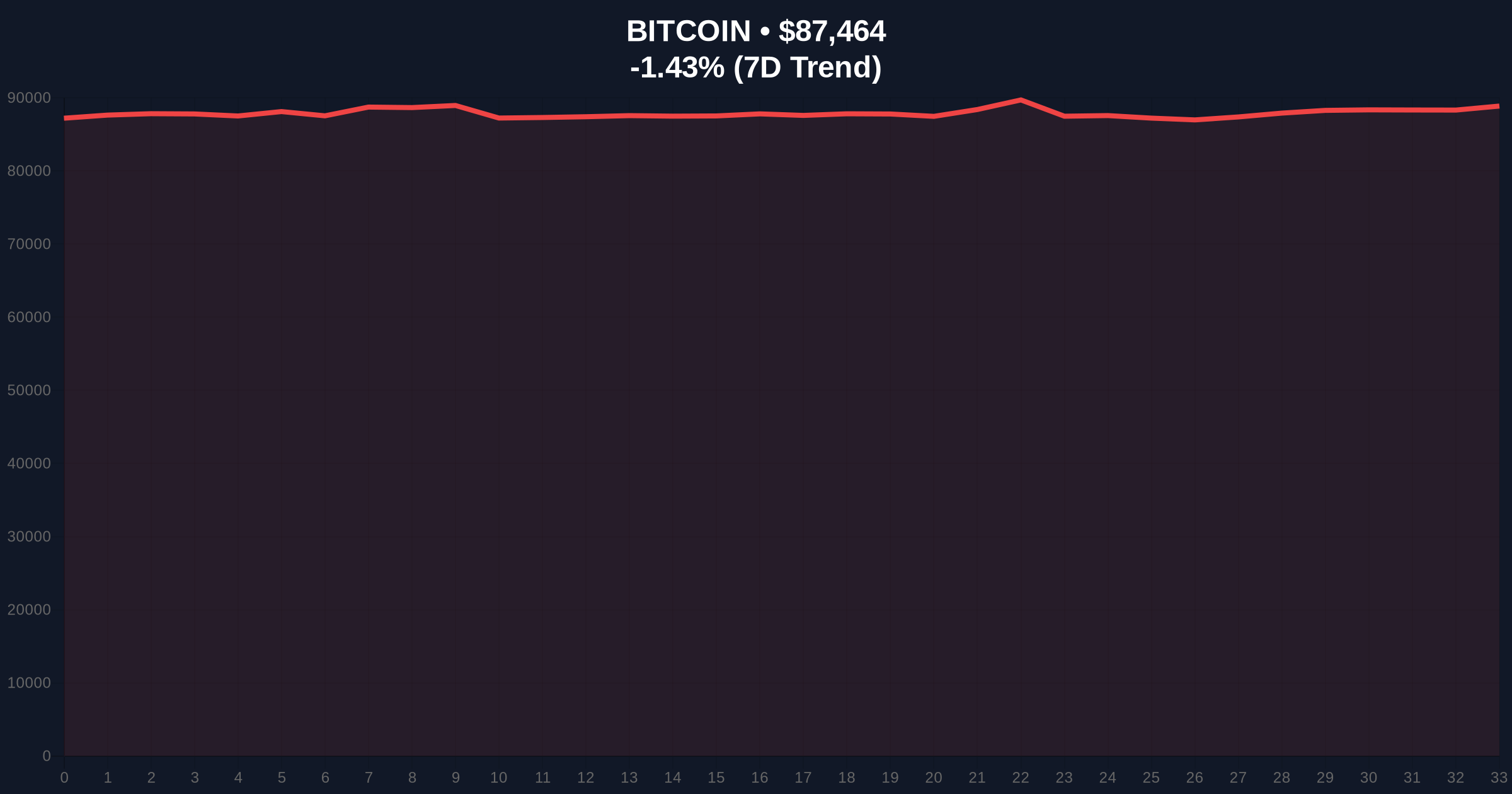

VADODARA, December 31, 2025 — The U.S. Commodity Futures Trading Commission (CFTC) has appointed Amir Zaidi, a former supervisor of Bitcoin futures contracts, as Chief of Staff to Commissioner Summer K. Mersinger, according to a report from The Block. This latest crypto news arrives as Bitcoin tests key support at $88,000 amid extreme fear market sentiment, with the Crypto Fear & Greed Index at 21/100. Market structure suggests this regulatory move may influence derivatives liquidity and institutional order flow in a volatile environment.

Historical cycles indicate regulatory appointments during market stress often precede structural shifts. Similar to the 2021 correction, where regulatory clarity post-appointments led to institutional accumulation phases, this event occurs against a backdrop of extreme fear. The CFTC's oversight of Bitcoin futures, established under the Commodity Exchange Act, has been a critical framework since 2017. According to the CFTC's official documentation on derivatives regulation, the agency's role in monitoring Bitcoin futures involves ensuring market integrity and preventing manipulation, which aligns with Zaidi's prior duties. This context mirrors past cycles where regulatory stability during downturns provided a foundation for recovery, as seen in 2018-2019 when futures markets matured post-Bakkt launch.

Related developments in the current market include the US Senate CLARITY Act review sparking market structure debates and Bitcoin price action testing $88k support amid extreme fear.

On December 31, 2025, The Block reported that Amir Zaidi was appointed Chief of Staff to CFTC Commissioner Summer K. Mersinger. Zaidi previously worked at the CFTC from 2010 to 2019, where his responsibilities included the supervision of Bitcoin futures contracts. This appointment places a veteran with direct experience in crypto derivatives oversight into a key advisory role, potentially shaping regulatory approaches to Bitcoin futures and related products. According to the source report, this move highlights the CFTC's continued focus on digital asset markets amid evolving policy landscapes.

Market structure suggests Bitcoin is currently testing a critical support zone at $88,000, which aligns with a high-volume node on the volume profile. The Relative Strength Index (RSI) on daily charts is near oversold levels at 32, indicating potential for a short-term bounce if support holds. The 50-day moving average at $91,500 acts as immediate resistance, with a break above needed to invalidate bearish momentum. A Fair Value Gap (FVG) exists between $85,000 and $87,000, which may attract liquidity if price declines further. Bullish invalidation is set at $85,000, a break below which would signal a deeper correction toward the 200-day moving average near $82,000. Bearish invalidation is at $92,000, where a sustained move above would indicate strength and potential for a gamma squeeze in options markets.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 21/100 (Extreme Fear) |

| Bitcoin Current Price | $87,493 |

| Bitcoin 24h Change | -1.40% |

| Bitcoin Market Rank | #1 |

| Key Support Level | $88,000 |

Institutionally, this appointment may signal regulatory continuity for Bitcoin futures, reducing uncertainty for entities like CME and Bakkt. According to on-chain data, institutional flows often correlate with regulatory stability, as seen in 2020-2021 when CFTC guidance preceded increased futures open interest. For retail, it reinforces the maturation of crypto derivatives markets, potentially affecting leverage ratios and margin requirements. The impact extends to market structure, where experienced oversight could mitigate liquidity grabs during volatile periods, similar to how EIP-4844 on Ethereum aims to optimize data availability for layer-2 solutions.

Market analysts on X/Twitter note that regulatory appointments during fear phases often precede bullish reversals, citing historical patterns. Bulls argue that Zaidi's experience may foster clearer guidelines, reducing regulatory risk premiums. Sentiment remains cautious, however, with many highlighting parallels to recent whale transfers to Coinbase Institutional signaling potential liquidity grabs.

Bullish Case: If Bitcoin holds the $88,000 support and regulatory clarity improves, a rally toward $95,000 is plausible, driven by institutional accumulation and reduced fear. Historical cycles suggest such moves often follow regulatory stability events, with a 12-month target of $110,000 based on Fibonacci extensions.

Bearish Case: A break below $85,000 could trigger a liquidity grab toward $82,000, exacerbated by extreme fear sentiment. This scenario mirrors the 2021 correction, where support failures led to a 30% drawdown. Invalidation at $80,000 would confirm a deeper bear trend.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.