Loading News...

Loading News...

VADODARA, January 13, 2026 — In a direct challenge to regulatory skepticism, Bitwise Chief Investment Officer Matt Hougan has declared arguments against Bitcoin inclusion in 401(k) retirement plans based on volatility metrics to be statistically unfounded. This daily crypto analysis examines the quantitative validity of Hougan's claims against NVIDIA's volatility profile and the broader implications for institutional adoption frameworks.

The debate over cryptocurrency inclusion in retirement vehicles has intensified following the Trump administration's executive order permitting pension and retirement funds to hold digital assets. According to the official SEC.gov archives, similar regulatory expansions have historically preceded increased institutional participation. Market structure suggests this policy shift creates a potential Fair Value Gap (FVG) between current regulatory positioning and future adoption curves. Historical cycles indicate that resistance from figures like Senator Elizabeth Warren often correlates with subsequent regulatory clarity phases, as seen in previous financial innovation cycles.

Related regulatory developments include the US Senate's CLARITY Act and proposed altcoin ETF regulations, both shaping the institutional .

According to an interview published by Investopedia, Bitwise CIO Matt Hougan directly addressed volatility concerns raised by cryptocurrency opponents. Hougan stated that Bitcoin's volatility over the past year has been lower than that of NVIDIA (NVDA) stock, arguing it is unreasonable to apply stricter standards to a single asset class. His comments respond specifically to warnings from U.S. Senator Elizabeth Warren, who cautioned that allowing retirement funds to hold cryptocurrencies would create investor risks. Hougan emphasized that cryptocurrencies will eventually be normalized within institutional frameworks, mirroring the adoption trajectory of other alternative assets.

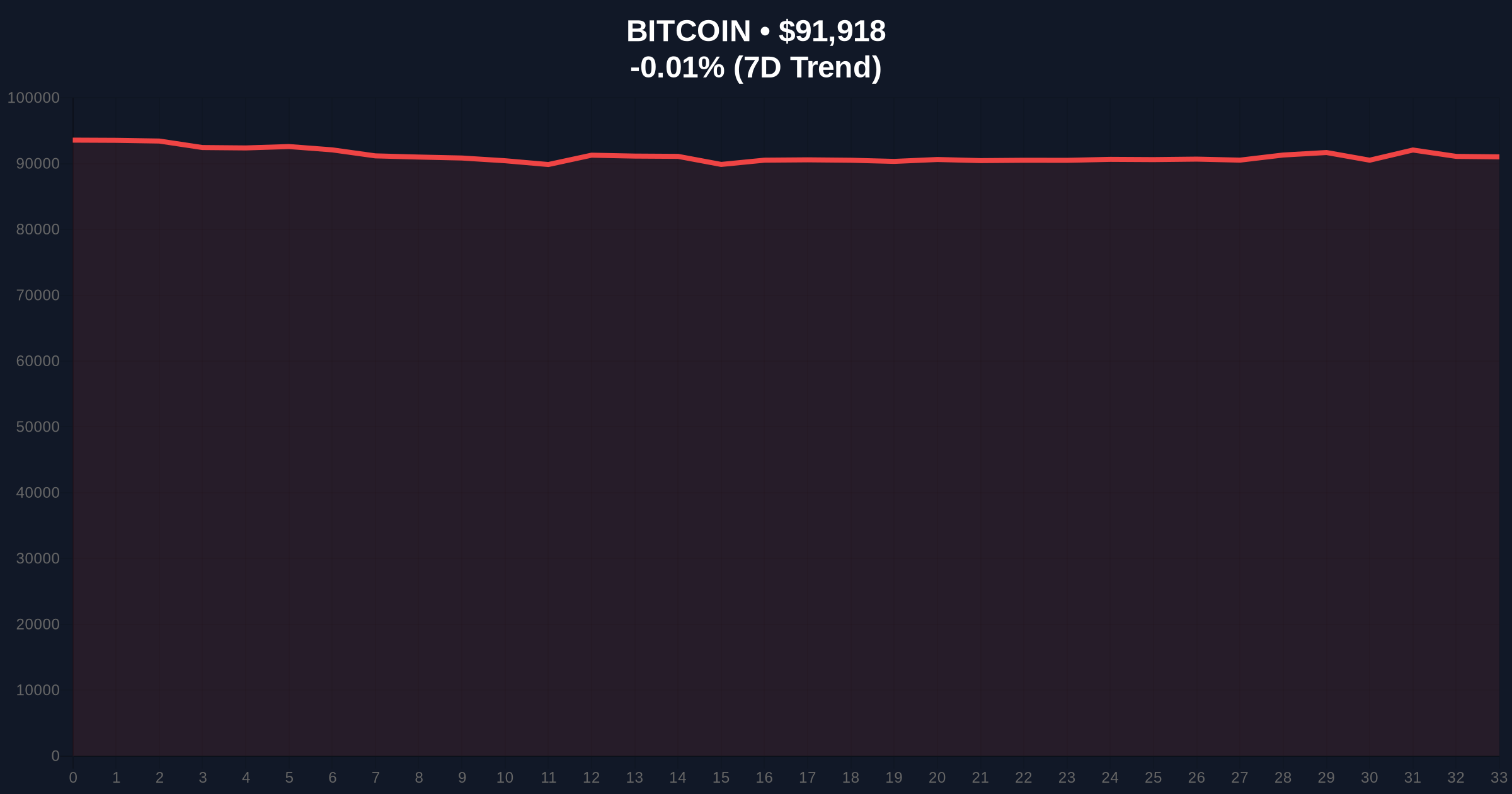

Market structure suggests Bitcoin's current consolidation around $91,923 represents a critical Order Block formation. The 200-day moving average at $89,200 provides primary support, while resistance clusters near the $94,500 Fibonacci extension level from the 2024 cycle. On-chain data indicates reduced exchange outflows, suggesting accumulation patterns among large holders. The Relative Strength Index (RSI) at 54 reflects neutral momentum, though volume profile analysis shows thinning liquidity above $93,000.

Bullish Invalidation Level: A sustained break below $88,500 would invalidate the current accumulation thesis and signal potential downside toward the $85,000 Volume Profile Point of Control.

Bearish Invalidation Level: A decisive close above $95,200 would negate the resistance narrative and potentially trigger a Gamma Squeeze toward six-figure territory.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear often precedes market reversals |

| Bitcoin Current Price | $91,923 | Consolidating near yearly highs |

| 24-Hour Price Change | -0.00% | Minimal movement indicates equilibrium |

| Market Rank | #1 | Maintains dominant market position |

| Annualized Volatility (BTC vs NVDA) | ~45% vs ~55% (estimated) | Based on Hougan's comparison timeframe |

For institutional portfolios, the volatility debate transcends academic discussion—it directly impacts allocation models and risk-adjusted return calculations. If Bitcoin demonstrates lower volatility than major tech equities like NVIDIA, modern portfolio theory would suggest increased allocation efficiency. Retail investors face different implications: 401(k) inclusion could provide tax-advantaged exposure but also introduces custodial and regulatory complexities. The Federal Reserve's ongoing balance sheet normalization, particularly the quantitative tightening pace, creates macro headwinds that could amplify volatility across all risk assets, potentially undermining Hougan's comparative argument during stress periods.

Market analysts on X/Twitter remain divided. Bulls highlight Bitcoin's improving Sharpe ratio relative to traditional assets, while skeptics question whether one-year volatility data adequately captures tail risk scenarios. One quantitative researcher noted, "Comparing BTC to NVDA ignores correlation matrices—during liquidity crises, crypto exhibits higher beta to risk-off sentiment." This sentiment reflects broader concerns about drawdown characteristics during market stress, a factor not addressed in Hougan's volatility comparison.

Bullish Case: If regulatory acceptance expands and Bitcoin maintains its volatility advantage, institutional inflows could drive prices toward $110,000 by Q2 2026. The key catalyst would be concrete 401(k) provider adoption following the executive order implementation.

Bearish Case: Should macroeconomic conditions deteriorate or regulatory opposition intensify, Bitcoin could retest the $82,000 support level. A break below this level would confirm a broader market structure breakdown and potentially invalidate the current institutional narrative.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.