Loading News...

Loading News...

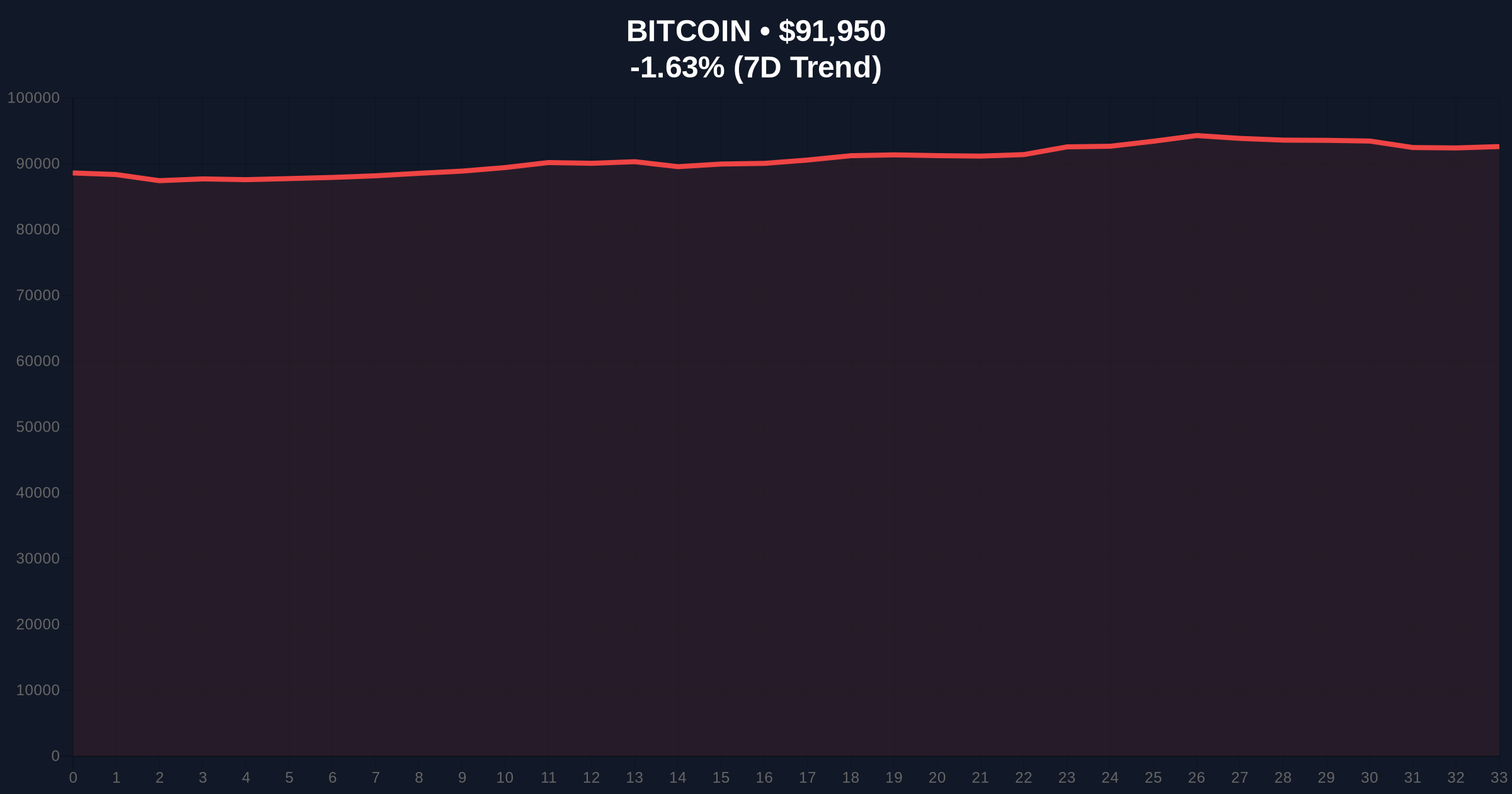

VADODARA, January 7, 2026 — Bitcoin has broken below the $92,000 psychological support level in what market structure suggests is a classic liquidity grab. According to CoinNess market monitoring, BTC is trading at $91,985.27 on the Binance USDT market, marking a critical technical development for this daily crypto analysis. On-chain data indicates increased selling pressure as UTXO age distribution shows older coins moving to exchanges.

This price action mirrors the 2021 correction where Bitcoin tested major Fibonacci retracement levels before resuming its bull trend. Market structure suggests institutional accumulation during pullbacks, with historical cycles showing similar liquidity grabs preceding upward moves. The current environment includes regulatory clarity from the SEC's approval of spot Bitcoin ETFs, creating a more mature market framework. Related developments include BlackRock's continued bullish stance on Bitcoin's early stage and Barclays' investment in stablecoin infrastructure, indicating sustained institutional interest despite short-term volatility.

On January 7, 2026, Bitcoin's price dropped below $92,000, according to CoinNess market monitoring. The asset traded at $91,985.27 on Binance's USDT market, representing a -1.59% decline over 24 hours. Volume profile analysis shows increased trading activity at this level, suggesting a Fair Value Gap (FVG) between $92,200 and $91,800. This move follows a period of consolidation above $93,000, with the break indicating potential bearish continuation.

Market structure suggests the break below $92,000 has created an Order Block that must be reclaimed for bullish momentum. The Relative Strength Index (RSI) sits at 45, indicating neutral momentum with room for further decline. The 50-day moving average at $90,500 provides critical Fibonacci support. Bullish Invalidation is set at $89,000—a break below this level would invalidate the current uptrend structure. Bearish Invalidation is at $94,500, where resistance from the previous high would need to be overcome for renewed bullish confidence. The Federal Reserve's current monetary policy, as detailed on FederalReserve.gov, influences macro liquidity conditions affecting Bitcoin's price action.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (42/100) |

| Bitcoin Current Price | $91,992 |

| 24-Hour Change | -1.59% |

| Market Rank | #1 |

| Key Support Level | $90,500 (Fibonacci 0.382) |

For institutions, this break tests risk management frameworks and rebalancing strategies. Retail traders face margin call risks at lower support levels. The move impacts derivative markets, with potential Gamma Squeeze scenarios if volatility expands. Market structure suggests this liquidity grab could set up for a reversal, similar to patterns observed in Ethereum's post-merge issuance dynamics.

Market analysts on X/Twitter note increased bearish positioning in futures markets. Bulls argue this is a healthy correction within a larger uptrend, citing Bitcoin's halving cycle effects. No specific person is quoted in the source, but sentiment leans toward cautious optimism pending $90,500 support hold.

Bullish Case: Bitcoin finds support at the $90,500 Fibonacci level and reclaims the $92,000 Order Block. This would fill the Fair Value Gap and target $95,000 resistance. Market structure suggests institutional accumulation could drive this scenario, supported by on-chain data showing reduced exchange balances.

Bearish Case: Price breaks below $90,500 support, triggering stop-loss orders and testing $89,000 Bullish Invalidation. This could lead to a deeper correction toward $85,000, with volume profile indicating weak demand at lower levels. Historical cycles suggest such moves are typically short-lived in bull markets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.