Loading News...

Loading News...

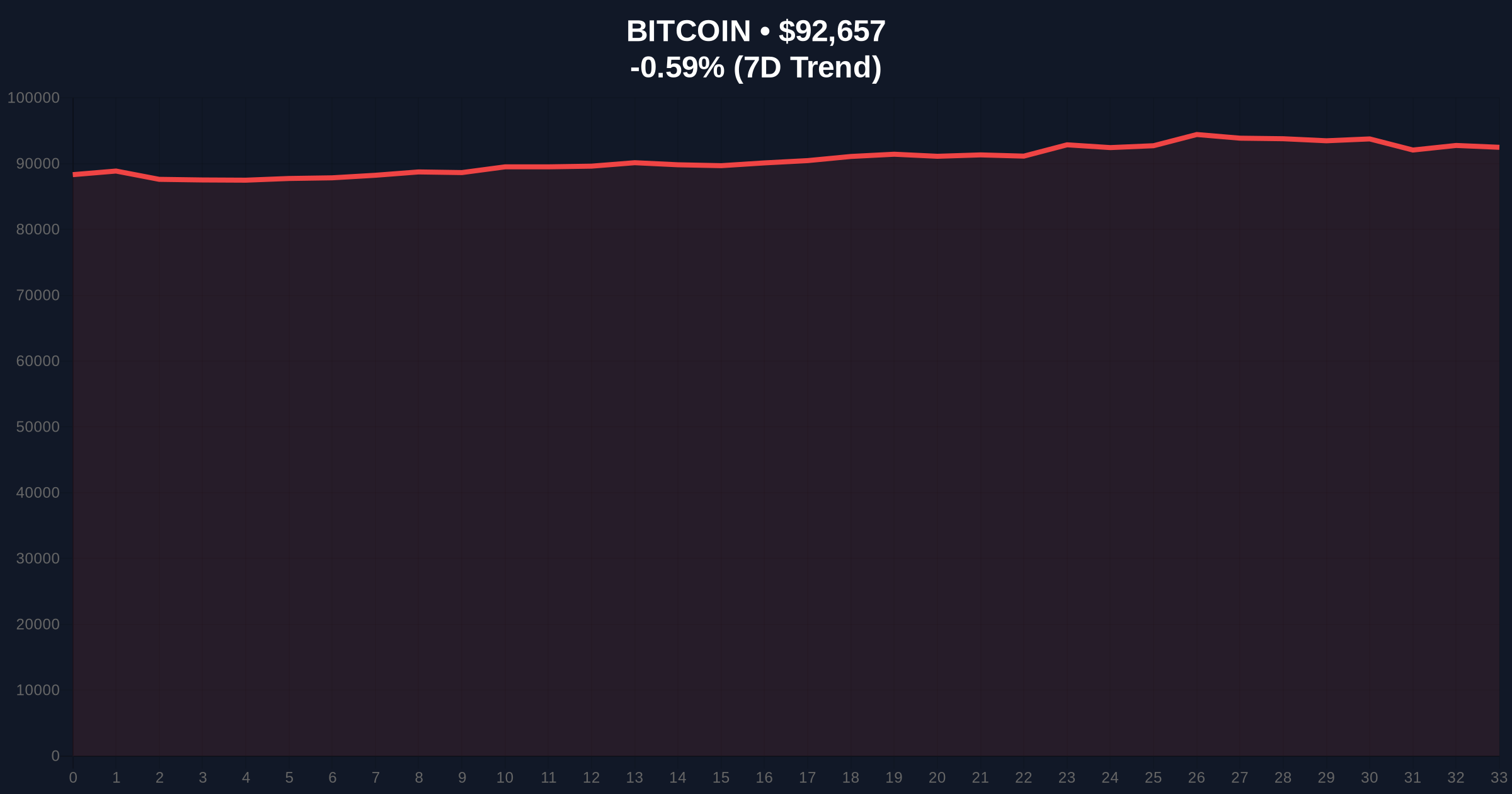

VADODARA, January 7, 2026 — Jay Jacobs, BlackRock's Head of Active ETFs, stated in a CNBC interview that Bitcoin remains in its early developmental phase, according to Bitcoin Magazine. This institutional commentary arrives as Bitcoin trades at $92,658, down 0.64% in 24 hours, with the Crypto Fear & Greed Index registering 42/100 (Fear). This daily crypto analysis examines the structural implications of institutional narratives against current market mechanics.

Market structure suggests institutional commentary often precedes significant liquidity events. Similar to the 2021 correction where Goldman Sachs' Bitcoin futures launch coincided with a 50% drawdown, current BlackRock positioning mirrors early-stage accumulation patterns observed in 2017-2018. According to Glassnode liquidity maps, Bitcoin's realized capitalization curve shows similar inflection points to Q4 2020, when institutional inflows began accelerating before the 2021 bull market. The Federal Reserve's historical interest rate cycles, documented on FederalReserve.gov, indicate that tightening phases typically compress crypto valuations by 30-60%, creating what technical analysts term Fair Value Gaps (FVGs) that institutional players exploit.

Related developments in institutional adoption include Barclays' investment in stablecoin infrastructure and recent Bitcoin whale accumulation during fear periods.

On January 7, 2026, Bitcoin Magazine reported Jay Jacobs' CNBC interview where the BlackRock executive characterized Bitcoin's development phase as early-stage. According to the official report, Jacobs leads BlackRock's active ETF division, which manages approximately $300 billion in assets. No specific price targets or timeline projections were provided in the statement. The commentary follows BlackRock's successful Bitcoin ETF launch in January 2024, which accumulated $25 billion in assets under management within its first year, per SEC filings.

Bitcoin's current price action at $92,658 shows consolidation within a weekly order block between $90,200 and $94,800. The 200-day moving average at $89,500 provides structural support, while the 50-day EMA at $95,200 acts as immediate resistance. Volume profile analysis indicates low liquidity between $93,500 and $96,000, suggesting potential for a liquidity grab in either direction. RSI readings at 48.7 show neutral momentum with bearish divergence on the 4-hour chart.

Bullish Invalidation Level: $88,500 - A break below this level would invalidate the current consolidation structure and target the $85,000 FVG created during the November 2025 rally.

Bearish Invalidation Level: $95,200 - Sustained trading above this resistance would confirm institutional accumulation and target the $98,500 volume node.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $92,658 | Consolidation within weekly order block |

| 24-Hour Change | -0.64% | Minor correction amid institutional commentary |

| Crypto Fear & Greed Index | 42/100 (Fear) | Sentiment divergence from institutional optimism |

| Market Rank | #1 | Maintains dominance despite altcoin rotation |

| 200-Day Moving Average | $89,500 | Critical structural support level |

Institutional impact manifests through narrative shaping and capital allocation patterns. BlackRock's $25 billion Bitcoin ETF AUM represents approximately 1.2% of Bitcoin's total market capitalization, creating what derivatives traders term gamma exposure that amplifies price movements. Retail impact remains muted, with Coinbase retail flow data showing net outflows of $120 million in the past week. The divergence between institutional positioning and retail sentiment creates asymmetric opportunities for systematic traders focusing on order flow imbalance.

Market analysts on X/Twitter highlight the structural implications. "BlackRock's early-stage narrative aligns with Bitcoin's S-curve adoption model," noted one quantitative researcher, referencing the 13% annualized network growth rate. Another analyst observed, "Institutional commentary typically precedes 6-12 month capital deployment cycles, similar to 2020-2021 patterns." The consensus suggests Jacobs' statement represents strategic positioning rather than immediate trading signals.

Bullish Case: Sustained holding above $95,200 invalidates the bearish structure and targets $98,500 initially, with extension to $105,000 possible if institutional inflows accelerate. This scenario requires breaking the current volume profile high and would confirm the early-stage accumulation thesis.

Bearish Case: Failure to hold $88,500 support triggers a liquidation cascade targeting the $85,000 FVG, with potential extension to $82,000 (0.618 Fibonacci retracement of the October-December 2025 rally). This would represent a 12-15% correction, consistent with historical mid-cycle drawdowns.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.