Loading News...

Loading News...

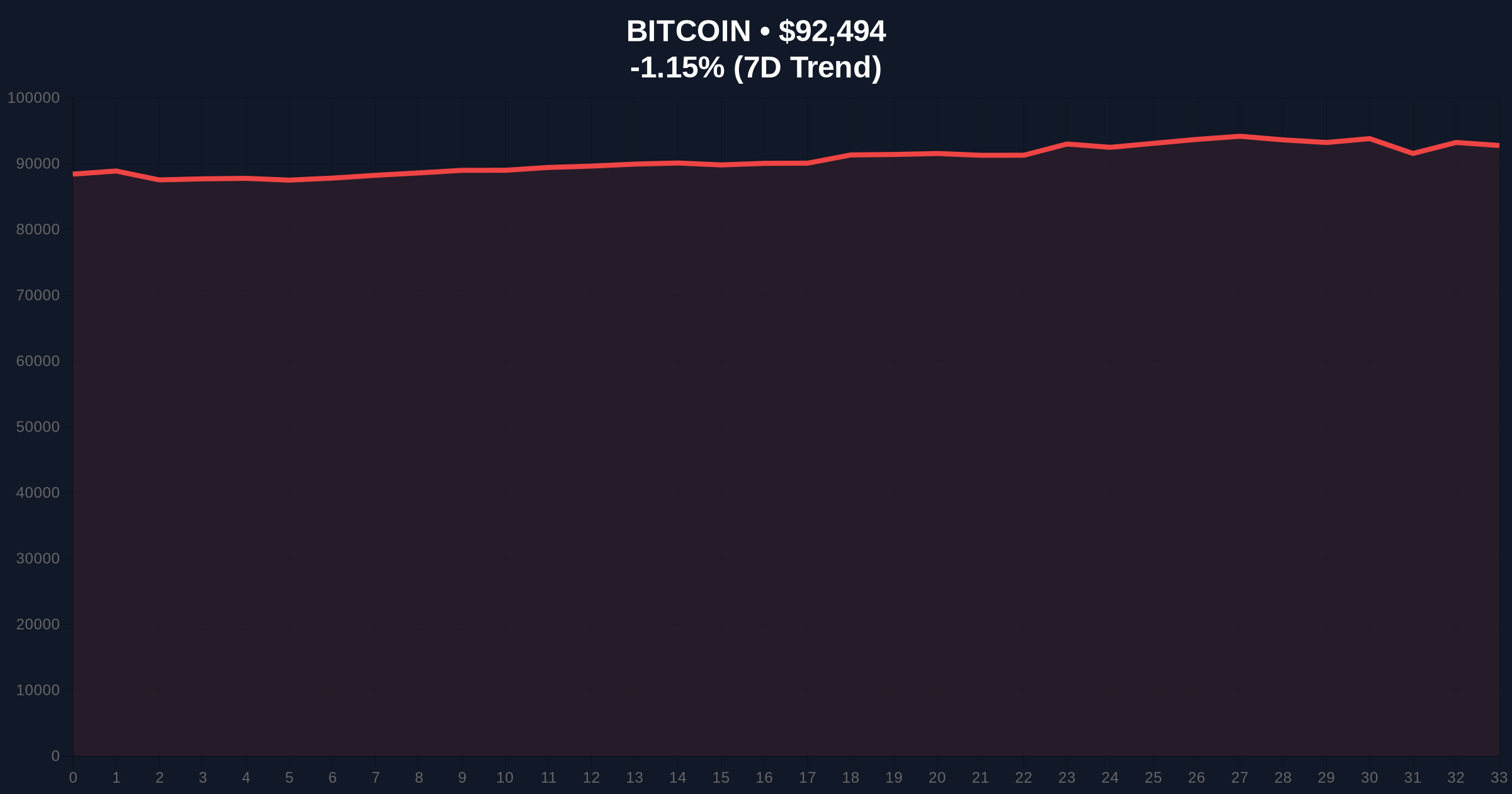

VADODARA, January 7, 2026 — The long/short ratio for Bitcoin perpetual futures across the world's top three crypto futures exchanges by open interest stands at 50.08% long to 49.92% short over the last 24 hours, according to exchange data. This daily crypto analysis reveals a market in near-perfect equilibrium, with Binance showing a slight short bias at 49.51% long versus 50.49% short, while Bybit leans marginally long at 50.53% long versus 49.47% short. Market structure suggests this balance reflects institutional uncertainty as Bitcoin trades around $92,496, down 1.15% in 24 hours.

This equilibrium in futures positioning mirrors patterns observed during previous consolidation phases, such as the Q3 2024 period when Bitcoin tested the $85,000 support multiple times. Underlying this trend is the broader macroeconomic environment, where Federal Reserve policy decisions on interest rates continue to influence risk asset correlations. According to historical cycles, periods of balanced long/short ratios often precede significant directional moves as liquidity accumulates on both sides of the market. Related developments include recent analysis of Bitcoin futures liquidations hitting $144 million, which highlighted similar structural tensions.

Exchange-specific data from the source indicates precise breakdowns: Binance recorded 49.51% long positions versus 50.49% short, OKX showed 49.38% long versus 50.62% short, and Bybit displayed 50.53% long versus 49.47% short. These figures, sourced from the exchanges' public APIs, represent aggregate positions across perpetual futures contracts, which lack expiry dates and are heavily traded by institutional players. The near-50/50 split across all three venues suggests no dominant directional bias among large traders, a scenario that typically reduces immediate volatility but increases sensitivity to external catalysts.

Bitcoin's current price action around $92,496 places it within a critical Fair Value Gap (FVG) between $91,000 and $94,000, identified on higher timeframes. The 50-day exponential moving average at $90,500 provides immediate support, while resistance clusters near $95,000 based on volume profile analysis. Relative Strength Index (RSI) readings on the 4-hour chart hover at 48, indicating neutral momentum without overbought or oversold conditions. Market structure suggests a Bullish Invalidation level at $89,500, where a break below would negate the current consolidation thesis and target lower liquidity pools. Conversely, the Bearish Invalidation level sits at $96,200, above which short positions would face significant pressure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) |

| Bitcoin Current Price | $92,496 |

| 24-Hour Price Change | -1.15% |

| Aggregate Long/Short Ratio | 50.08% Long / 49.92% Short |

| Binance Long/Short Ratio | 49.51% Long / 50.49% Short |

For institutional portfolios, this equilibrium signals reduced directional conviction, potentially leading to choppy price action as market makers balance order books. Retail traders face increased risk of whipsaws in such environments, particularly around key psychological levels like $90,000. The significance extends to derivatives markets, where balanced ratios can precede gamma squeezes if spot price movements trigger options-related hedging. On-chain data indicates that perpetual futures funding rates remain neutral across exchanges, supporting the view of a temporary stalemate rather than sustained bullish or bearish pressure.

Market analysts on social platforms note the rarity of such balanced ratios, with some interpreting it as accumulation before a volatile move. Bulls point to historical instances where equilibrium preceded rallies, while bears highlight parallels to periods before sharp corrections. No single industry leader has issued a definitive statement, but aggregated sentiment leans cautious, reflecting the Fear & Greed Index score of 42. This aligns with broader concerns about regulatory developments, as seen in reports on stablecoin risk data withholding.

Bullish Case: If Bitcoin holds above the $90,000 support and breaks the $95,000 resistance, the balanced long/short ratio could fuel a short squeeze, targeting $98,000 based on Fibonacci extensions. This scenario would require sustained buying pressure from spot markets, possibly driven by institutional inflows post-ETF approvals.

Bearish Case: A breakdown below $89,500 could trigger cascading liquidations in long positions, exacerbated by the slight short bias on Binance and OKX. This would likely target the next major order block near $86,000, where previous consolidation occurred. Such a move would align with the current Fear sentiment and broader macroeconomic headwinds.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.