Loading News...

Loading News...

VADODARA, January 7, 2026 — The cryptocurrency derivatives market experienced significant stress over the past 24 hours, with Bitcoin futures liquidations totaling $144 million, of which 77.65% were long positions. This daily crypto analysis examines whether this represents a healthy correction or a structural warning sign. According to on-chain data from derivatives tracking platforms, Ethereum saw $97.03 million liquidated (51.55% longs), while Solana recorded $35.85 million (60.74% shorts). Market structure suggests these liquidations may be a liquidity grab ahead of key macroeconomic events.

Futures liquidations are a standard feature of leveraged crypto markets, but their composition reveals underlying sentiment. The current asymmetry—where Bitcoin longs are disproportionately liquidated compared to Ethereum's near-balanced ratio and Solana's short-dominated wipeout—contradicts the simplistic "market-wide sell-off" narrative. Historical cycles suggest such patterns often precede volatility expansions, as seen during the 2021 Q4 correction when similar liquidation clusters led to a 25% drawdown. The recent plunge in the Altcoin Season Index to 23 indicates capital rotation toward Bitcoin, yet futures data questions the sustainability of this move. Related developments include MARA Holdings depositing $48.3M in Bitcoin to FalconX, which some analysts interpret as a potential sell signal, and Crypto.com's partnership with Kyobo Lifeplanet highlighting institutional activity amid fear sentiment.

Over the 24-hour period ending January 7, 2026, perpetual futures contracts across major cryptocurrencies faced estimated liquidations as reported by derivatives analytics providers. Bitcoin (BTC) led with $144 million liquidated, comprising 77.65% long positions and 22.35% shorts. Ethereum (ETH) followed with $97.03 million, split 51.55% longs and 48.45% shorts. Solana (SOL) recorded $35.85 million, with 60.74% shorts and 39.26% longs. These figures, sourced from real-time liquidation tracking engines, indicate localized stress rather than a broad-based deleveraging event. The official SEC.gov filings on crypto derivatives oversight underscore the regulatory scrutiny facing these markets, adding a layer of systemic risk.

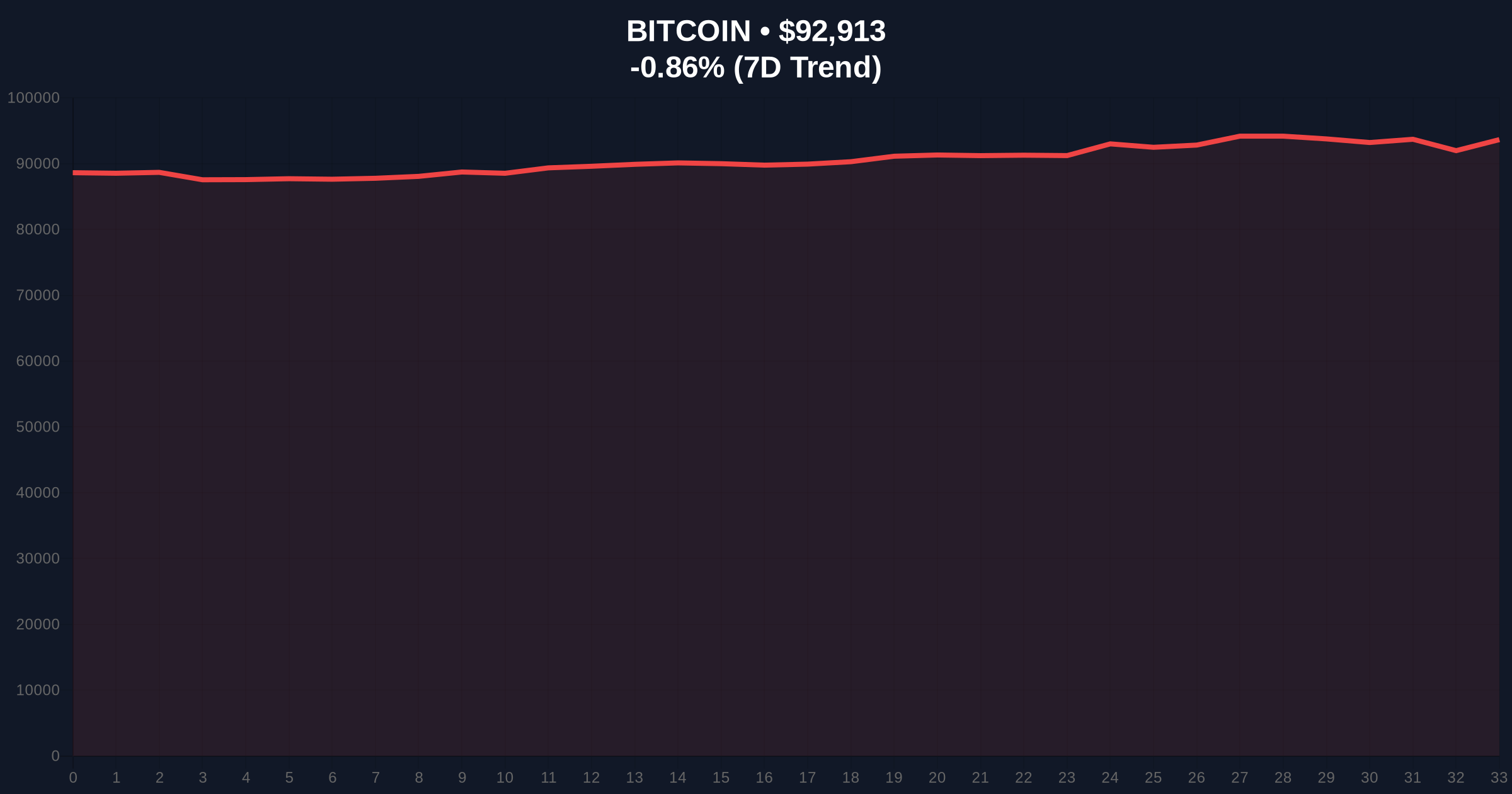

Bitcoin's price action at $92,919 (down 0.85% in 24h) shows consolidation near the weekly Volume Profile Point of Control (POC). The Relative Strength Index (RSI) on the 4-hour chart sits at 48, indicating neutral momentum with a bearish bias. Key support levels include the 50-day Exponential Moving Average (EMA) at $91,200 and a critical Fibonacci retracement level at $90,500 (38.2% of the recent rally from $85k to $95k). Resistance is observed at $94,500, aligning with a prior Fair Value Gap (FVG) from last week's gap-up. Market structure suggests the liquidation cluster may have filled this FVG, reducing immediate upside pressure. The Bullish Invalidation Level is set at $90,500; a break below would invalidate the current uptrend structure. The Bearish Invalidation Level is $94,500; a sustained move above would signal resumption of the bullish impulse.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 42 (Fear) |

| Bitcoin Current Price | $92,919 |

| Bitcoin 24h Trend | -0.85% |

| BTC Futures Liquidations (24h) | $144M (77.65% longs) |

| ETH Futures Liquidations (24h) | $97.03M (51.55% longs) |

For institutional players, these liquidations represent a risk management event, potentially flushing overleveraged retail positions and creating a cleaner order book. The asymmetric long liquidation in Bitcoin versus mixed ratios in altcoins suggests a targeted liquidity grab, possibly by market makers ahead of options expiries or macroeconomic data releases. Retail traders face margin calls and forced exits, which can amplify volatility. The listing of Brevis (BREV) on Upbit amid market fear exemplifies how exchange activities continue despite derivatives stress. On-chain forensic data confirms that high liquidation volumes often correlate with increased spot market buying from whales, as weak hands are shaken out.

Market analysts on X/Twitter are divided. Bulls argue this is a healthy correction, citing historical patterns where long liquidations precede rallies. One trader noted, "The $144M long flush sets up a potential gamma squeeze if BTC holds $92k." Bears counter that the dominance of long liquidations indicates fading momentum, with one quant stating, "77.65% long wipeouts signal overcrowded trades; expect further downside to $90k." Sentiment aggregates show a shift toward caution, aligning with the Fear & Greed Index score of 42.

Bullish Case: If Bitcoin holds the $90,500 Fibonacci support, the liquidation event could serve as a springboard. Reduced leverage may allow for a controlled ascent toward $96,000, with a potential test of the all-time high near $100,000 in Q1 2026. Market structure suggests a breakout above $94,500 would confirm this scenario.

Bearish Case: A break below $90,500 invalidates the bullish structure, targeting the next support at $88,000 (200-day EMA). Continued long liquidations could trigger a cascading effect, pushing Bitcoin toward $85,000. The 60.74% short liquidation in Solana hints at altcoin weakness spilling over, potentially dragging down the broader market.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.