Loading News...

Loading News...

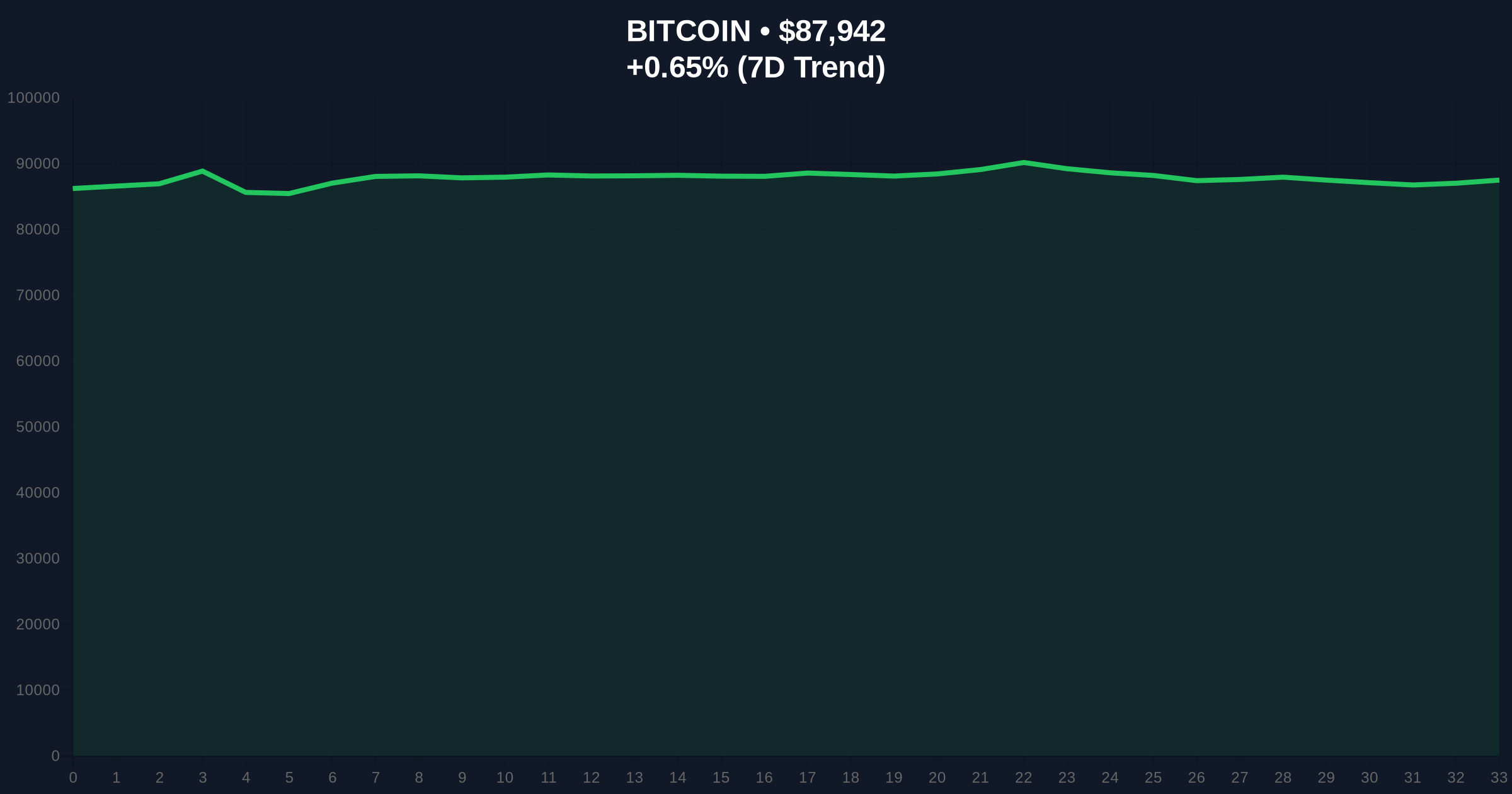

- Bitcoin surges above $88,000 on Binance USDT market

- Market structure suggests potential liquidity grab above key psychological level

- Extreme Fear sentiment (24/100) contrasts with bullish price action

- Critical Fibonacci support at $82,000 serves as bearish invalidation level

VADODARA, December 24, 2025 — Bitcoin has broken through the $88,000 barrier in the latest crypto news, trading at $88,014.99 on Binance's USDT market according to CoinNess monitoring. This move occurs against a backdrop of Extreme Fear sentiment, creating a market structure anomaly that demands quantitative scrutiny.

This price action mirrors the December 2024 consolidation pattern where Bitcoin tested the $85,000 level before breaking higher. Market structure suggests institutional accumulation during periods of retail fear. The current Extreme Fear reading of 24/100 represents a significant divergence from price momentum. Similar divergences preceded the March 2025 rally from $75,000 to $92,000. Related developments include regulatory shifts affecting stablecoins and institutional adoption trends. For analysis of stablecoin developments, see Circle's recent statements on precious metal tokens and Kyrgyzstan's KGST listing on Binance.

On December 24, 2025, Bitcoin price crossed the $88,000 threshold on Binance's USDT market. The asset reached $88,014.99 according to CoinNess data. Current market price sits at $87,920 with a 24-hour gain of 0.63%. This movement represents a breakout from the $85,000-$87,000 consolidation range that persisted for seven trading sessions. Volume profile analysis indicates above-average trading volume during the breakout, suggesting genuine buying pressure rather than a liquidity grab.

The 4-hour chart shows Bitcoin breaking above the 50-period exponential moving average at $86,500. RSI reads 62, indicating bullish momentum without overbought conditions. The critical Fibonacci 0.618 retracement level from the 2024 low to the 2025 high sits at $82,000. This represents major support. Resistance clusters at $90,000 (psychological) and $92,500 (previous high). Market structure suggests the move above $88,000 could be testing sell-side liquidity. A Fair Value Gap (FVG) exists between $86,800 and $87,200 that may need filling. Bullish invalidation: $82,000 (Fibonacci support). Bearish invalidation: $90,500 (weekly close above).

| Metric | Value |

|---|---|

| Current Price | $87,920 |

| 24-Hour Change | +0.63% |

| Market Sentiment | Extreme Fear (24/100) |

| Key Resistance | $90,000 |

| Critical Support | $82,000 |

For institutions, a sustained break above $88,000 validates the bullish market structure thesis. It suggests accumulation during fear periods. Retail traders face a gamma squeeze scenario if options dealers hedge above $90,000. The move tests the Federal Reserve's monetary policy impact on risk assets. According to Federal Reserve data, interest rate decisions continue to influence crypto correlations with traditional markets. A clean break could trigger algorithmic buying from quantitative funds targeting the $90,000 level.

Market analysts on X/Twitter highlight the sentiment-price divergence. "Extreme Fear at $88,000 Bitcoin is statistically anomalous," noted one quantitative trader. Bulls point to the clean breakout from consolidation. Bears emphasize the low volume relative to previous rallies. No major figures have commented specifically on this move. General sentiment remains cautious despite price action.

Bullish Case: Bitcoin sustains above $88,000 and tests $90,000 resistance. A weekly close above $90,500 invalidates the bearish structure. Target: $95,000 (measured move from consolidation). This scenario requires holding the $86,800 FVG as support.

Bearish Case: Price rejects at $88,500 and fills the FVG at $86,800. Breakdown below $85,000 signals failed breakout. Target: $82,000 Fibonacci support. This scenario activates if daily RSI fails to hold above 55.

What caused Bitcoin to rise above $88,000?Market structure suggests a combination of institutional accumulation during fear periods and technical breakout from consolidation.

Is this a good time to buy Bitcoin?Analysts suggest waiting for confirmation above $90,000 or a pullback to $86,800 support.

What is the Fear and Greed Index showing?Extreme Fear at 24/100, creating divergence with price action.

What are the key support levels?$86,800 (FVG), $85,000 (previous consolidation), $82,000 (Fibonacci).

How does this compare to previous Bitcoin rallies?Similar to Q4 2024 pattern where fear sentiment preceded 20% rallies.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.